FET: Key data suggests 20% drop ahead – What now?

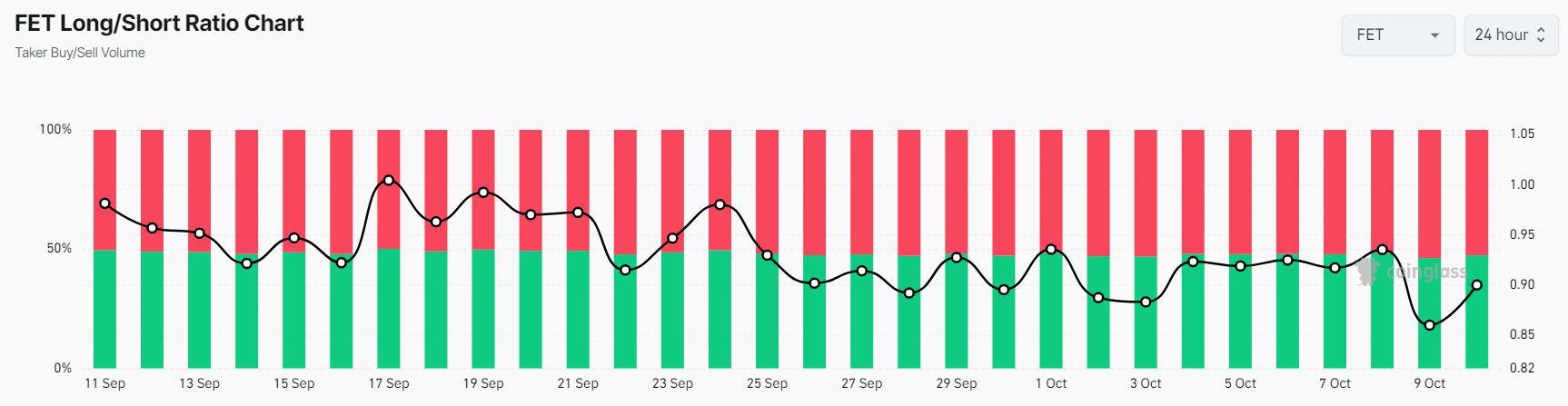

- FET’s Long/Short Ratio was at 0.90, indicating strong bearish market sentiment among traders.

- 53.2% of top traders held short positions, while 46.8% held long positions.

Amid the ongoing bearish market sentiment, Artificial Superintelligence Alliance Price Prediction [FET] is poised for a massive price decline as it failed to hold a crucial support level.

Similarly, major cryptocurrencies including Bitcoin [BTC], Ethereum [ETH] have been struggling, having experienced notable price declines over the past 24 hours.

Current price momentum

At press time, FET was trading near the $1.35 level, after a price decline of over 4.7% in the past 24 hours. During the same period, its trading volume dropped by 4.9% indicating lower participation from traders and investors.

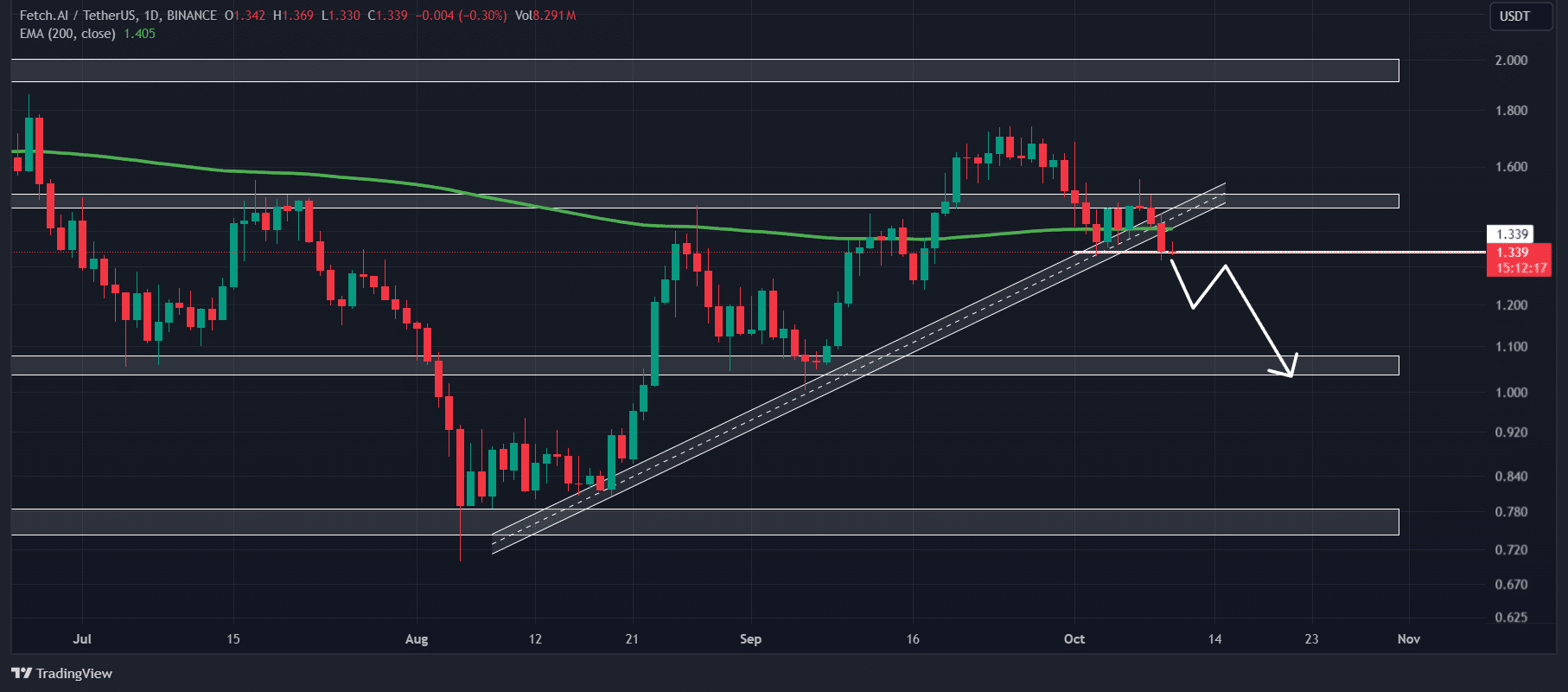

FET recently breached crucial trendline support, a strong consolidation zone, and the 200 Exponential Moving Average (EMA) on a daily time frame.

It closed a daily candle below the consolidation zone, which confirmed this as a successful breakdown.

Based on the historical price momentum, there is a strong possibility that FET’s price could drop by 20% to reach the $1.03 level in the coming days.

Despite this bearish outlook, its Relative Strength Index (RSI) is in an oversold zone that suggests a potential price recovery.

However, this seems unlikely at the moment, due to the prevailing bearish market sentiment.

Bearish on-chain metrics

The altcoin’s negative outlook is further supported by on-chain metrics.

According to the on-chain analytics firm Coinglass, FET’s Long/Short Ratio was 0.90 at press time, indicating strong bearish market sentiment among traders.

Additionally, its Futures Open Interest dropped by 6.7% over the past 24 hours and has been steadily falling, showing ongoing bearish market sentiment.

At press time, 53.2% of top traders held short positions, while 46.8% held long positions.

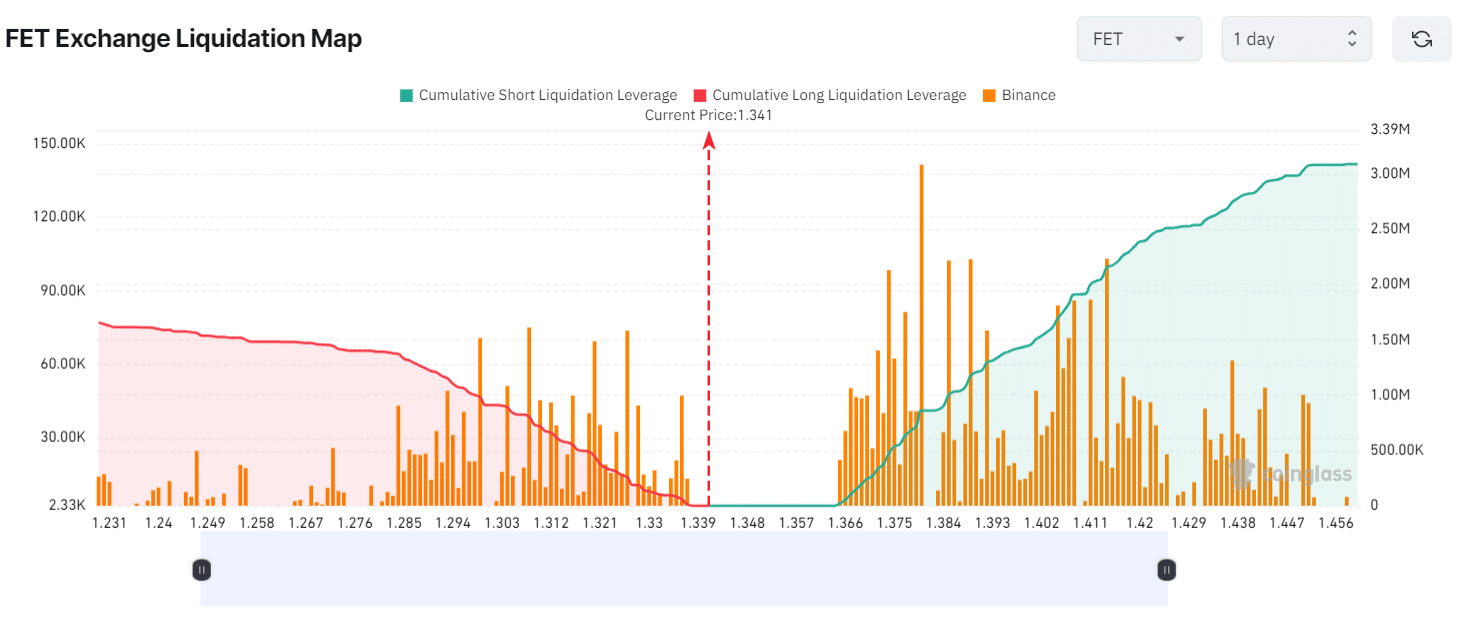

The major liquidation levels were at $1.30 on the lower side and $1.38 on the upper side, with traders over-leveraged at these levels, according to Coinglass data.

If the market remains unchanged and FET’s price drops to $1.30, nearly $807,000 worth of long positions will be liquidated.

Conversely, if sentiment shifts and the price rises to $1.38, approximately $2.17 million worth of short positions will be liquidated.

Read Artificial Superintelligence Alliance’s [FET] Price Prediction 2024–2025

This data shows that short sellers have been making significant bets on short positions over the past 24 hours.

By combining technical analysis with on-chain metrics, such as open interest and the Long/Short Ratio, it appears that bears are currently dominating the asset, with the potential to drive a massive price decline.