Fantom – How FTM’s consolidation can offer trading opportunities within range

- Fantom, at press time, had a bearish structure, but the range is expected to hold

- Reset of the short-term MVRV is the first step toward recovery

Fantom [FTM] was on a strong uptrend towards the end of September. A market-wide price slump followed the volatility around Bitcoin [BTC], and FTM was no exception. It formed a range around a key Fibonacci retracement level.

Despite the selling pressure, however, the on-chain metrics and the price action showed that bulls were gearing up for the next move upwards.

Short-term consolidation for FTM

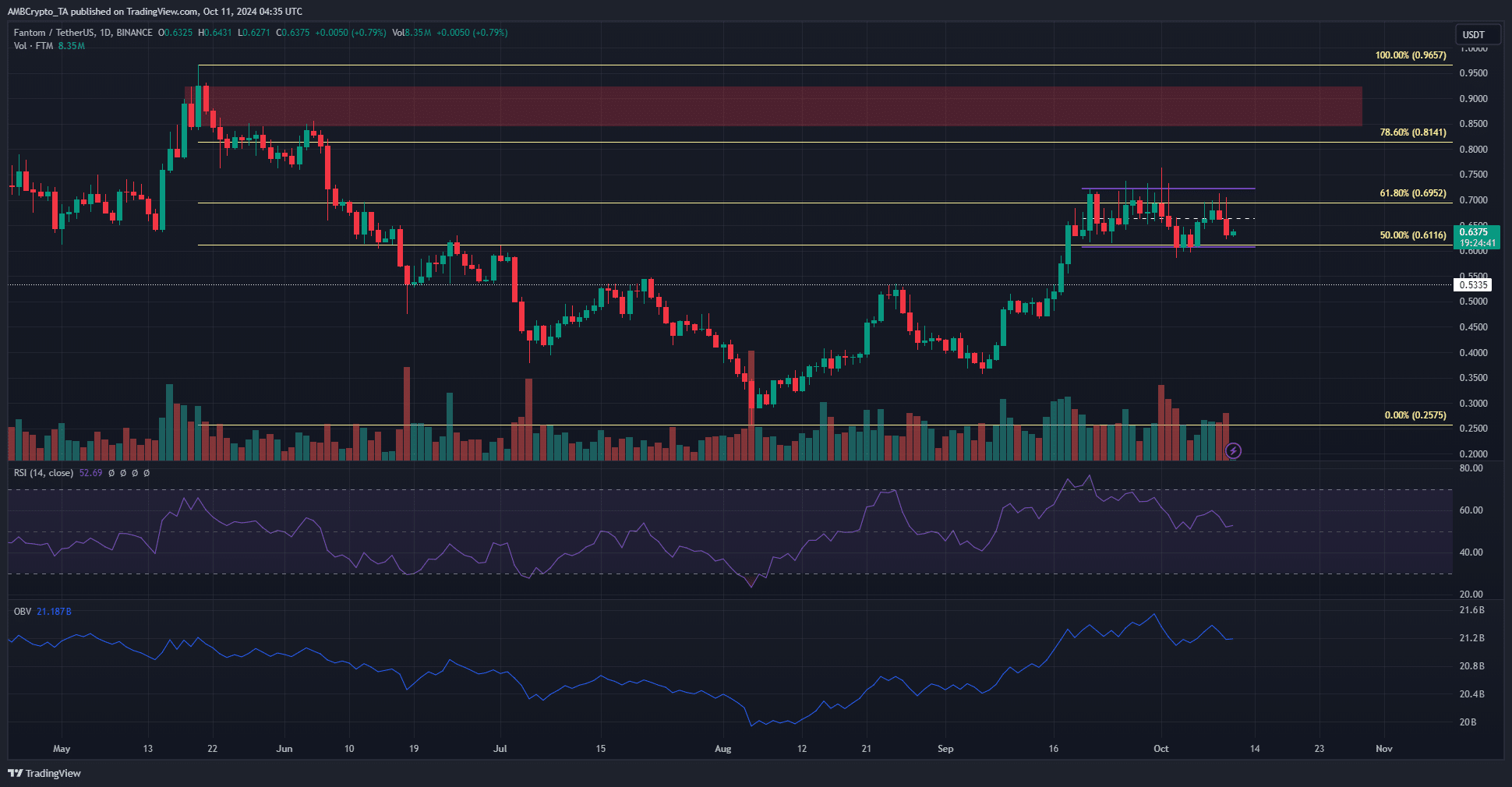

The intense bullishness in September gave way to milder, range-bound price action for the $1.8 billion market cap asset. This range (purple) extended from $0.608 to $0.724 and the token has traded within it for three weeks.

The daily RSI was above neutral 50 to show bullishness, but has trended downward recently. Its press time reading of 52.7 showed momentum was neutral. Similarly, the OBV also revealed that neither the buyers nor the sellers were dominant during the range formation.

This indicated that swing traders can use the range extremes to trade until the event of a breakout. As things stand, the lack of volume means Fantom may be in a consolidation phase.

Consolidation allowed profit-taking, but is it bullish?

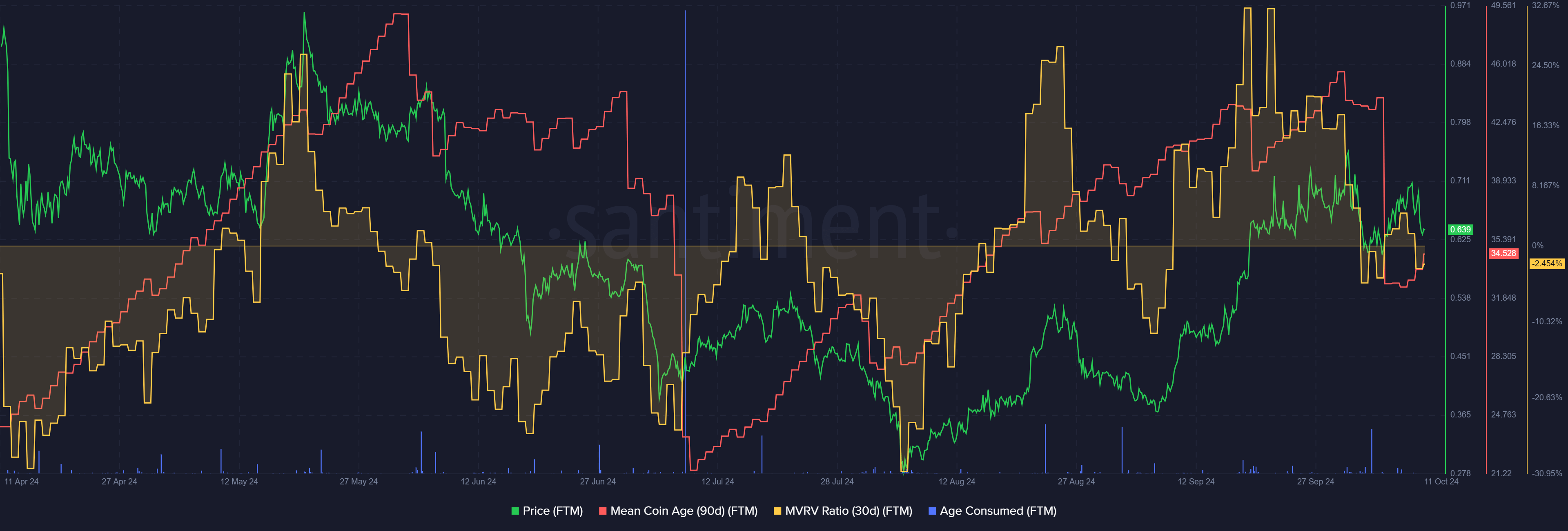

Source: Santiment

The consolidation since late September saw the mean coin age drop swiftly on 6 October. At the same time, the 30-day MVRV, which had been 20%, fell towards zero. This signified FTM distribution and profit-taking activity from short-term holders.

Read Fantom’s [FTM] Price Prediction 2024-25

Despite this drop, however, the bulls defended the 50% retracement level as support. The age consumed metric was also relatively silent recently. This defense could set up Fantom for the next price expansion northward.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion