Filecoin traders can gain profits if FIL makes it to this crucial level

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Solid bullish defense at the key support level resulted in a significant price reversal.

- Positive funding rates could see further gains registered in the short term.

Filecoin [FIL] defended the $3 support level again and rebounded strongly with 12% gains. AMBCrypto’s previous price analysis highlighted the long opportunity from the support level, based on the liquidity available at the critical price zone. This projection was validated with buyers posting a solid bullish reversal.

Read Filecoin’s [FIL] Price Prediction 2023-24

More gains are possible if bulls clear this hurdle

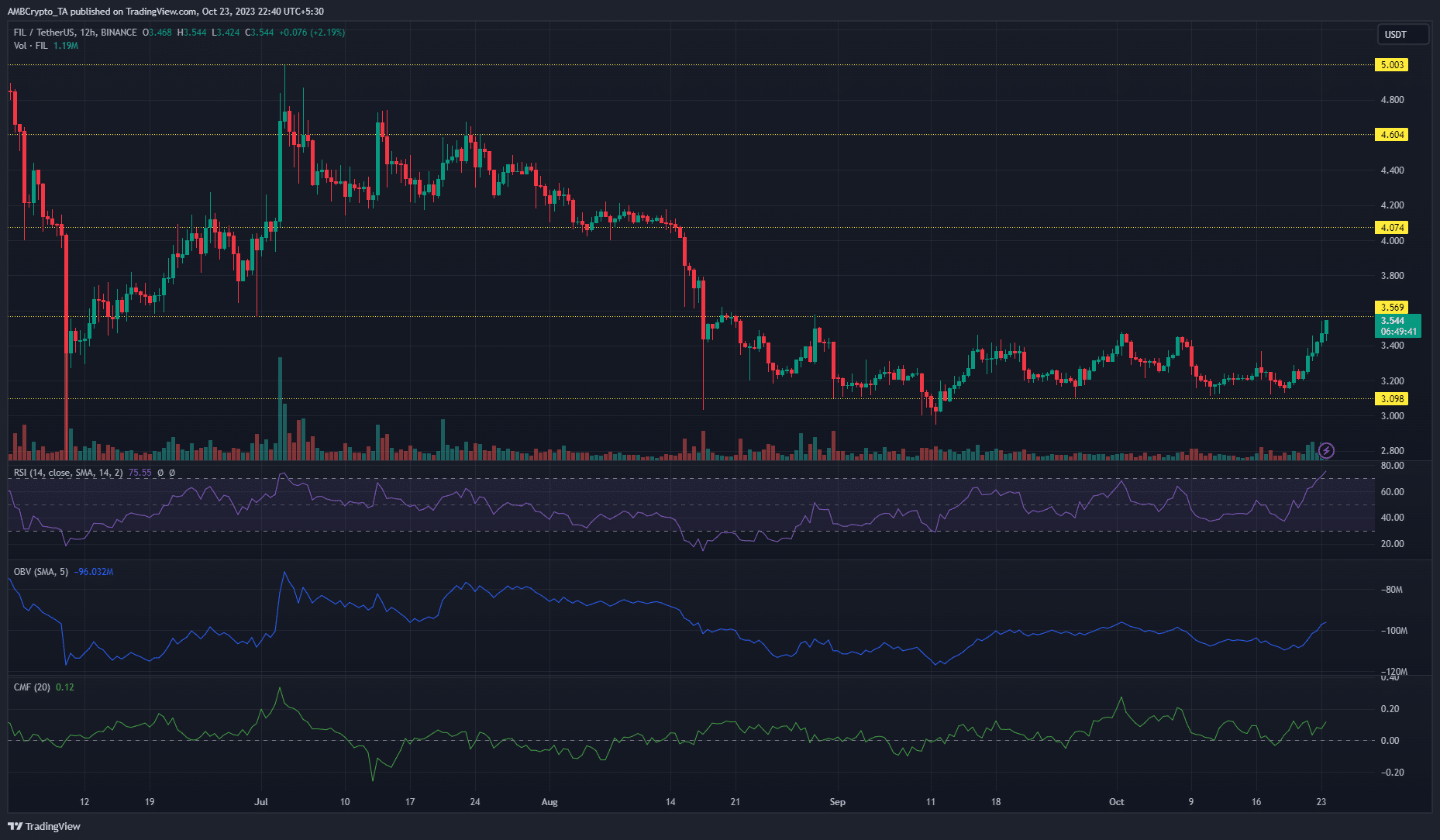

Source: FIL/USDT on Trading View

At press time, the bullish momentum was evident with multiple indicators flashing bullish signals.

The Relative Strength Index (RSI) crossed the neutral 50 and surged toward the overbought zone to highlight the strong buying pressure. In a similar fashion, the On Balance Volume (OBV) produced a decent uptick while the Chaikin Money Flow (CMF) remained above zero to signal good capital inflows.

The mix of the bullish price action and positive indicators suggested more gains were likely in the short term for FIL. However, the $3.5 hurdle needs to be cleared, as this resistance level has rebuffed previous bullish rallies.

If bulls are able to scale this resistance level, further gains can be reached at $3.8 to $4. Otherwise, a price rejection at $3.5 will extend the range-bound price movement.

Positive funding rates revealed a bullish bias in the futures market

Source: Coinalyze

Along with the bullish price action, most traders in the derivatives market continued to bet on FIL’s price rise. As per Coinalyze, the funding rate for FIL was positive, reflecting the dominance of bullish long positions.

How much are 1,10,100 FILs worth today?

In addition, the Open Interest (OI) surged from $73.4 million to $77.3 million. This was another sign of the bullish bias in the near term with further upward movement possible.