Fantom [FTM] still ready to push forward – Is a half-dollar value feasible?

![Fantom [FTM] still ready to push forward – Is a half-dollar value feasible?](https://ambcrypto.com/wp-content/uploads/2023/01/malvestida-FfbVFLAVscw-unsplash-e1674904135956.jpg)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- FTM was strongly bullish on the three-hour chart despite its sideways structure.

- Short-term holders enjoyed massive gains.

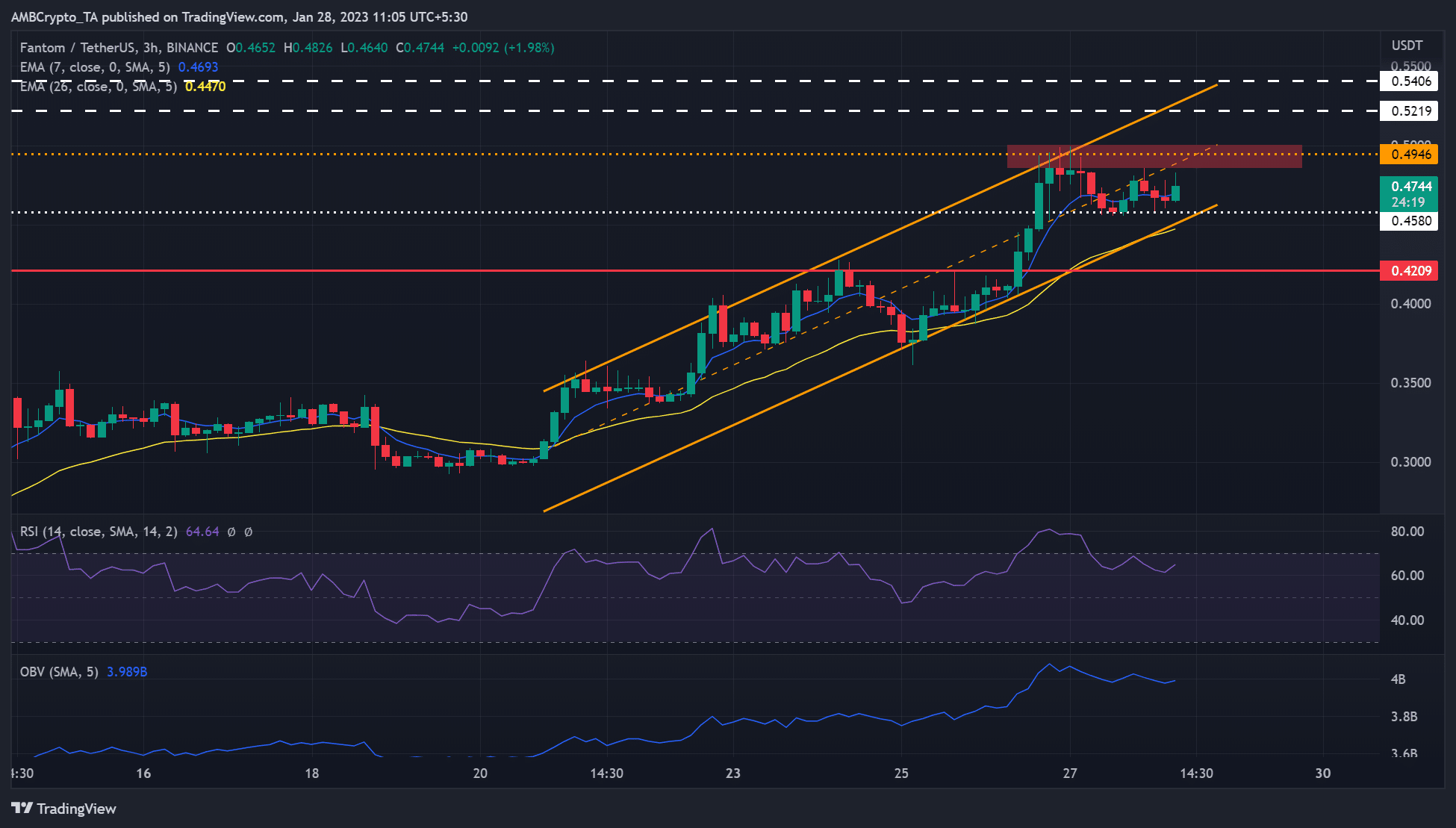

Fantom [FTM] has remained relatively bullish in the past week, apart from Wednesday (January 25). The three-hour chart’s Relative Strength Index (RSI) hit the overbought zone twice in the same period. In the past two days, FTM oscillated between $0.4580 and $0.4946.

Read Fantom [FTM] Price Prediction 2023-24

At the time of publication, FTM’s value was $0.4744.

The $0.5000 value: Is a retest likely?

Is your portfolio green? Check out the FTM Profit Calculator

FTM hit a peak of $0.4995 on its rising channel, ushering in a short-term price correction, which was checked by the $0.4580 support. The support has been retested several times, preventing any extended downtrend.

If the support continues to be steady, FTM could attempt to retest the overhead resistance level of $0.5000, which also doubles up as a crucial short-term selling pressure zone.

Besides, FTM’s price action curved out a parallel channel whose bullish break-out target would be $0.5219. Therefore, FTM could reclaim its 50 dollar cents value in the next few hours.

However, a break below the $0.4580 support would invalidate the bullish bias. The drop could settle at the bearish break-out target of $0.4209.

The RSI was at 65, giving credence to a bullish bias rather than a downtrend in the short term. But investors should track BTC’s price action because of the fluctuation in trading volumes (as evidenced by OBV), which suggests a likely extended price consolidation.

Short-term FTM holders recorded massive profits despite erratic trading volumes

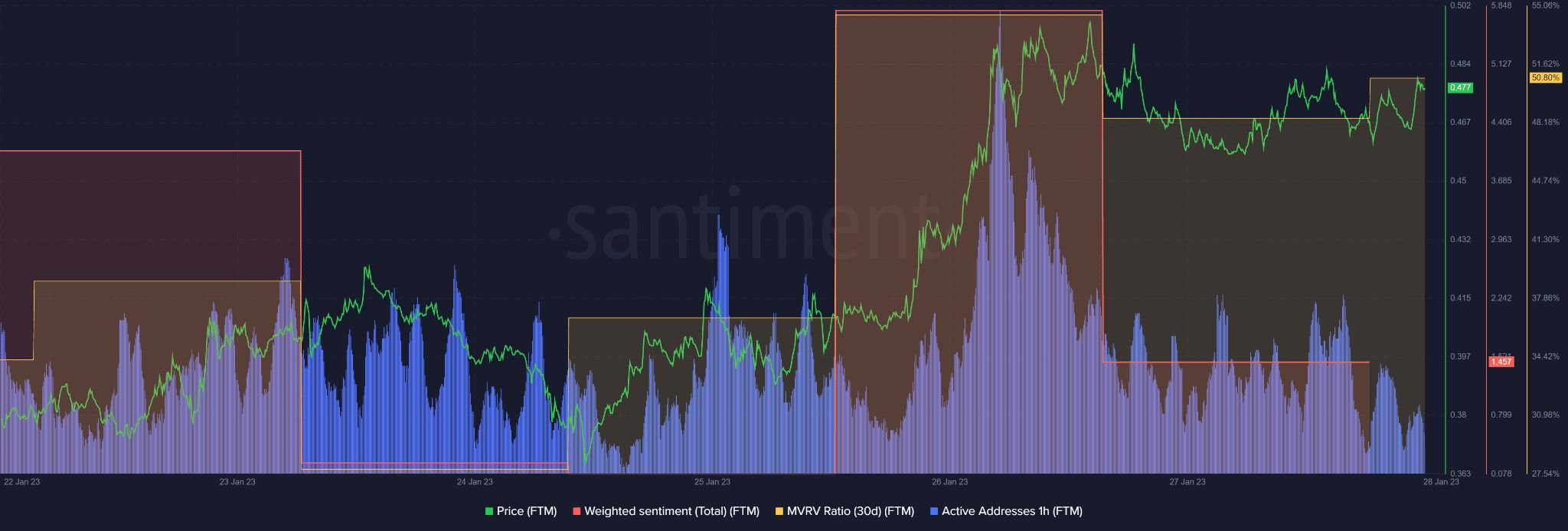

Short-term FTM holders’ were enjoying 50% profits at press time, as evidenced by the 30-D MVRV (Market Value to Realized Value) ratio. But the above profits have tanked by 5% after FTM faced price rejection at the $0.4950 level.

The drop in profits also saw weighted sentiment retreating to the lower range, indicating investors’ confidence dropped significantly. Nevertheless, the sentiment remained positive, capturing the underlying bullish outlook on FTM.

However, the erratic trading volumes, as shown by fluctuations in active hourly addresses, could undermine strong buying pressure. Although the uptick in active addresses at press time could boost FTM to aim at the selling pressure zone, it might not be enough to close above the $0.5000 mark comfortably.

Therefore, investors should closely track BTC’s price action. Any drop below the $23K zone could entice FTM bears to devalue the asset below $0.4580. But if BTC maintains the $23K zone and surges upwards, FTM bulls could be tipped to reclaim the $0.5000 half-dollar value.