Fear and Greed Index crypto hits 49: Neutral sentiment ahead?

- The Fear and Greed Index crypto hits 49, reflecting a cautious market poised for its next move.

- Consolidation dominates with the total market cap at $3.19T, as traders awaited clearer signals from macroeconomic trends.

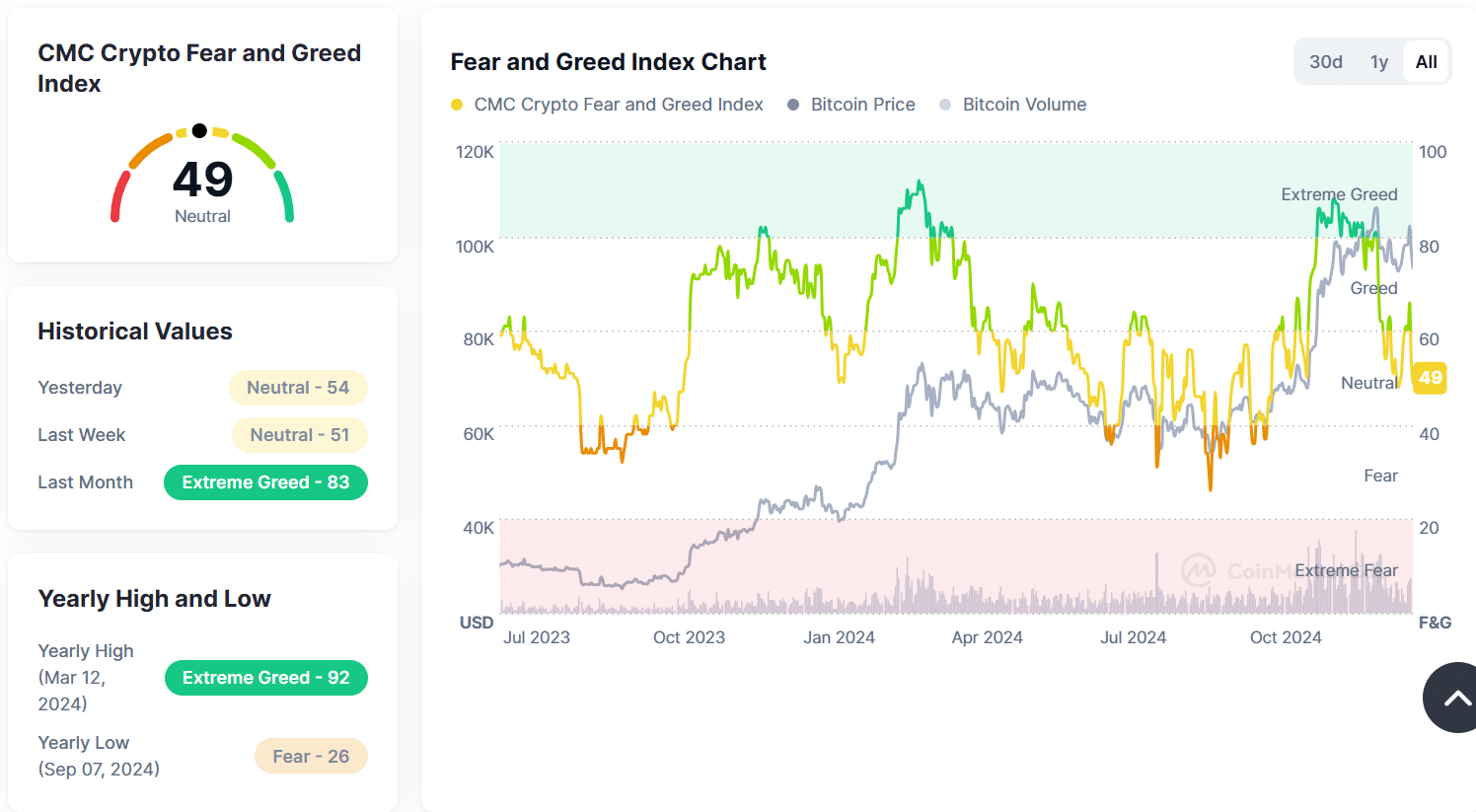

The cryptocurrency market finds itself in a phase of cautious neutrality as the Fear and Greed Index drops to 49 (Neutral).

This shift reflects a cooling sentiment after weeks of volatility and a transition from last month’s Extreme Greed levels of 83.

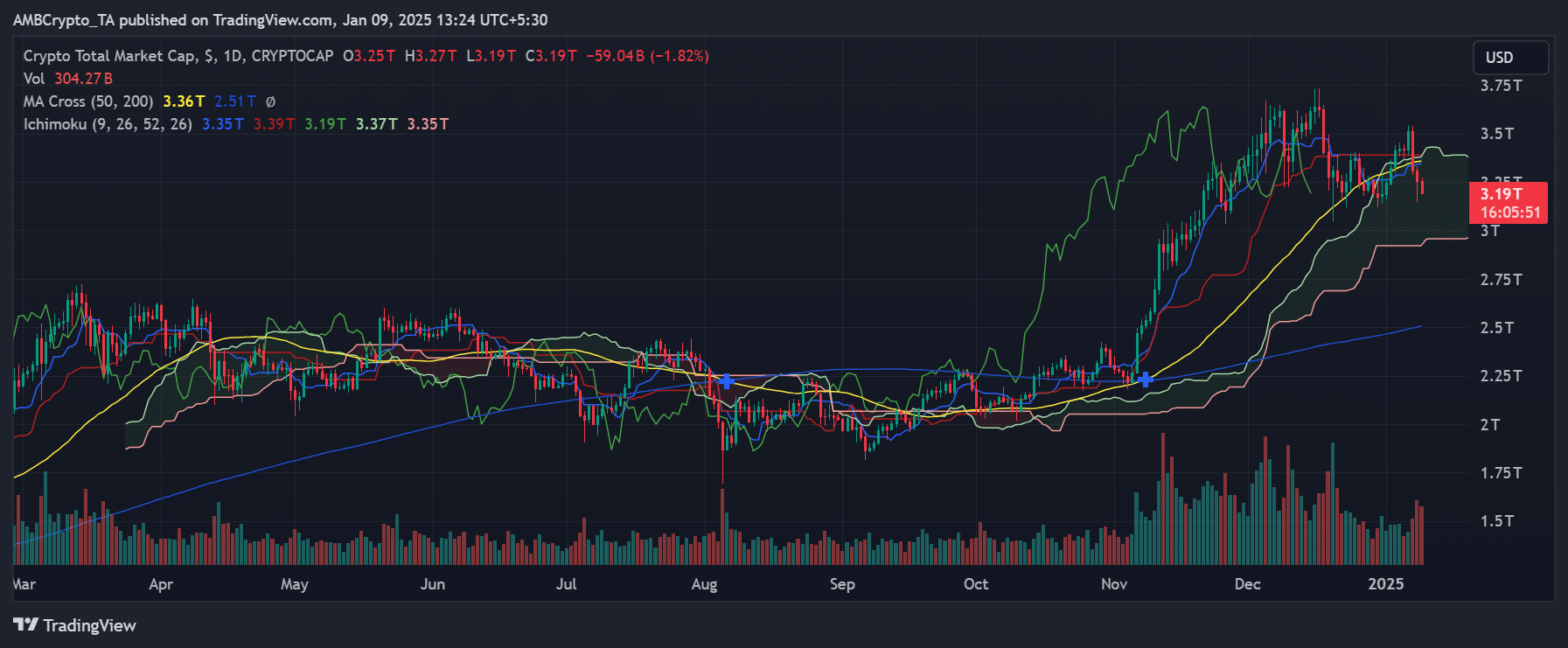

Meanwhile, the crypto total market cap chart highlights a broader consolidation pattern, suggesting that price movements may remain range-bound in the near term unless a strong catalyst emerges.

Fear and greed index crypto: Market uncertainty

The Fear and Greed Index has gradually declined from a high of 83 (Extreme Greed) last month to 49 (Neutral) at press time.

This drop underscores the growing uncertainty among market participants, influenced by macroeconomic factors such as stronger-than-expected U.S. jobs data and potential Federal Reserve rate hikes.

The historical values tell a compelling story. While sentiment was Neutral (54) yesterday and Neutral (51) last week, the index is now teetering on the edge of fear.

This change signals a hesitation in the market as traders adopt a wait-and-see approach ahead of key economic events later this week.

Consolidation in total crypto market cap

The total crypto market cap was $3.19 trillion at press time, reflecting a 1.82% decline over the past 24 hours. The Ichimoku Cloud and moving averages on the chart provide critical insights into the current market structure.

The market cap recently dipped below the 50-day moving average of $3.36 trillion, signaling short-term bearish pressure.

However, the Ichimoku Cloud shows support at $3.19 trillion, suggesting that a significant breakdown may be avoided if buyers step in at this level.

Trading volume, recorded at $304.27 billion, indicates moderate activity but lacks the momentum required for a breakout in either direction.

Unless a major catalyst emerges, such as dovish remarks from the Federal Reserve or improved macroeconomic data, the market will likely remain range-bound.

How the fear and greed index crypto moves is also important.

What’s next for crypto markets?

The current Neutral sentiment, combined with a consolidating market cap, suggests that crypto prices are unlikely to see significant volatility in the short term.

However, several scenarios could unfold based on market conditions.

In a bullish scenario, sentiment shifting back toward greed due to favorable macroeconomic developments could see Bitcoin and Ethereum retesting their ATHs.

This momentum would also drive altcoins higher, with the total market cap potentially breaking above the $3.4 trillion resistance.

On the other hand, a slip into fear territory could lead to Bitcoin and Ethereum dropping below their current levels, dragging the total market cap toward $3 trillion or lower.

Without a significant catalyst, the market may remain range-bound, consolidating within the $3.15 trillion to $3.35 trillion range, with Bitcoin and Ethereum maintaining their current levels.

These moves will impact the fear and greed index crypto.

Caution in neutral markets

The cryptocurrency market’s neutral sentiment reflects a balance between bullish optimism and bearish caution.

Consolidation will likely define the near-term price action as traders watch for signals from macroeconomic data and global markets.

While the Fear and Greed Index suggests hesitation, it also provides a foundation for potential recovery if external conditions turn favorable.

For now, patience and close monitoring of key support and resistance levels are essential.