Filecoin: Why $3.38 level could make or break FIL in the short-term

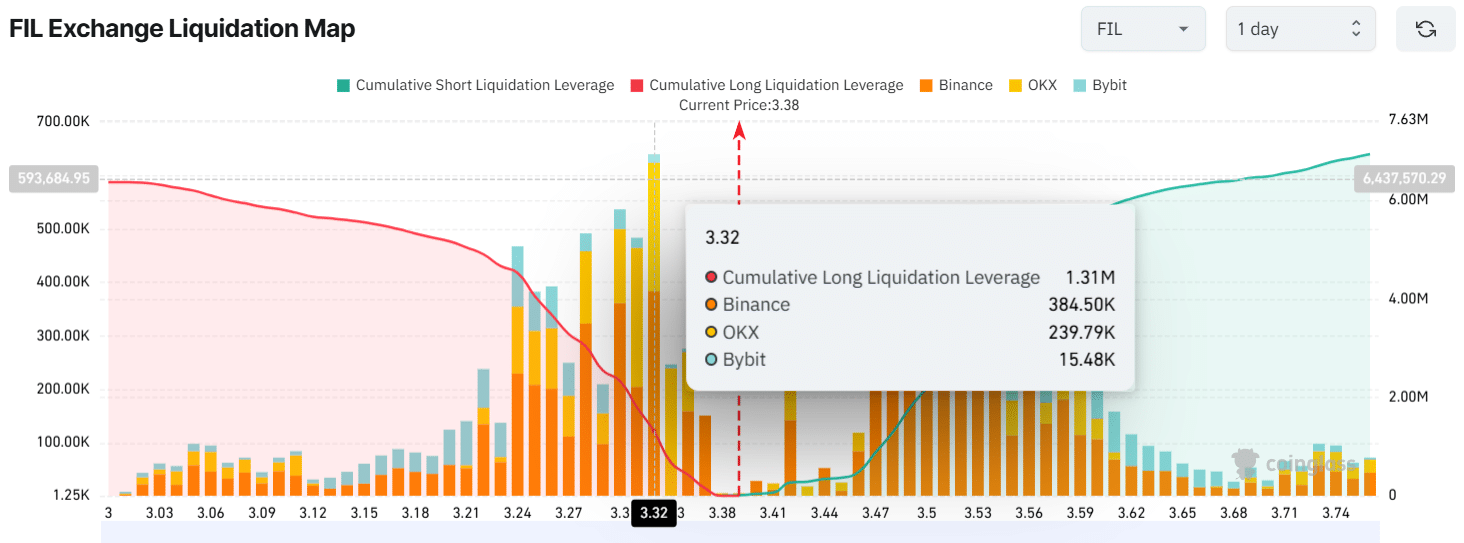

- Intraday traders were over-leveraged at the $3.32 level on the lower side and the $3.42 on the upper side.

- On-chain metrics revealed that exchanges have witnessed an outflow of FIL tokens worth $1.30 million.

Amid ongoing market uncertainty, major cryptocurrencies are experiencing a notable price decline, impacting market sentiment.

In this environment, the top-tier Decentralized Physical Infrastructure (DePIN) crypto project, Filecoin [FIL], has reached a crucial support level and is poised for significant upside momentum.

Current price momentum

Filecoin was trading near $3.37, at press time, and recorded a modest price gain of 0.50% in the past 24 hours.

However, during the same period, its trading volume surged by 16%. The surge indicates growing interest from traders and investors due to the formation of bullish price action.

Filecoin price action and upcoming levels

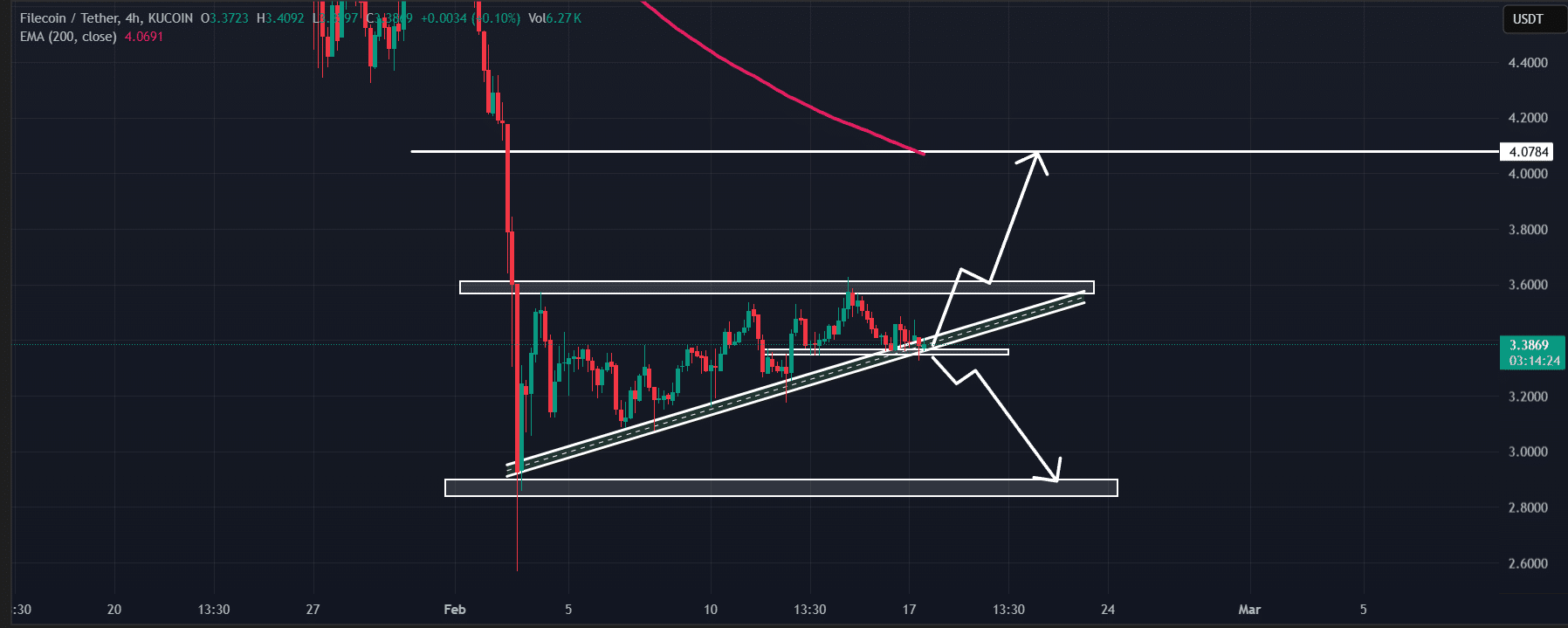

According to AMBCrypto’s technical analysis, Filecoin formed an ascending triangle pattern in the four-hour timeframe.

However, amid the recent price drop, the asset’s price has reached the ascending trendline support. The trend made this a textbook-style pattern, creating a make-or-break situation for the asset.

Based on recent price action, if FIL holds at $3.38, it could soar by 20% to reach $4.05. However, if FIL fails to hold this level and closes a four-hour candle below $3.30, it could drop by 14% to reach $2.92.

At the time of writing, FIL was trading below the 200-day Exponential Moving Average (EMA), indicating a downtrend.

Bullish on-chain metrics

Despite the critical situation, intraday traders were betting on Filecoin’s long positions, as reported by the on-chain analytics firm Coinglass.

Data showed that intraday traders holding long positions were over-leveraged at the $3.32 level, totaling $1.31 million in long positions. Meanwhile, traders betting on short positions were over-leveraged at $3.42, holding $268,620 in short positions.

These over-leveraged positions indicate that bulls are currently dominating the asset despite negative market trends.

In addition to intraday traders’ participation, long-term holders are accumulating tokens. Data from Spot Inflow/Outflow revealed that exchanges witnessed an outflow of FIL tokens worth $1.30 million in the past 24 hours.

This suggests accumulation by investors and long-term holders.

Given the current market sentiment, such outflows from exchanges can create buying pressure and drive further upside momentum.