Fartcoin recovers 40% in two days – Is a breakout likely?

- Fartcoin jumped over 30% this week following ‘fake news’ on Trump tariffs.

- Is the momentum enough for the memecoin to breach the $0.60 hurdle in April?

Fartcoin [FARTCOIN] led broader crypto recovery following ‘fake news’ about President Donald Trump’s 90-day pause on tariffs.

Even after the fake news was debunked, however, markets reversed recent losses, with AI memecoin Fartcoin posting over 40% gains in the past 48 hours.

Can Fartcoin front a breakout?

Since February, the memecoin consolidated between $0.60 and $0.20. Bulls failed to break above $0.60 during March’s 200% recovery.

However, they held above the 50-day Simple Moving Average (SMA), marking a tight consolidation between the support and overhead hurdle at $0.60.

The On-Balance Volume (OBV) also stayed above key support, while the RSI remained above the mid-range. Collectively, this suggested that Fartcoin bulls were well-positioned to push higher and could breach the $0.60 resistance.

If so, Fartcoin could surge to $0.70 or $0.80, tucking a potential extra gain of 30%.

On the contrary, a retest of the 50-day SMA could offer new buying opportunities if bulls fail to crack the overhead obstacle. However, a breach below the 50-day SMA would warrant caution to short-term bulls.

Speculative interest spikes

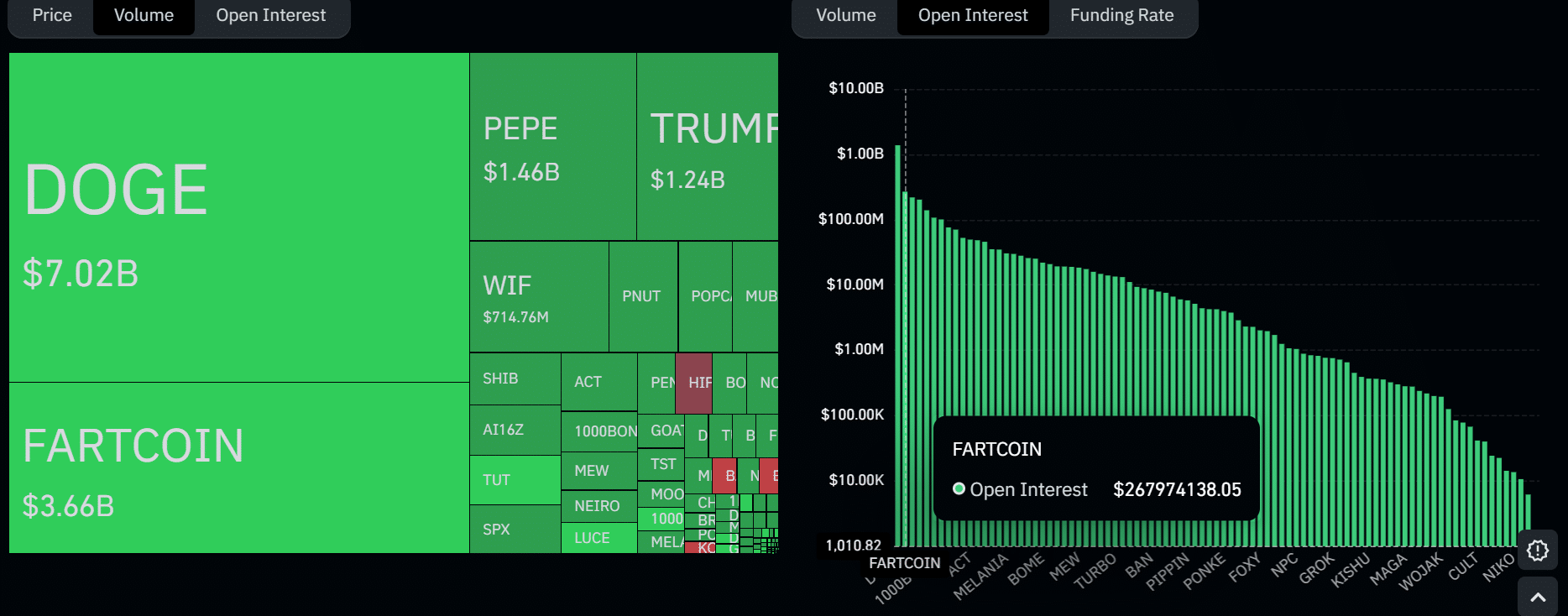

Fartcoin’s bullish sentiment and massive demand were also evident in the derivatives market. It was the second largest memecoin in trading volumes. DOGE had $7 billion in trading volumes, while Fartcoin saw $3.6 billion in volumes.

In addition, Open Interest (OI) rates in Fartcoin surged to $267 million, illustrating massive speculative interest amongst derivatives traders. However, this also meant the rally was driven by leverage, which could expose traders to liquidation cascades in case of sharp price declines.

However, netflow data revealed that the rally was driven by spot demand as well. According to Coinglass data, over $3 million Fartcoin was withdrawn from the Kraken exchange in the past seven trading days.

This showed strong accumulation and renewed speculative interest after the Q1 drawdown. Even so, whether the momentum will extend throughout Q2 remains to be seen.