FET price prediction: Top reasons why a bullish reversal is imminent

- FET has been under bearish pressure after failing to break out of a descending channel.

- A drop in exchange reserves as whale activity spikes suggests that a trend reversal is imminent.

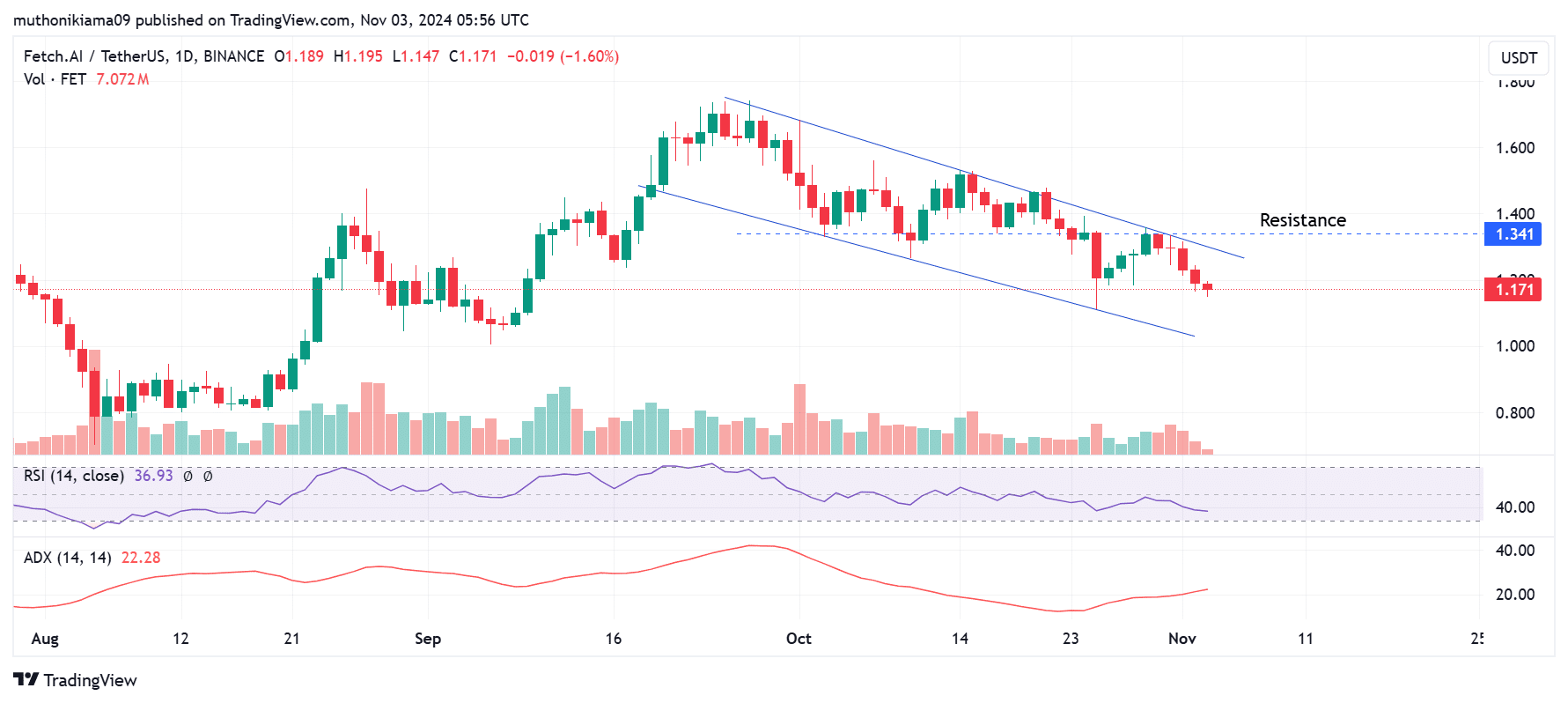

Artificial Superintelligence Alliance [FET] has been under bearish pressure after dropping by 14% in the last two weeks. This bearish sentiment has prevented a breakout from its descending parallel channel.

FET traded at $1.18 at press time. The altcoin continues to face resistance at $1,34, which is also the upper trendline of the descending channel, amid declining buying interest.

The Relative Strength Index (RSI) stood at 37, indicating high selling pressure. Moreover, the RSI has been making lower lows, pointing towards a strengthening bearish sentiment.

The Average Directional Index is also rising. This shows that the current downtrend is strong, and it could continue if there is no shift in demand.

Despite the prevailing bearish trends on the one-day chart, on-chain metrics are showing signs of bullish reversal.

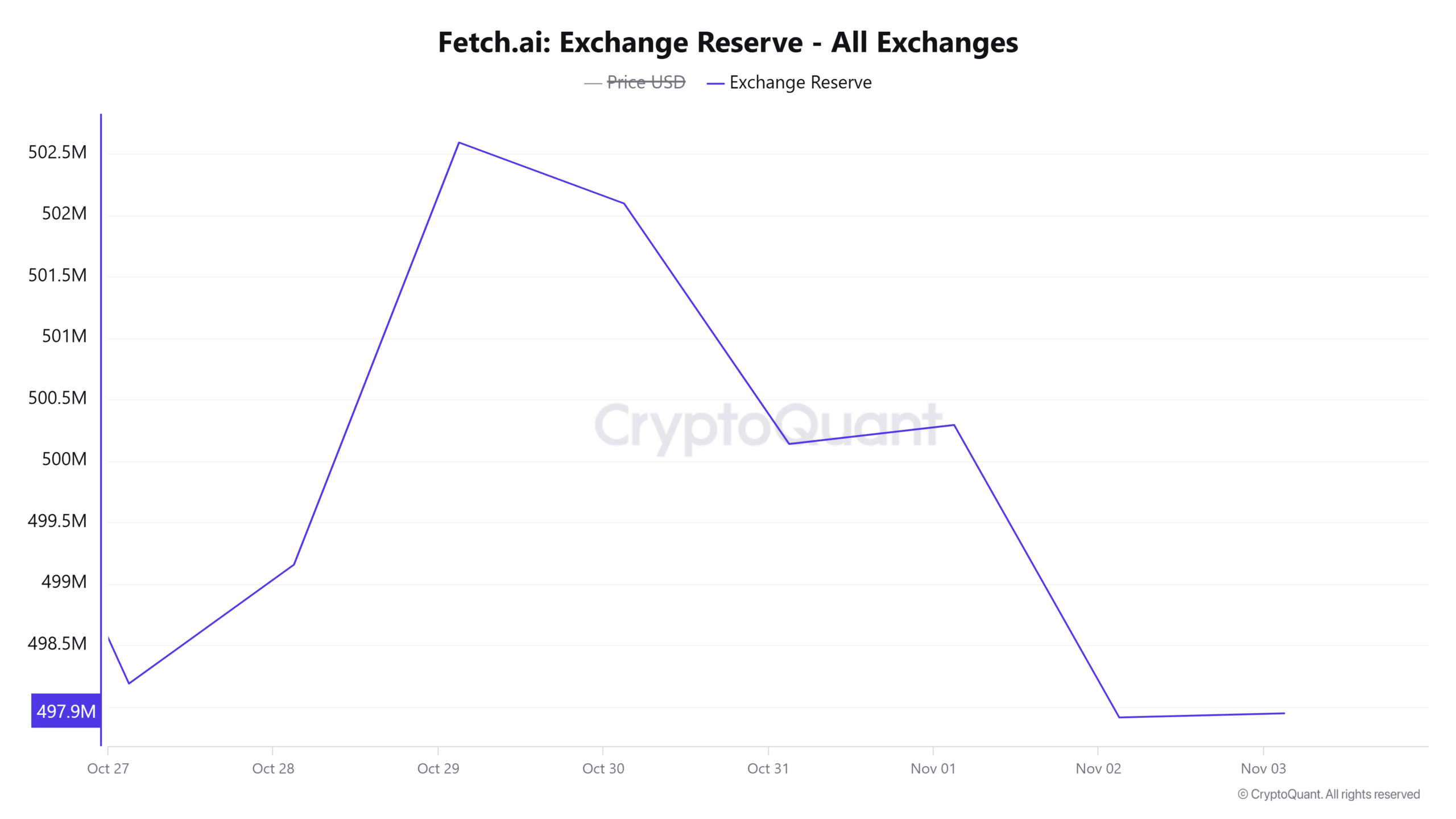

FET exchange reserves drop

Data from CryptoQuant shows that FET exchange reserves have plunged significantly in the last four days. The reserves dropped from 502 million to a weekly low of 497 million.

Declining exchange reserves positively impact price as it can result in reduced selling pressure. Therefore, if this decline continues in the coming days, the selling activity around FET could reduce and the token could be poised for a recovery.

A drop in this metric also suggests that the recent downtrend shook out the weak hands that have been contributing to the high-selling activity.

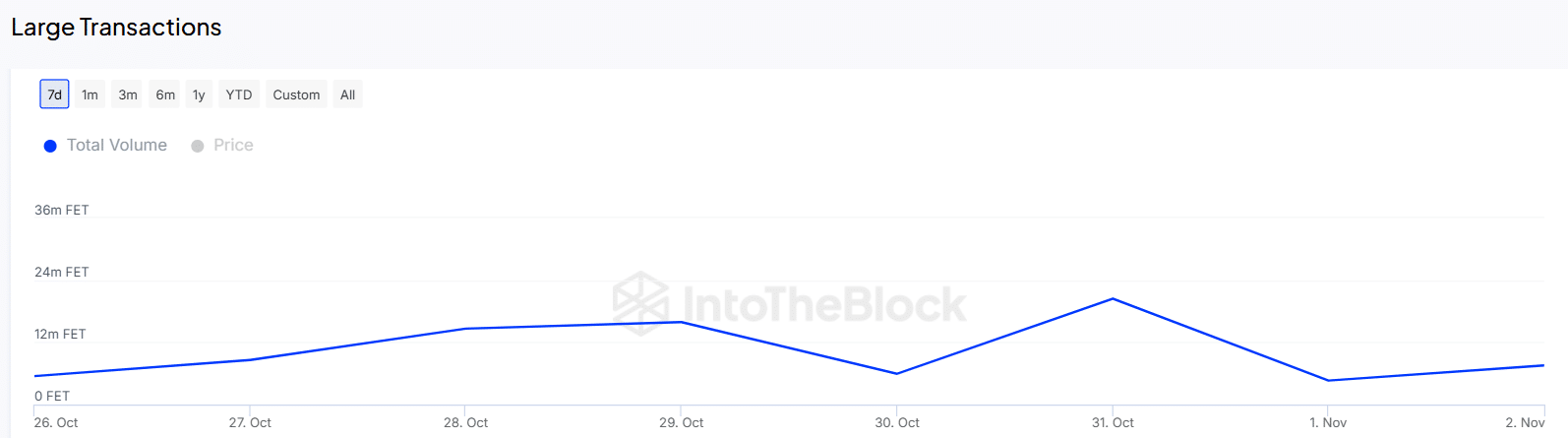

Whale activity on the rise

There has also been a spike in whale activity around the FET token. Data from IntoTheBlock shows that within 24 hours, large FET transactions surpassing $100,000 increased from 4.63M to 7.56M.

This spike suggests that whale activity around this altcoin is significantly high. If these whales are buying, it could have a positive impact on price. However, if they are selling, it could accelerate the downtrend.

Whales play a huge role in influencing FET’s price action. This is because they make up 63% of the token’s supply. Therefore, rising activity could contribute to volatile price movements.

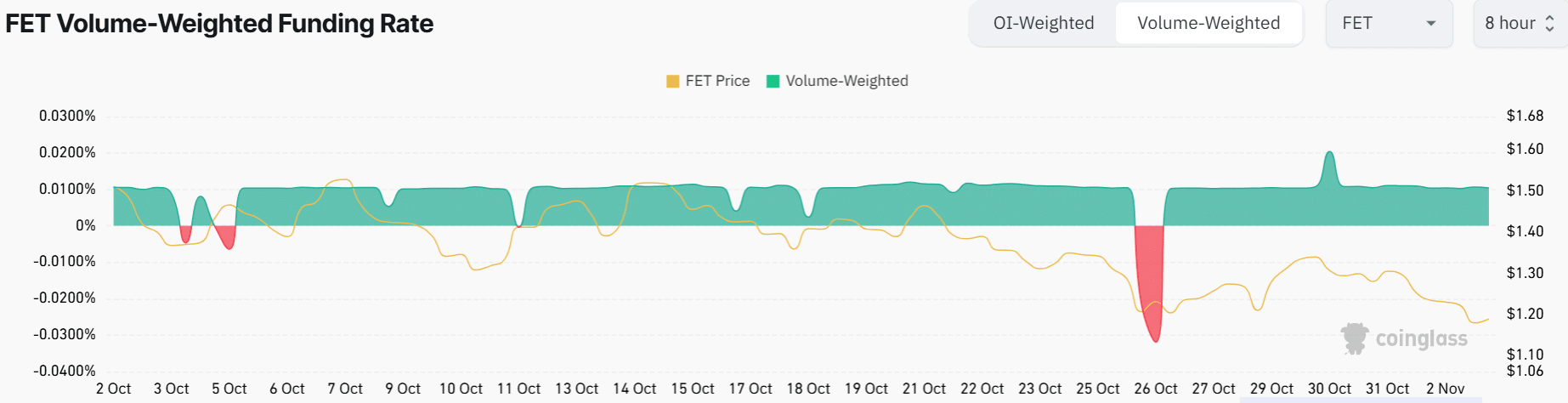

Long positions are still dominant

A look at funding rates shows that traders opening long positions on FET are still more than short traders.

Read Artificial Superintelligence Alliance’s [FET] Price Prediction 2024–2025

This data shows that long traders are paying a premium to maintain their positions. However, given that open interest had dropped by 5% at press time, it suggests that there is weak demand for new long positions.

The positive funding rates amid declining open interest show that the bullish sentiment in the derivatives market is showing signs of weakening. If there is no fresh buying activity and demand for long positions, the bearish sentiment could persist.