Fantom’s Q3 performance takes a hit; here’s why

- In July, Multichain’s Fantom bridge suffered a hack.

- This resulted in a decline across the Fantom ecosystem in Q3.

In July 2023, the cross-chain router protocol Multichain was hacked. This resulted in the loss of $126 million worth of cryptocurrency on its Fantom [FTM] bridge, which had a significant impact on the network’s performance in Q3.

Read Fantom’s [FTM] Price Prediction 2023-24

On-chain data provider Messari, in a new report, found that due to the hack, Fantom witnessed a series of declines in some of its ecosystem metrics.

Firstly, its native token FTM experienced a large selloff in mid-August. This resulted in a 15% decline in the altcoin’s value between 16 and 18 August and a 35% fall in its circulating market capitalization during the quarter under review.

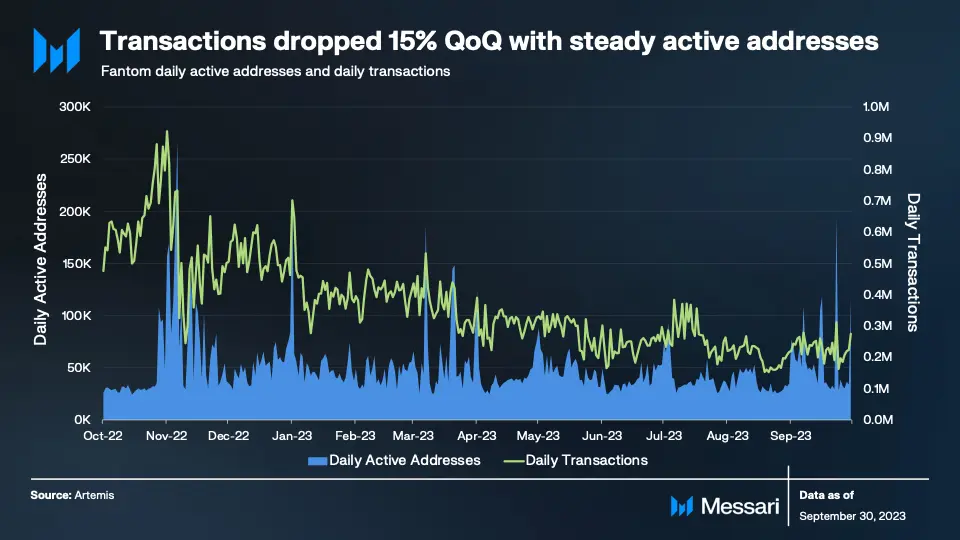

Further, a quarter-over-quarter (QoQ) assessment of Fantom’s network activity revealed a slight decline in usage in Q3. According to Messari, the protocol’s average count of daily transactions totaled 235,000 between July and September, falling by 15%.

September brings slight cheer

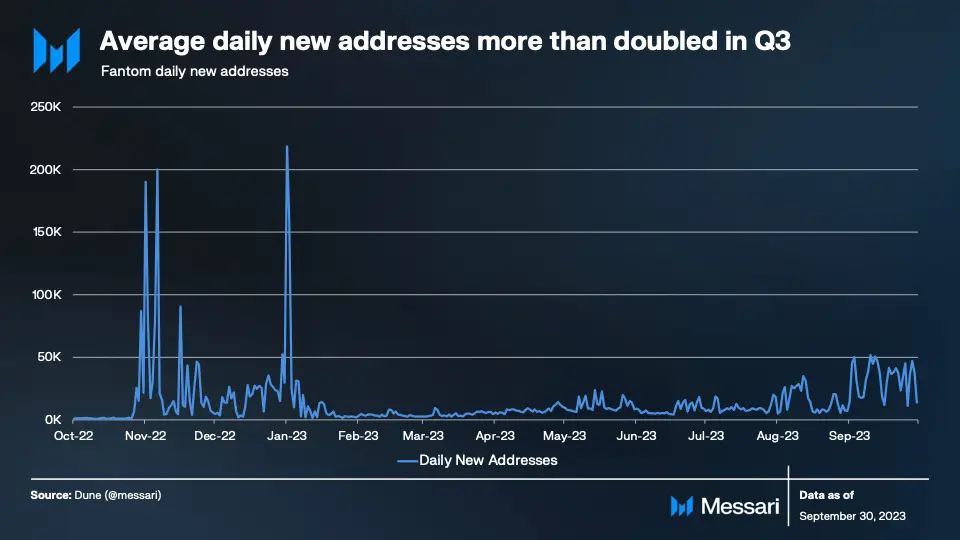

Interestingly, while the first half of the quarter was marked by a fall in the transactions count on the protocol, its daily count of new addresses trended upward in September. This led to a 106% QoQ increase in daily new addresses on Fantom.

According to Messari:

“The increase in daily new addresses coincides with the late-August launch of Estfor Kingdom, a blockchain-based game on Fantom. According to DappRadar, Estfor Kingdom hit a peak of 16,500 unique users on September 4, 2023. On the same day, there were 31,000 new addresses on Fantom. While Estfor Kingdom helped drive growth, there were likely other factors as well.”

Moreover, due to the hack, Fantom’s quarterly revenue climbed by 2% in July. This was because of the high activity on the network, which pushed gas fees to new highs.

Messari found that on the day of the hack, the average gas fee peaked at 10,200 Gwei, breaking the previous record of 9,650 Gwei on May 11, 2022.

Realistic or not, here’s FTM’s market cap in BTC’s terms

However, after the initial revenue rally, “quarterly revenues decreased in the second half of Q3’23” to close the three-month period at $700,000. This represented a 32% decline from the $1 million recorded in protocol revenue in Q2.

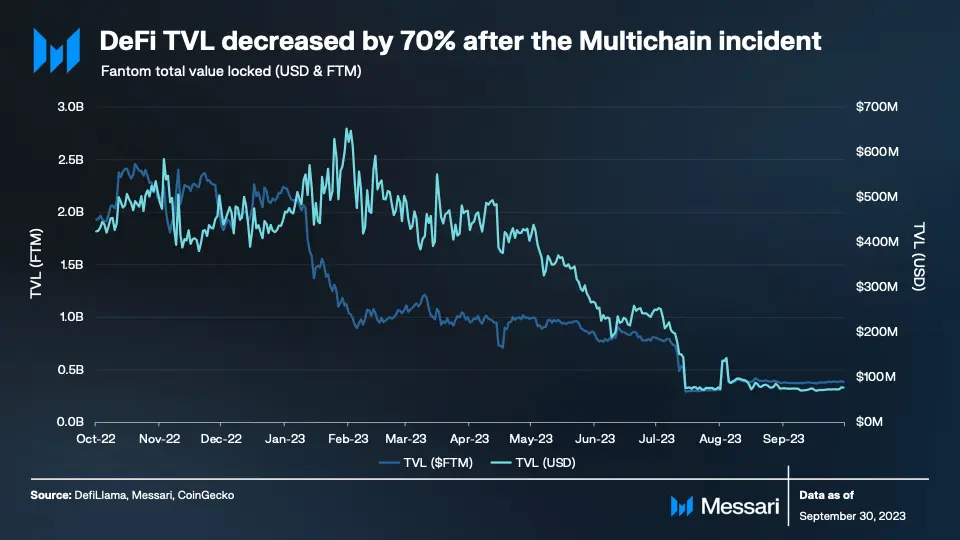

The protocol’s DeFi ecosystem was not spared from the decline, as its total value locked (TVL) plunged by 70% in Q3.

“Many of the top DeFi applications on Fantom experienced a downturn in TVL throughout Q3’23. Notable protocols by TVL include SpookySwap (-71%), Tarot (-25%), Scream Finance (-45%), Beethoven X (-80%), and Tomb Finance (-14%),” Messari found.