Fiat trading on Binance falls sharply: Analyzing the causes

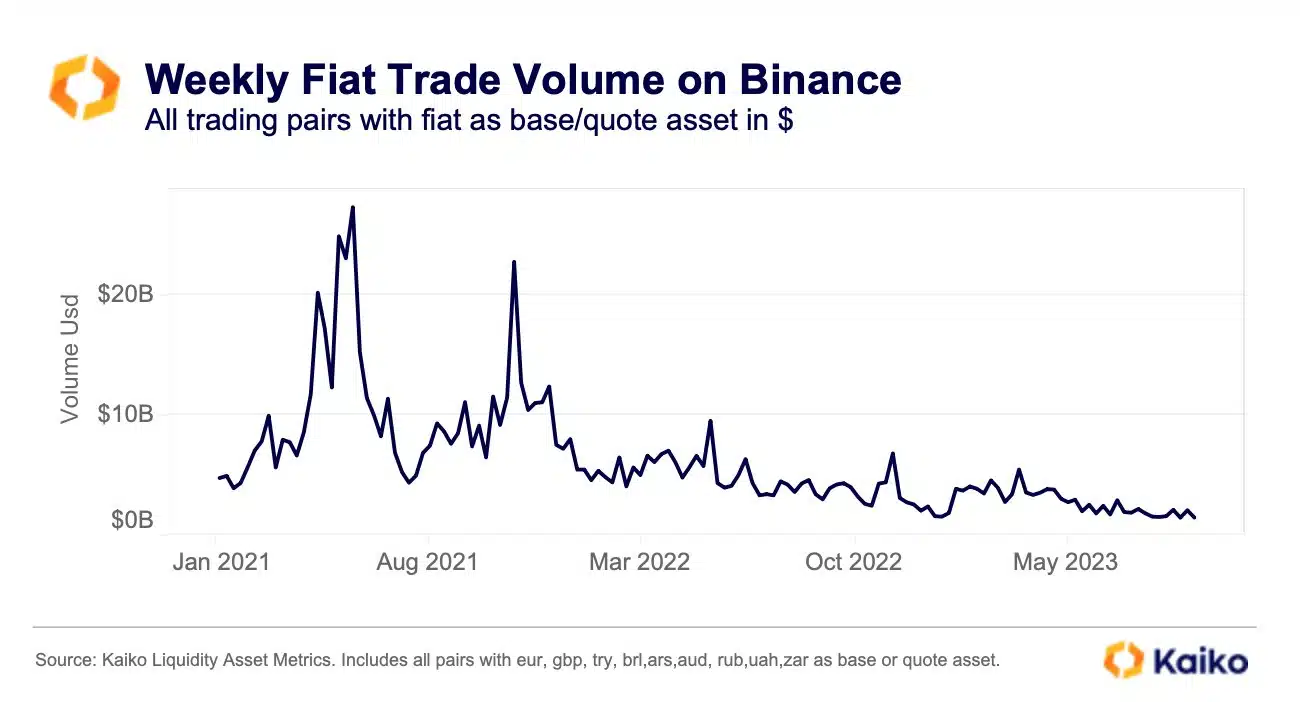

- Fiat-dominated trades on Binance were down by a staggering 95% since 2021 highs.

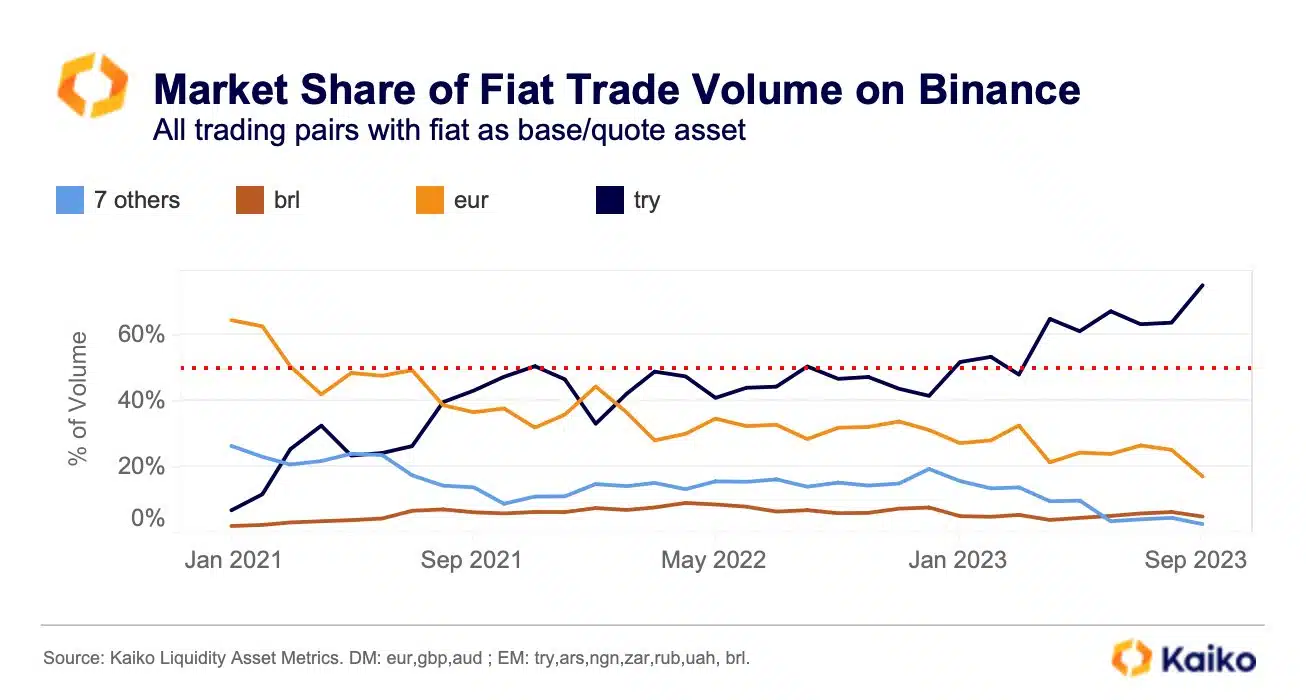

- The Turkish lira was the largest fiat trading pair on Binance.

The ongoing lull in prices of major cryptos has dented market sentiment, with many market makers and retail traders steadily exiting exchanges in recent months.

How much are 1,10,100 BNBs worth today?

Like other trading pairs, volumes in fiat pairs also took a beating. According to crypto market data provider Kaiko, fiat volumes on world’s largest exchange Binance [BNB] plunged by 60% since the beginning of the year.

Moreover, when compared from its all-time high (ATH) recorded in the 2021 bull market, fiat-dominated trades were down by a staggering 95%. The analysis covered major currencies like the euro (EUR), Great Britain pound (GBP), Turkish lira (TRY), Russian Ruble (RUB), and many more.

The factors behind the decline

Over the years, crypto exchanges have attracted numerous passionate traders looking to earn quick money by taking advantage of the market’s violent fluctuations. The most common way for these traders to interface with the world of cryptos has been through fiat on-ramping and off-ramping services.

However, with returns on crypto investments having declined significantly over the last year or so, most traders have abstained from transferring their fiat funds to digital assets.

Another major factor behind the decline could be a lack of interest to convert money into USD-backed stablecoins. During much of 2022, U.S. Dollar Index (DXY) was pumping, which prompted global users to exchange their national currencies with assets like Tether [USDT].

However, as the inflation has eased in 2023, a sharp fall in the DXY was recorded, thereby disincentivizing USD ownership to some extent.

Turkish lira bucks the trend

While fiat-to-crypto trading experienced a drought, the currency of a major G-20 nation seemed to be defying the trend. As per Kaiko, the Turkish lira (TRY) was the largest fiat trading pair on Binance.

In fact, it captured a whopping 3/4 of the total volumes on the exchange in early September.

Interestingly, while volumes involving some other major currencies like the Euro and Brazilian Real shrank, TRY’s market dominance climbed from 50% to 60% year-to-date (YTD).

Read Binance Coin’s [BNB] Price Prediction 2023-24

According to data from CoinGecko, USDT/TRY was the ninth-largest trading pair on the exchange in the last 24 hours of trading.

Turkey has been dealing with hyperinflation, with the TRY depreciating significantly against the USD in recent memory. At the time of writing, 1 USD was worth 26.97 TRY, a threefold increase over the previous two years.