Fear and greed: Crypto market in trouble? Bitcoin’s plunge raises concerns

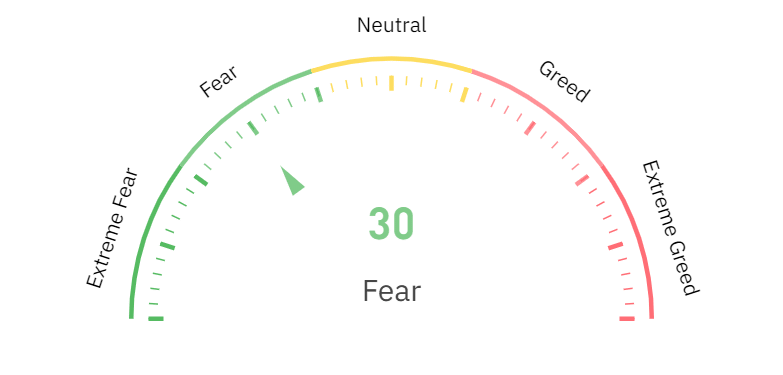

- Crypto Fear and Greed showed that the market has descended into fear.

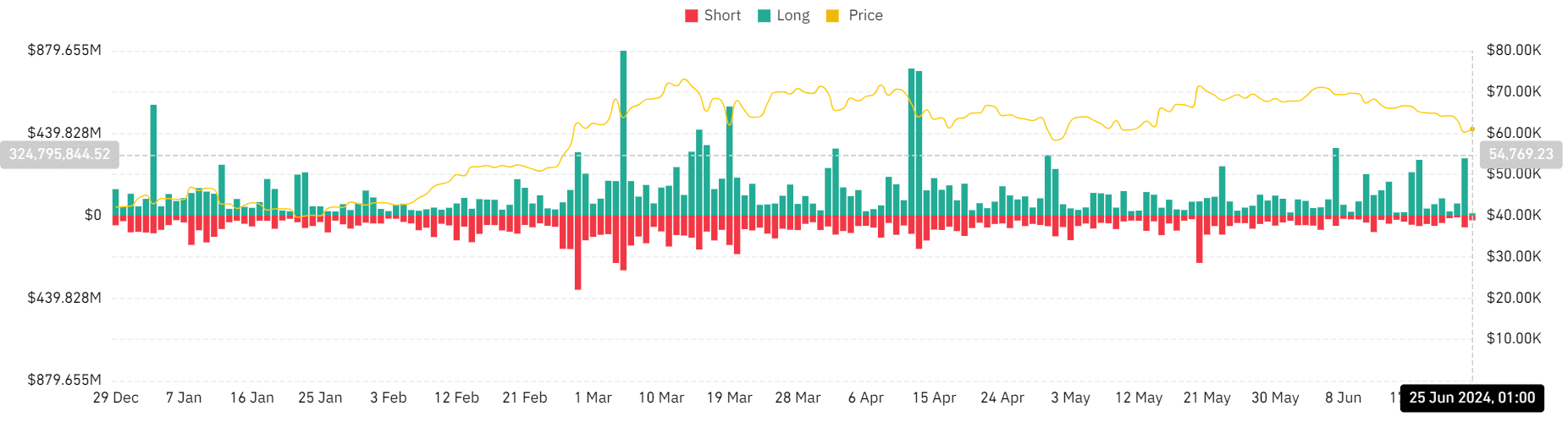

- Long liquidation volume also spiked.

The recent drop in Bitcoin’s [BTC] price has had a notable ripple effect across the cryptocurrency market. This decline has impacted market sentiment significantly, as evidenced by changes in the Fear and Greed crypto index.

The impact of the price drop was also visible in the liquidation map.

Fear dominates crypto

The press time reading of the Fear and Greed crypto Index, at 30, as reported by Coinglass, clearly indicated that fear was dominating the market sentiment.

This measure gauges the general sentiment among cryptocurrency investors by compiling data across various sources, including market volatility, social media sentiment, trends, and other relevant factors.

A score of 30 falls in the “fear” category, suggesting that investors are concerned about potential downside risks. This sentiment often arises in response to recent negative market events, such as significant price drops.

This can lead to a more cautious approach among investors.

In such conditions, trading volumes might decrease as investors hold off on buying, fearing further losses. Conversely, they might sell off their holdings to avoid deeper losses if they anticipate further downtrend.

This shift towards fear reflects growing uncertainty and pessimism about the market’s near-term prospects.

Market sees increased liquidation

The analysis of the liquidation chart highlights a significant spike in liquidations on the 24th of June, totaling over $367 million.

The liquidations were dominated by long positions, which accounted for over $305 million. It is a critical factor that contributed to the shift towards fear in the Fear and Greed crypto index.

When long positions liquidate on such a large scale, it indicates that many investors, who were betting on the price of cryptocurrencies to rise, have been forced to exit their positions.

This can lead to a sharp decline in prices as the market is flooded with sell orders.

The smaller volume of short liquidations, over $62 million, showed that fewer traders betting against the market forcefully closed their positions.

This suggested that investors expected continued growth, which did not materialize.

How Fear and Greed crypto could have shaped up

This imbalance between long and short liquidations often exacerbates downward price movements, increasing fear and uncertainty in the market. A spike in short liquidations typically has the opposite effect.

It indicates that pessimistic traders are being squeezed out, which can push prices upward and potentially shift sentiment towards greed if sustained.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The recent events, as illustrated by these liquidations, are key indicators of market sentiment and dynamics.

They reflect not only the reactions of individual traders to price movements, but also the broader market psychology that can drive future trading behavior.

![Polygon's [POL] short-term momentum faces strong resistance HERE](https://ambcrypto.com/wp-content/uploads/2025/03/Polygon-Featured-400x240.webp)