Fidelity makes a major crypto play – Joins the Solana ETF race

- Fidelity made an SOL ETF move, leaving only BlackRock out of the race.

- Over $470M SOL were moved from exchanges in the past three weeks.

Fidelity, a $15 trillion asset manager, has joined the U.S. spot Solana [SOL] exchange-traded funds (ETF) race.

On the 25th of March, the firm filed a 19b-4 form with the SEC (Securities and Exchange Commission), via Cboe BZX exchange for a spot SOL ETF.

SOL ETF race heats up

Only BlackRock was yet to make a similar application. But Grayscale, 21Shares, Bitwise, Canary Capital, and VanEck had done so. The market’s expectation for approval was high, at 86% per Polymarket.

In fact, in February, the agency acknowledged all the filings and subsequently entered them into the Federal Register (FR), triggering the 240-day window for an approval decision. As of this writing, Franklin Templeton’s filing was yet to hit the FR.

Unsurprisingly, Fidelity’s move was expected after registering a trust in Delaware on the 20th of March, a common pathway for issuers eyeing a new ETF filing.

After recent ETF futures approval and a subsequent debut on CME Futures, SOL was the top contender in the altcoin ETF lineup. Other altcoins like Litecoin [LTC], Polkadot [DOT], Avalanche [AVAX], Sui [SUI], and Dogecoin [DOGE] also saw ETF interest amongst issuers.

However, Nate Geraci of ETF Store projected that the agency might not greenlight all altcoin ETFs.

“Optimistic on approval of various altcoin ETFs (but SEC will likely draw line somewhere). Quite a bit of debate around whether advisors want broad crypto exposure ETFs vs targeting single crypto ETFs. I’m bullish on broad crypto ETFs.”

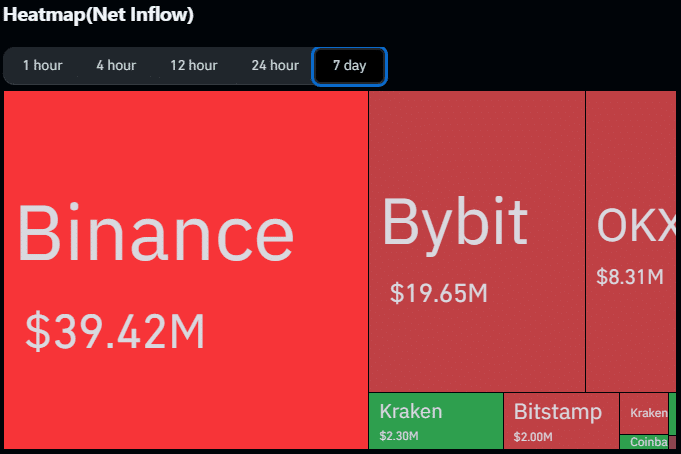

On markets, speculators betted on the altcoin’s price upside. Notably, over the past seven days, holders withdrew approximately $70M of SOL from exchanges, signaling bullish expectations for the future.

Source: Coinglass

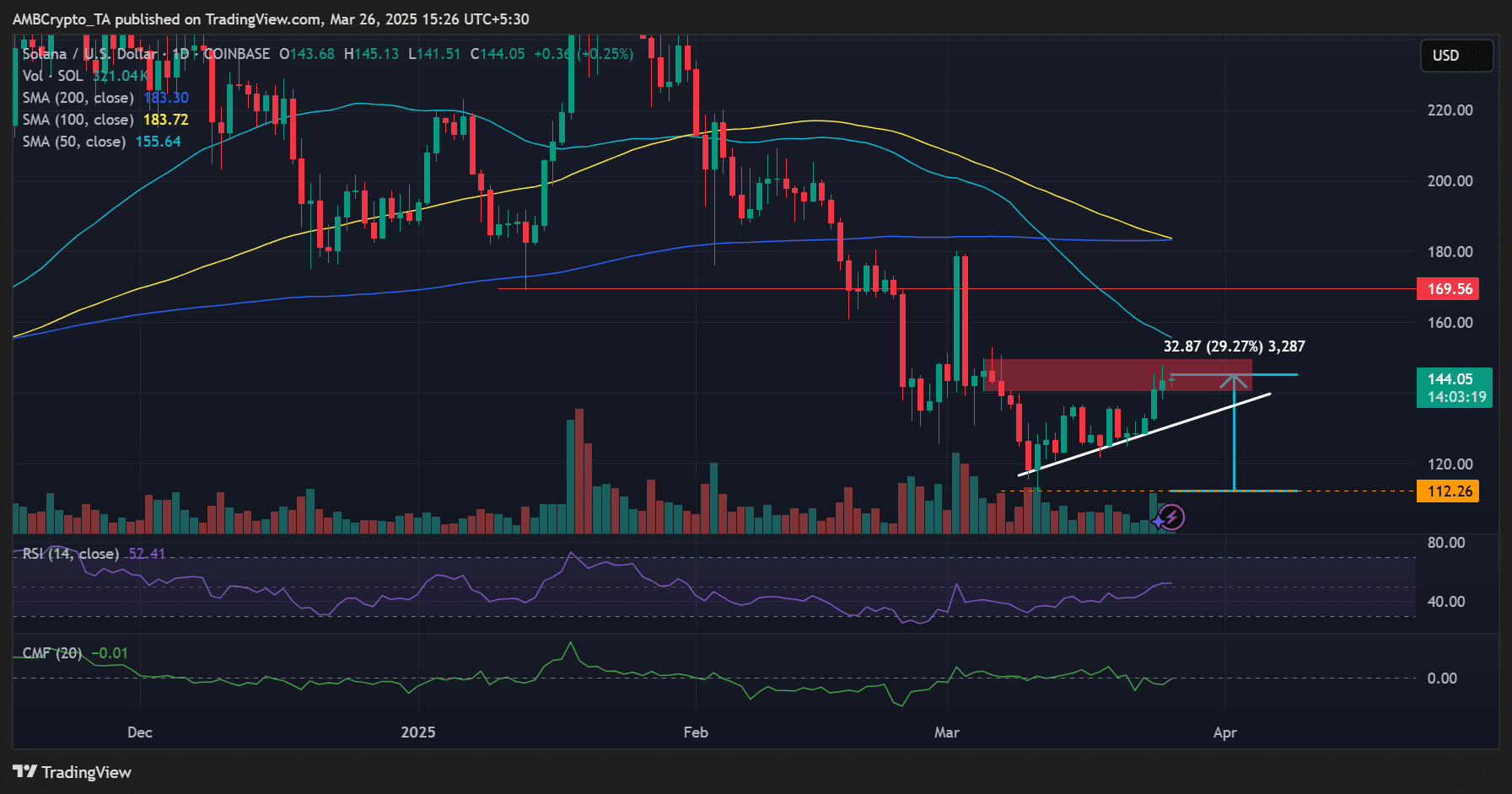

Coinglass data showed that over $470M SOL was moved from exchanges in the past three weeks alone. The demand triggered the altcoin to bounce nearly 30% from the March low of $112.

However, bulls had to clear the $150 hurdle to climb higher, or short sellers could regain the market edge.

![Shiba Inu [SHIB] price prediction - Mapping short-term targets as selling pressure climbs](https://ambcrypto.com/wp-content/uploads/2025/03/SHIB-1-2-400x240.webp)