Few crypto exchanges dominate the market: Why this is concerning

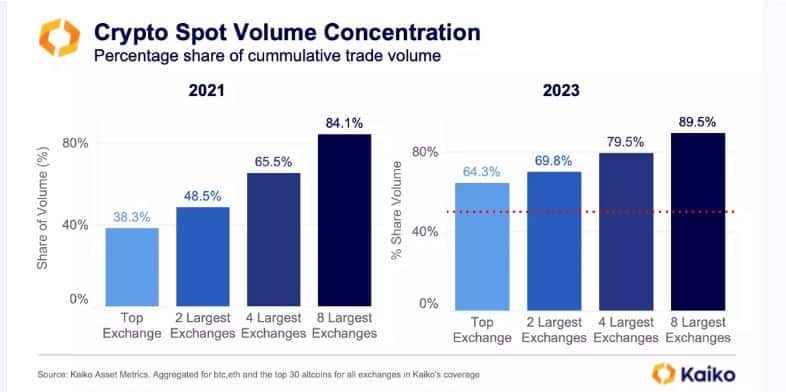

- Binance’s share of spot trading volume jumped from 38.3% in 2021 to 64.3% in 2023.

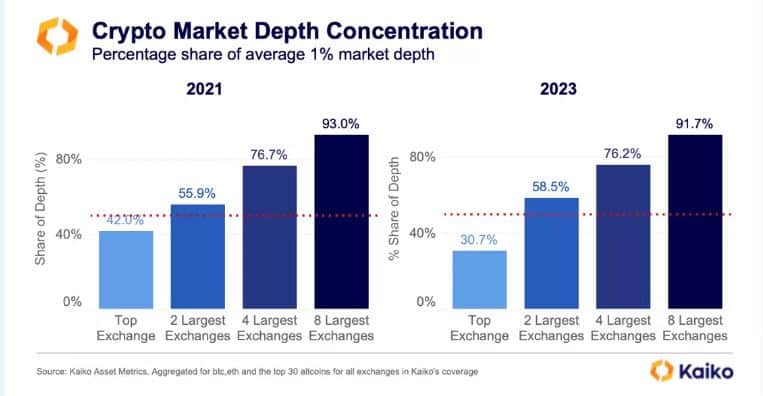

- Due to the SEC lawsuit, Binance’s market depth fell from 42% in 2021 to 30.7% in 2023.

For an ecosystem which pandered to the libertarian ideals of decentralization, the increasing centralization and dominance of a few crypto entities couldn’t get starker.

According to Claire Medalie, Director of Research at Kaiko, liquidity in the crypto market has become more concentrated over time, with only eight trading platforms accounting for about 90% of global market depth and trading volumes.

This was astonishing, considering there were hundreds of crypto exchanges operational across different countries at the time of writing, data from CoinGecko revealed.

Single point of failure?

Market depth is an exchange’s ability to absorb relatively large market orders without materially affecting the asset’s price. Trading volumes. on the other hand, represent the total amount of a digital asset traded over a certain period. Both indicators are used to assess liquidity in the markets.

Highly concentrated markets meant that the liquidity was not distributed evenly across exchanges. Such a situation, as per Kaiko, could lead to higher volatility in the market.

Another issue with a disproportionate market share was that the collapse of one entity could bring the entire market down, something that was on show with the FTX implosion of 2022.

The asymmetry becomes much more pronounced when one puts Binance, world’s largest crypto exchange, into context. Binance’s share of spot trading volume jumped from 38.3% in 2021 to 64.3% in 2023. Interestingly, the total share of eight largest exchanges increased less dramatically, from 84.1% to 89.5%.

It became evident that Binance scooped up the majority of business from its nearest rivals and consolidated its position in the market. The collapse of FTX, which was the third-largest exchange at that time, played to Binance’s advantage.

The inference one could draw was that Binance served as a single point of failure for the industry. As a result, incidents of regulatory crackdowns and security breaches have had a cascading effect on the market value of crypto assets.

Binance’s market depth falls

In contrast to trading activity, Binance’s market depth fell considerably, from 42% in 2021 to 30.7% in 2023. This could be attributed to the exodus of market participants following the SEC’s lawsuit against the platform and attempts to freeze assets at its American branch, Binance.US.

The fall in Binance’s market depth also led to a decline in the share of the top eight exchanges. Although, it still remained above 90% at press time.

![Solana [SOL] - Is there any good news after trading volume hits 2024 low?](https://ambcrypto.com/wp-content/uploads/2025/03/Solana_Abdul-400x240.webp)