Fantom network grows: A sign of FTM’s incoming price rally?

- Fantom’s price tested key levels, with increased network activity signaling potential recovery.

- Market sentiment showed optimism as bullish liquidations and technical indicators hinted at a reversal.

Fantom [FTM], trading at $0.7934 at press time with a 2.16% drop in the past 24 hours, continued to spark interest despite its current downtrend.

Recent network data showed increased activity, raising the question: Could this mark the beginning of a price reversal?

Can FTM break free from its current range?

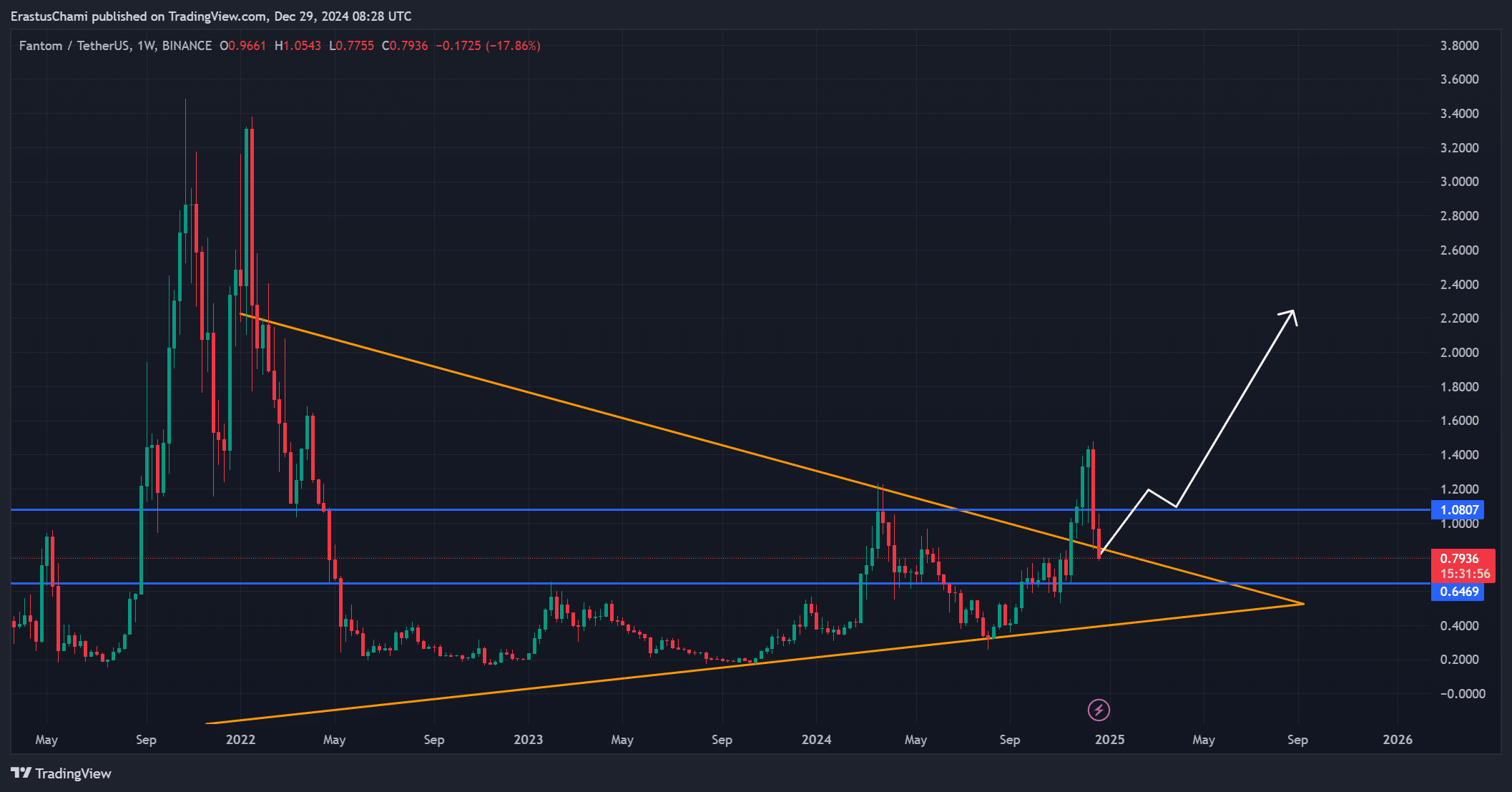

FTM’s price remained within a tight range, with critical support at $0.7316 and resistance at $0.9671. A breakout above this resistance could push the price toward $1.08, a level with significant psychological importance.

However, failure to hold the current support could lead to further losses. The descending triangle pattern visible on the charts suggests a major price move may be imminent.

Therefore, the next few trading sessions could determine FTM’s short-term trajectory.

Is network activity hinting at a bullish future?

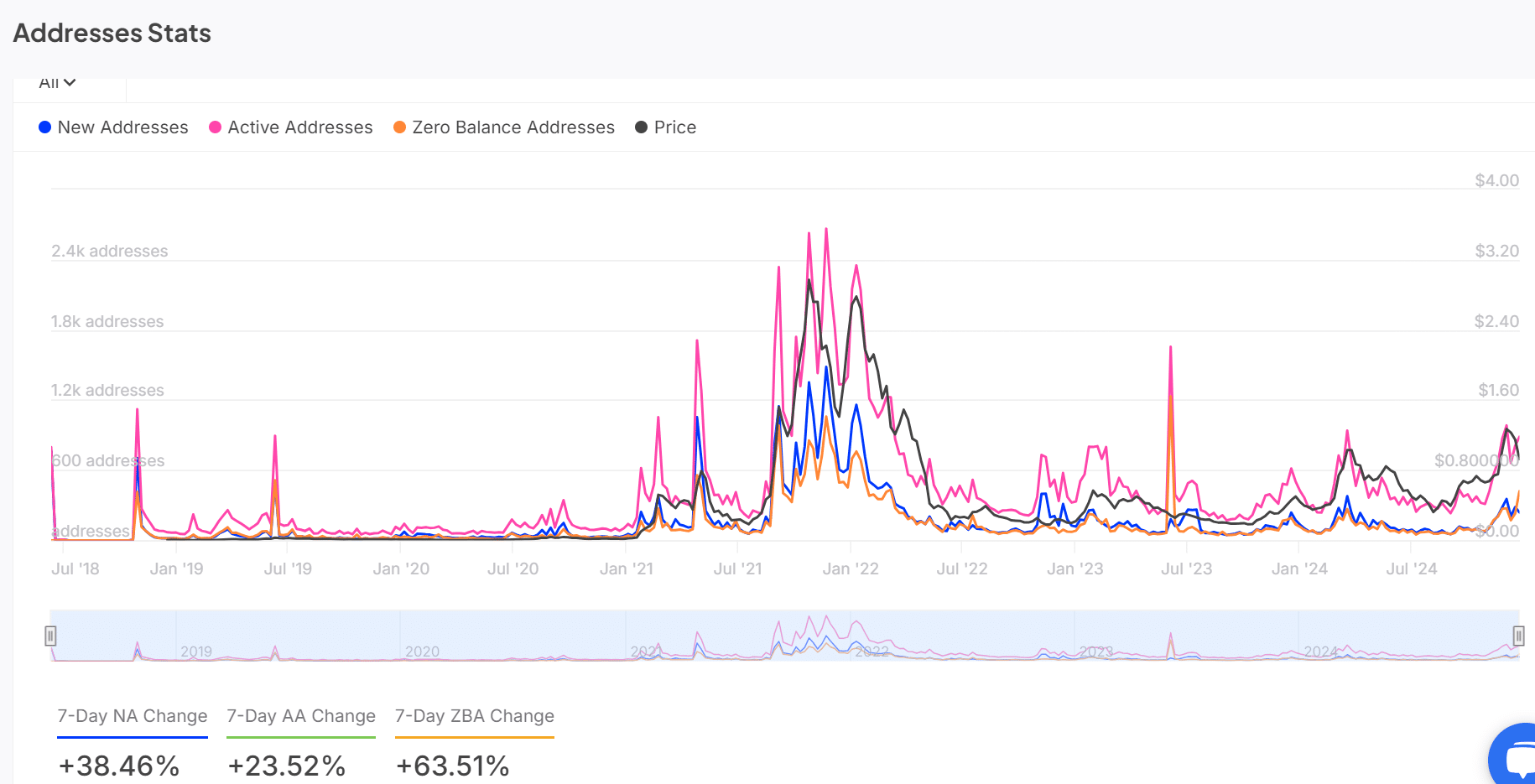

Fantom’s blockchain activity surged at press time, with new addresses rising by 38.46%, active addresses increasing by 23.52%, and zero balance addresses growing by 63.51% in the past week.

This increase reflected growing interest and participation in the ecosystem, which could bolster FTM’s long-term value.

However, while these numbers looked promising, consistent growth will be essential to sustaining bullish momentum. Therefore, network activity remains a key indicator to watch.

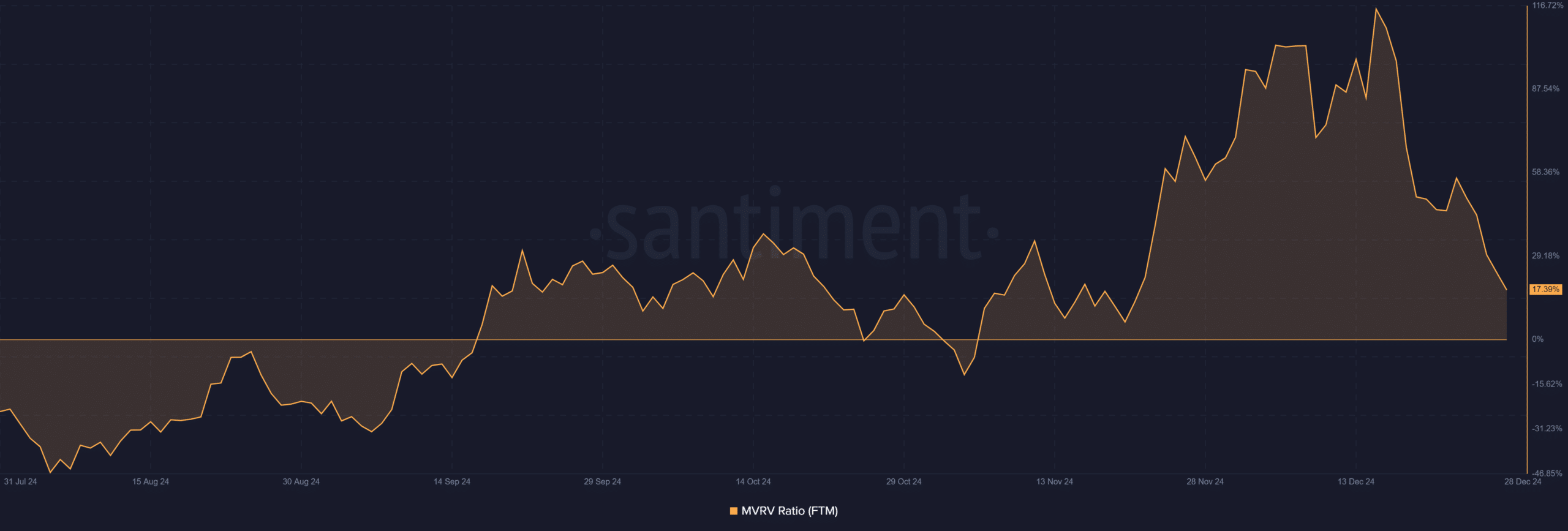

MVRV ratio signals potential undervaluation

The Market Value to Realized Value (MVRV) ratio has dropped to 17.39%, highlighting reduced profitability for FTM holders.

Historically, such declines have preceded significant price moves, as they often signal undervaluation.

This could attract buyers looking to capitalize on discounted prices. However, persistent selling pressure could also push prices lower. Traders should monitor sentiment closely to gauge the market’s next move.

Are technical indicators flashing a reversal signal?

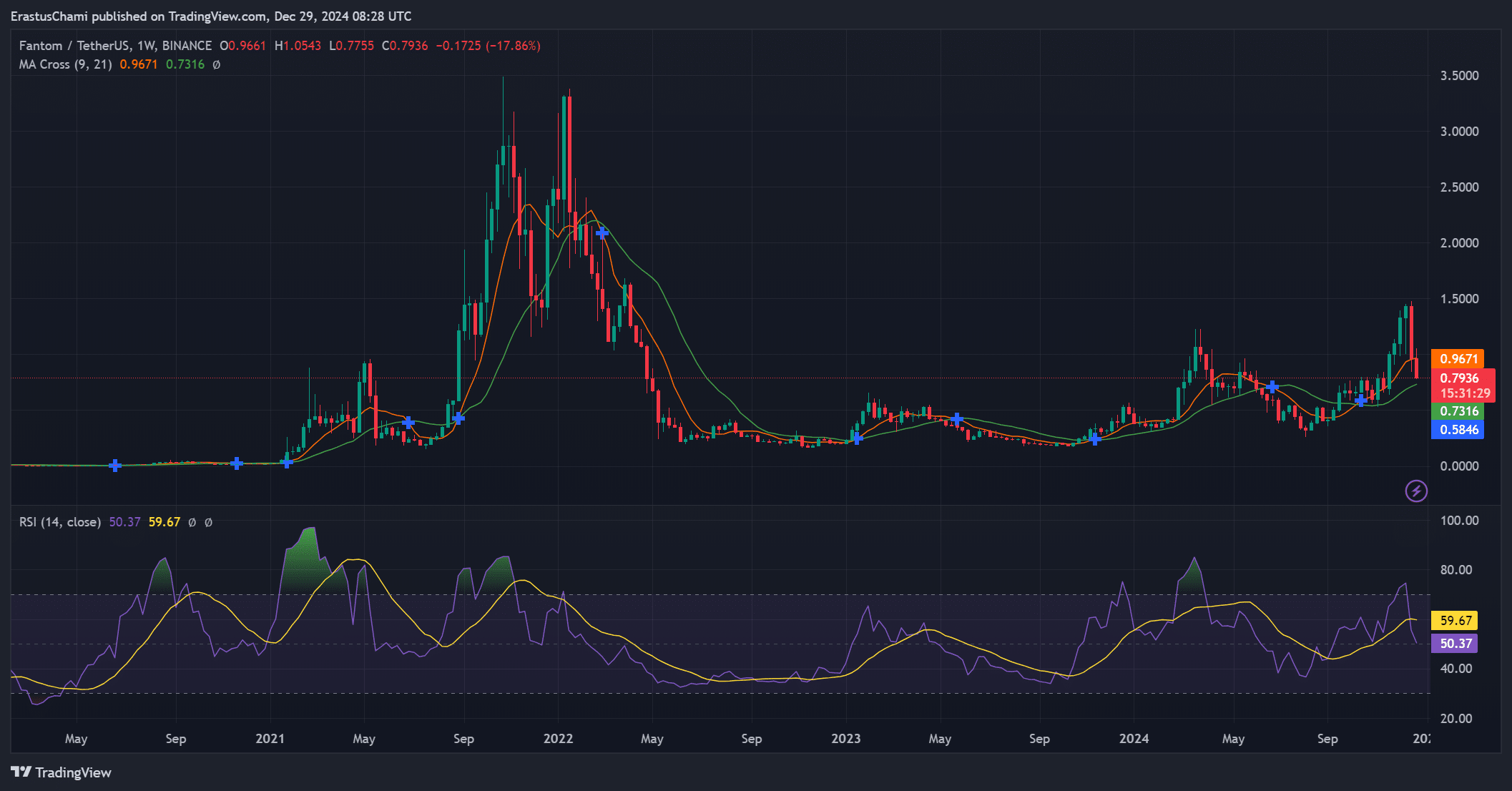

The Relative Strength Index (RSI), at 50.37 indicated neutral momentum at press time, with a slight tilt toward bullish recovery.

Meanwhile, the moving average cross suggested potential volatility, as the short-term average approached the long-term average.

Therefore, these indicators point to a potential turning point for FTM’s price, making the upcoming days crucial for traders.

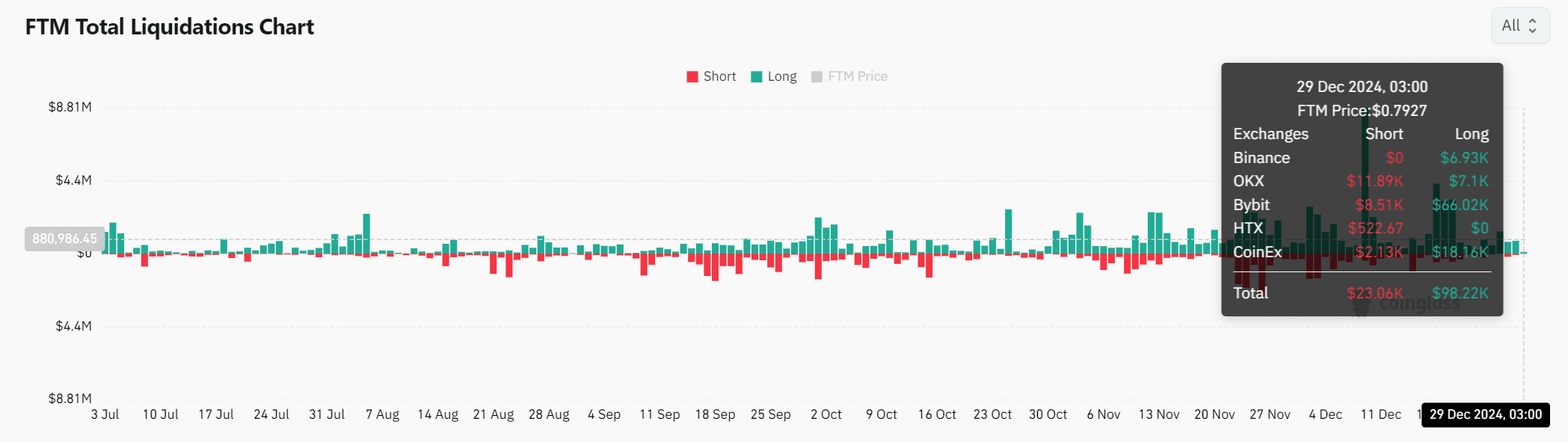

Liquidations suggest traders remain optimistic

Liquidation trends show $23.06K in shorts against $98.22K in longs, revealing bullish sentiment despite recent declines. This imbalance suggests that many traders are positioning for an upward price movement.

However, external market forces could still weigh on FTM’s performance. Therefore, liquidation data should be analyzed alongside other metrics for a more comprehensive view.

Read Fantom’s [FTM] Price Prediction 2024-25

Fantom’s rising network activity, alongside bullish liquidation trends and technical signals, suggests the potential for a price recovery.

However, the declining MVRV ratio and resistance levels must be carefully monitored. If FTM sustains its network growth and breaks key levels, a rally could materialize in the coming weeks.