Fantom price prediction – Mixed market signals could push FTM THIS way!

- FTM’s bullish trend persisted within an ascending channel, with key resistance at $0.7955

- Mixed on-chain signals underlined cautious optimism as liquidations had their say

Fantom’s [FTM] price jumped by 6.31% over the past 24 hours to trade at $0.6786 at press time. It boasted a $1.90 billion market cap, alongside a 24-hour volume surge of 68.26%, hitting $142.91M.

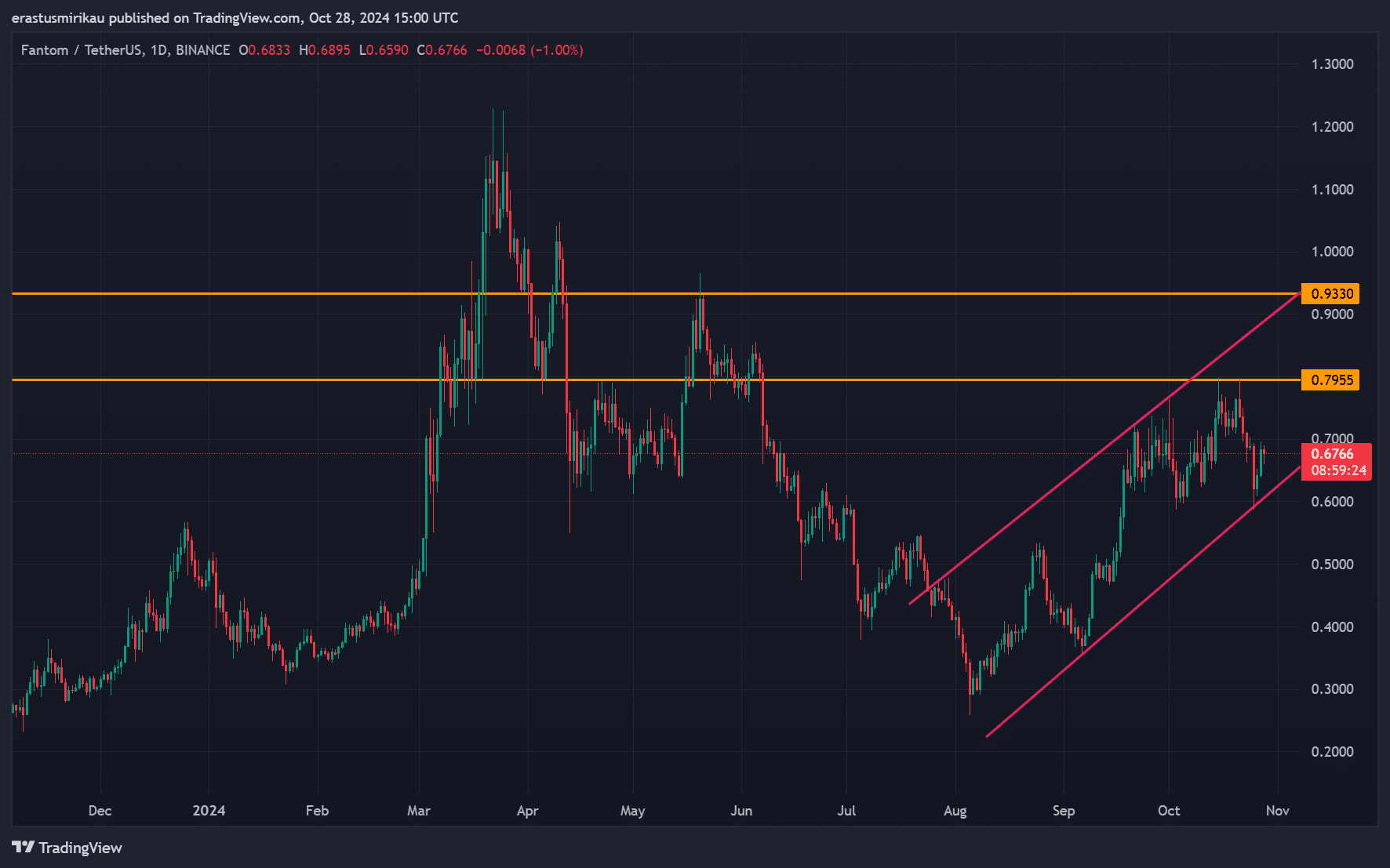

The altcoin’s prevailing price action keeps FTM within an ascending channel, eyeing resistance levels at $0.7955 and $0.9330. Therefore, in light of the market momentum gaining, investors should wonder – Can Fantom (FTM) hold this bullish trend?

Analyzing the ascending channel – Will this support hold?

FTM’s trajectory within the ascending channel highlighed a clear bullish trend. The channel’s structure suggested FTM could maintain upward momentum, if it respects the support and resistance boundaries.

Additionally, breaking above the $0.7955 resistance would reinforce bullish sentiment, possibly pushing the price towards the next level at $0.9330.

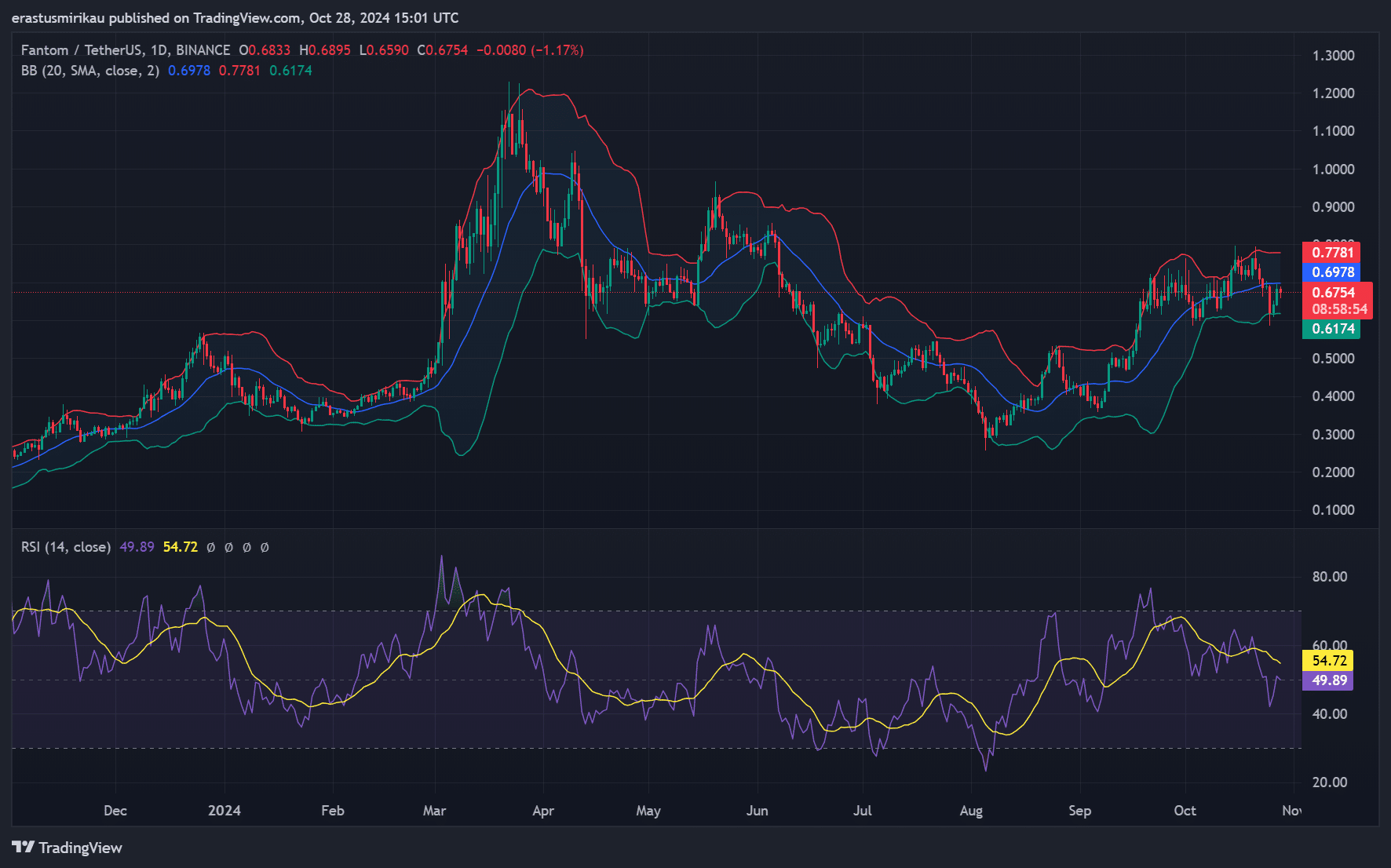

Bollinger bands and RSI’s findings

At press time, the Bollinger Bands seemed to be widening, indicating a surge in volatility as FTM approached the upper band. Such an expansion generally signifies that buyers are dominating the trend. Consequently, if the price continues hugging the upper band, it alludes to a potential breakout to new highs.

The Relative Strength Index (RSI), with a value near 54.72 at press time, remained in the neutral zone. This suggested that FTM has further room to climb without facing overbought conditions. Simply put, the press time RSI level supported the possibility of additional gains if buying volume persists.

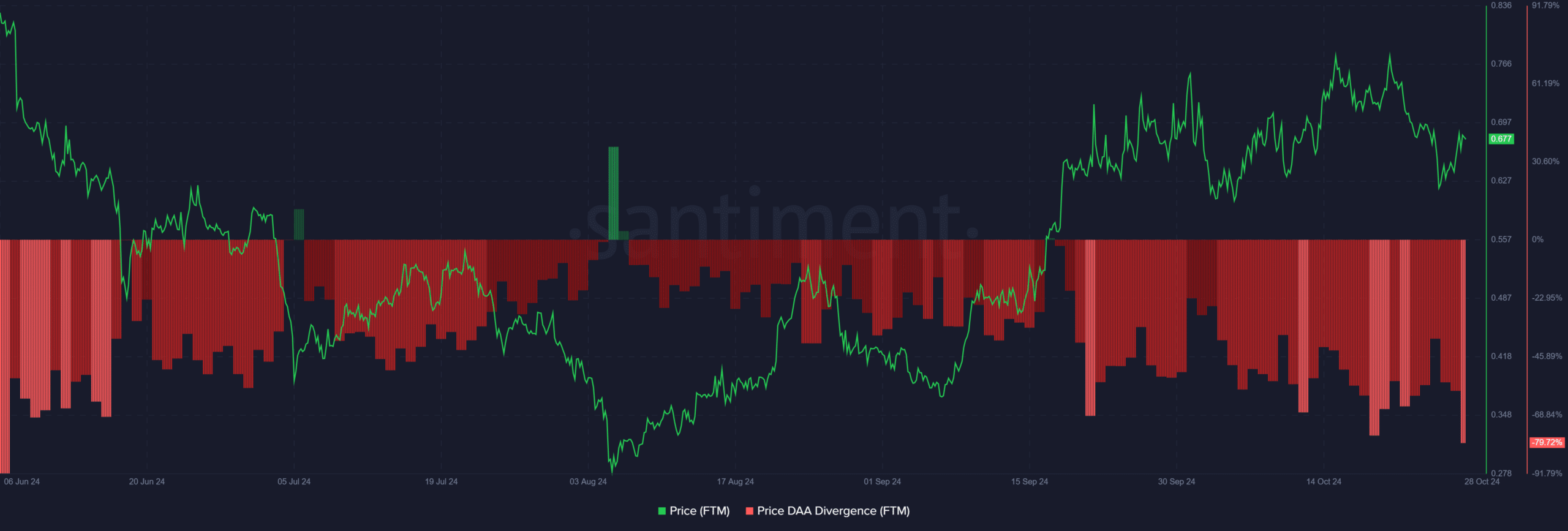

Price DAA divergence – A potential red flag?

The Price DAA (Daily Active Addresses) Divergence underlined a concerning -79.72% reading, suggesting fewer active addresses despite recent price hikes. This discrepancy also highlighted a lack of underlying network growth – Often a sign of reduced sustainability for the rally.

Additionally, fewer active addresses may weaken FTM’s foundation in the event of greater selling pressure. This might also urge traders to watch for a potential pullback, if address activity fails to rebound.

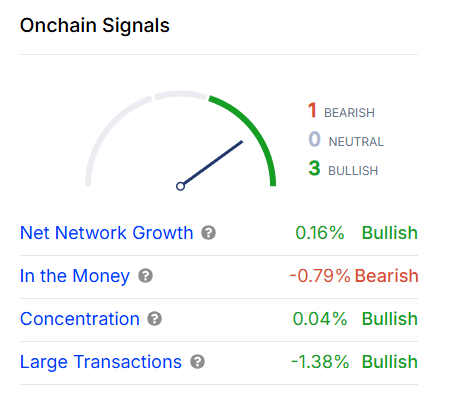

FTM On-chain signals – Mixed sentiment?

Fantom’s on-chain data presented mixed signals. Net Network Growth stood at a modest 0.16%, indicating gradual adoption. Meanwhile, the concentration of large holders rose by 0.04%, showing that major investors are not offloading positions – Typically a bullish indicator. Large Transactions also saw a 1.38% decrease, hinting at lower sell-off pressure from whales.

However, the “In the Money” metric revealed a slight bearish tilt at -0.79%, indicating a small fall in profitable positions. Consequently, these mixed on-chain signals reflected cautious optimism, with investors closely monitoring market sentiment shifts.

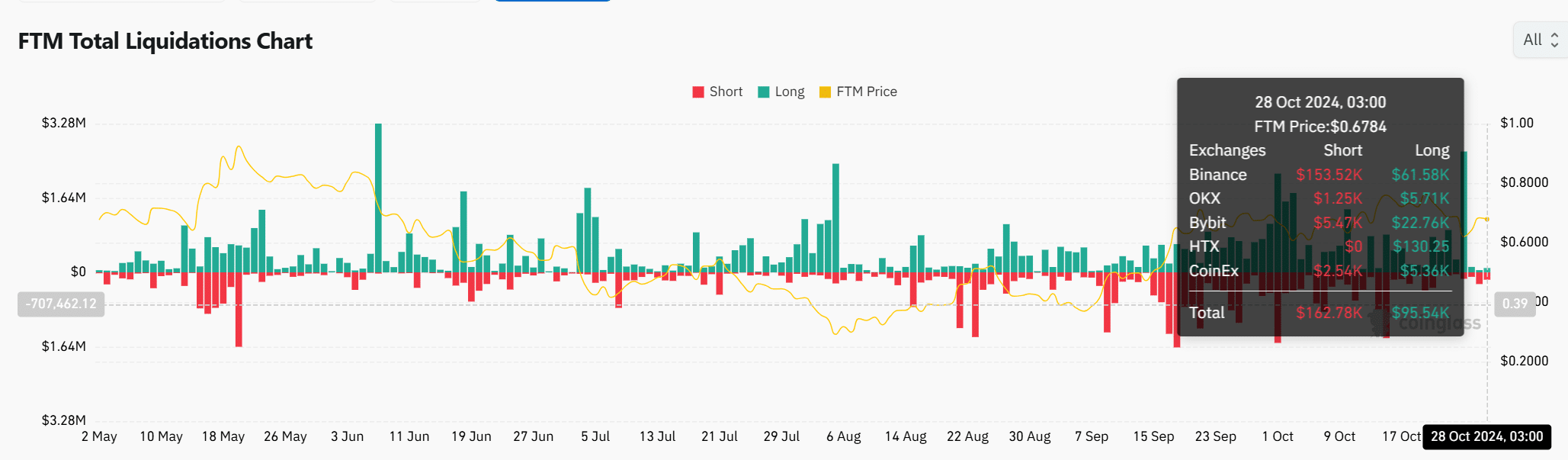

FTM liquidations- Short traders face pressure

Finally, FTM’s liquidation data showed that short positions recorded significant liquidations of $162.78k, with long liquidations lower at $95.54k.

Consequently, this pattern projected bearish sentiment among short traders, misjudging the price trend. If FTM maintains strength above $0.67, further short liquidations could drive the price higher.

Read Fantom’s [FTM] Price Prediction 2024-25

Fantom’s press time momentum, paired with supportive technical indicators and a balanced on-chain picture, flashed a positive outlook for the altcoin.

However, the Price DAA Divergence and the slightly bearish “In the Money” metric implied caution. If FTM clears the $0.7955 resistance with sustained volume, it may continue its rally towards new highs within the channel.