Filecoin’s [FIL] recovery slowed – Can bulls sustain the momentum?

![Filecoin’s [FIL] recovery slowed - Can bulls sustain the momentum?](https://ambcrypto.com/wp-content/uploads/2023/03/matt-bowden-GZc4fnQsaWQ-unsplash-scaled-e1677741941365.jpg)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

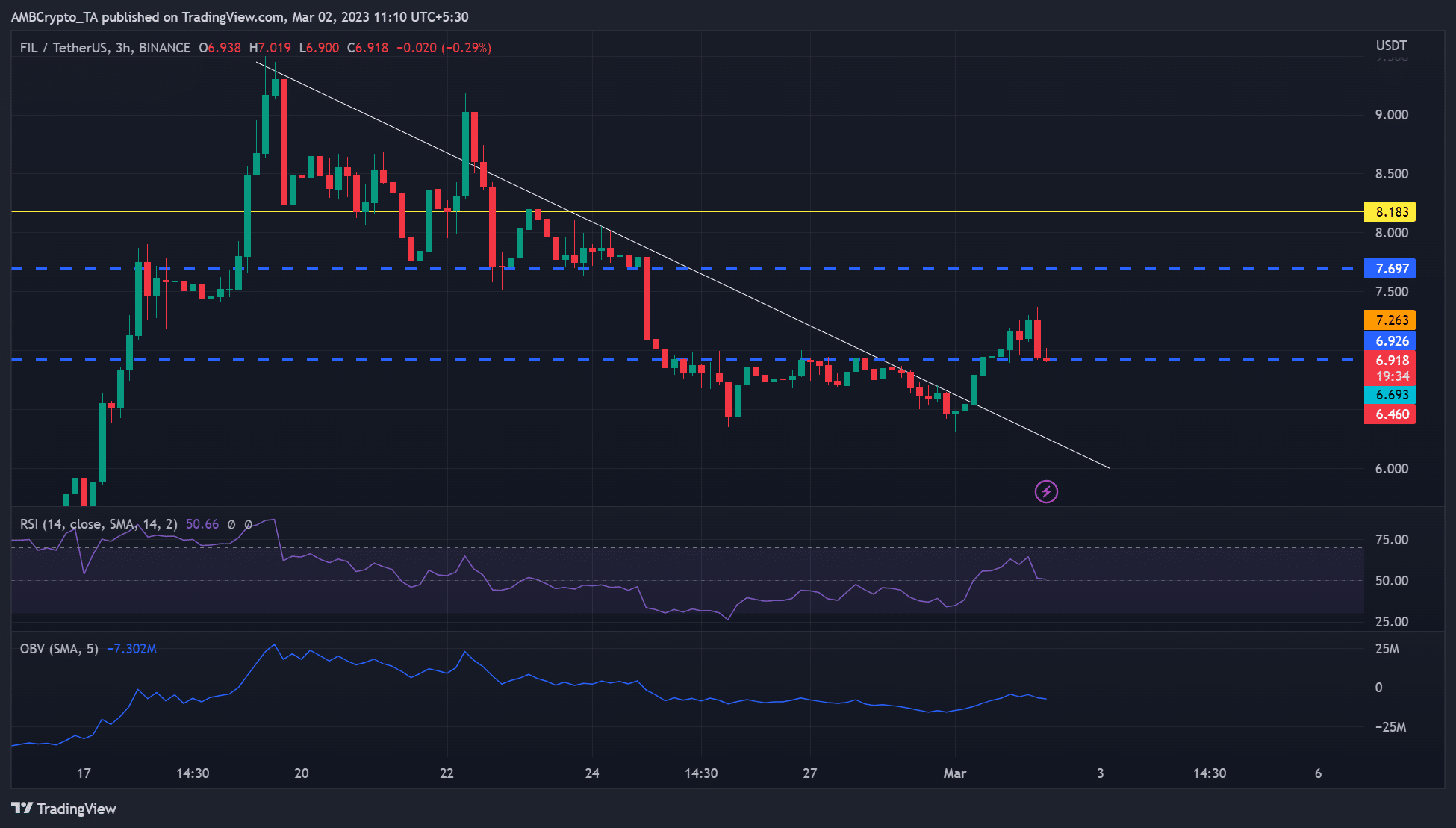

- FIL broke above a descending line, confirming a short-term bullish structure.

- But it faced rejection at $7.263 and dropped to key support.

Filecoin’s [FIL] market structure weakened at the end of February but started March positively. It fell from $9.5 to $6.5, a 32% plunge, but fronted an impressive recovery on 1 March. However, the recovery was at stake, at the time of writing, after facing a price rejection at $7.263.

Is your portfolio green? Check out the FIL Profit Calculator

Will the $6.926 support hold?

From 25 February, FIL consolidated significantly within the $6.693 – $6.926 range before breaking below and toiling underneath the descending line. But it broke above the descending line on 1 March, setting FIL for a short-term recovery.

But the price rejection at $7.263 could delay the recovery. Bulls could seek a retest of the bearish order block (OB) at $7.263 if the RSI faces rejection at the 50-mark and rebounds. Above the OB, bulls could experience a relatively smooth breeze toward $7.697.

Bears could be tipped to run the market if RSI breaks below the 50-mark and BTC falls below $23.35K. As such, short-sellers could target $6.693 or $6.640 for shorting opportunities.

The OBV (On Balance Volume) rose on 1 March but fluctuated at the time of writing, which could suggest a potential sideway structure. Nevertheless, on-chain metrics suggest bullish sentiment, which could boost the recovery.

Read Filecoin’s [FIL] Price Prediction 2023-24

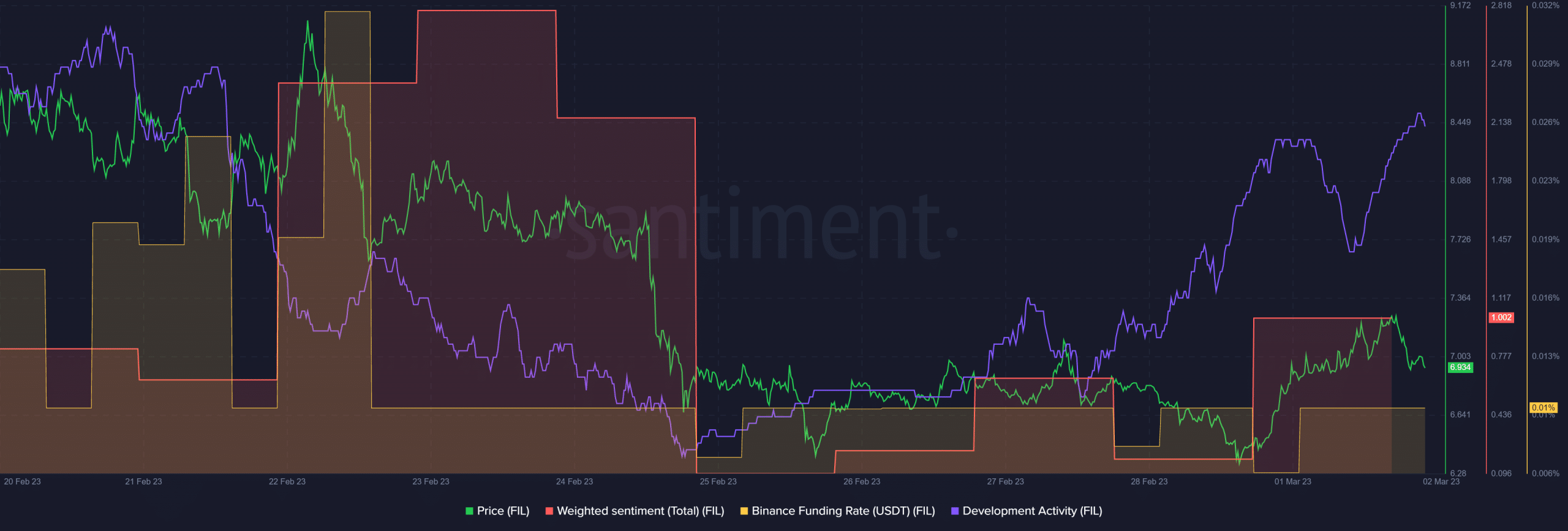

Development activity increased alongside demand and investors’ confidence in FIL

According to Santiment, development activity increased sharply at press time, which could further boost investors’ confidence in the token and pumps its value.

Moreover, the weighted sentiment improved, indicating that investors’ outlook on the asset improved tremendously on 1 March.

In addition, the Funding Rate for FIL/USDT pair increased, indicating that demand for the token in the derivatives market went up. That’s a bullish signal which could further boost the recovery. However, investors should track BTC price action before making moves.