Fantom’s memecoin experiment: Can it ape Solana’s success?

- Activity on Fantom was on a 30-day even though the co-founder put out an exciting update.

- If deployed, press time data showed that the memecoins might not match up to Solana’s.

Fantom [FTM], through co-founder Andre Cronje, has disclosed that it would be opening its network to anyone who wants to deploy a memecoin.

Cronje said this, in a blog post, published on the 9th of April. According to him, the goal is to create a “safer environment” for communities and investors.

Time to save the chain?

However, Cronje, who recently defended Solana [SOL] after the project faced some criticism, gave certain conditions. He noted that 10% of any of the approved tokens would be locked, and 5% would go to the team’s expenses. In other terms, he mentioned that,

“The remaining 85% of the tokens will be put up in a FTM/token LP in foundation multisig. An amount of 100,000 FTM will be provided.”

Fantom’s decision to unlock its doors comes off the back of a thriving memecoin season. While some blockchains have had their time, Solana seems to have remained atop the dominance.

But there was a difference between what was happening on Fantom and what Solana memecoins brought. Before the emergence of projects like Bonk [BONK], and dogwifhat [WIF], activity on Solana was impressive.

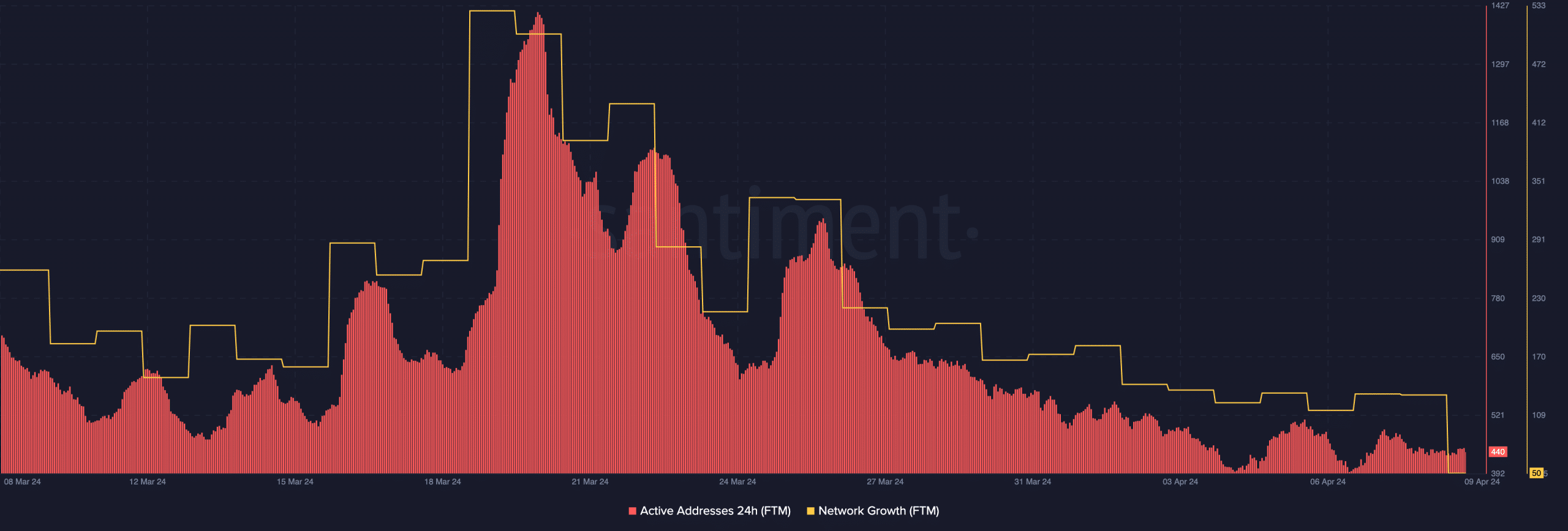

However, AMBCrypto’s analysis showed that it was not the same as the DeFi scalable blockchain. At press time, Santiment’ data showed how the 24-hour active addresses on Fantom were at their lowest in the last 30 days.

Fewer active addresses indicate less demand for FTM. If this continues, it could be difficult for the community to show interest in the memecoins.

Challenges lie ahead

Like the active addresses, network growth on the chain also dropped. The chart, as shown above, implies that Fantom has struggled to attract new participants.

However, it is not out of place to assume that the situation might change. For example, if one memecoin launches and the community finds it worthwhile, liquidity might improve, as well as FTM’s demand.

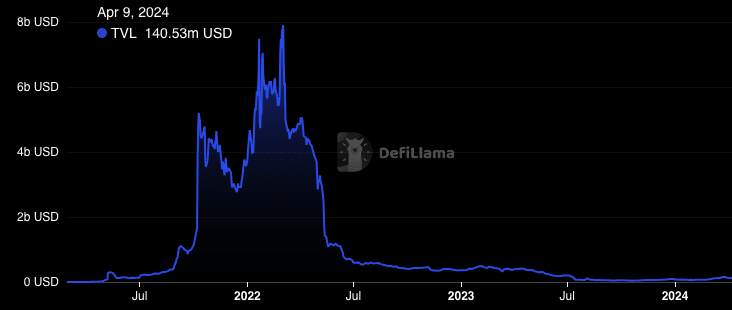

Beyond the metrics mentioned above, the Total Value Locked (TVL) can also tell if the proposal might do well when implemented.

According to DeFiLlama, the project’s TVL was $140.53 million. One thing we noticed was how the TVL had increased but was still far off the $5 billion value it hit at the peak of the 2021 bull market.

While the increase shows improving health, it also reflects hesitation by participants to commit a lot of capital in anticipation of a good yield.

Realistic or not, here’s FTM’s market cap in SOL terms

Nonetheless, the state of these metrics does not mean that the memecoin, if (when) deployed, would underperform.

However, likely, they might not match up to the way the plethora of tokens deployed under Solana did. At the same time, it might be too early to predict.