Filecoin’s momentum slowed- Are more opportunities for bears likely?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- FIL hiked massively in the past few weeks.

- The momentum slowed amidst macroeconomic uncertainty.

Filecoin [FIL] has seen double-digit appreciation in the past few weeks. In the past seven and 30 days, the token rallied by 50%. The major driving factor for the recent uptrend was a planned expansion to include a Filecoin virtual machine (FEVM).

However, FIL tanked by over 10% in the past 24 hours, according to CoinMarketCap. The correction followed a sharp rejection of Bitcoin [BTC] at the $25K price level amidst market uncertainty and a possible hawkish stance by the Fed if inflation persists.

Is your portfolio green? Check out the FIL Profit Calculator

The Personal Consumer Expenditure (PCE), to be released on Friday, is a crucial tool Fed uses to track inflation and could determine its policy stance in March FOMC’s meeting.

Simply put, Friday’s event will influence FIL’s price action in March and overall Q1 2023 performance.

FIL’s short-term recovery at stake

Notably, FIL tanked by 17% after a price rejection at $9.181. But $7.708 support was steady and allowed bulls to launch a recovery but faced an obstacle by the time of writing.

FIL could drop to the 23.60% Fib level of $7.904, $7.708, or $7.510, especially if BTC falls below $24.20K. Short-term bears can use these levels as short-selling targets. A stop loss can be placed above the 50% Fib level of $8.345.

How much are 1,10,100 FILs worth today?

On the other hand, near-term bulls could target the overhead resistance level of $9.181 if FIL closes above the 50% Fib level. But they must deal with the hurdles at 61.8% and 78.6% Fib levels. The upswing could be accelerated if BTC retests the $25K level. But the upswing will invalidate the above bearish bias.

Meanwhile, the RSI and OBV declined significantly in the past few days, showing that FIL’s momentum slowed. In addition, the DMI (Directional Movement Index) showed -DI (red line) increased in the same period, confirming the weakening structure.

FIL’s development activity and demand declined; weighted sentiment improved

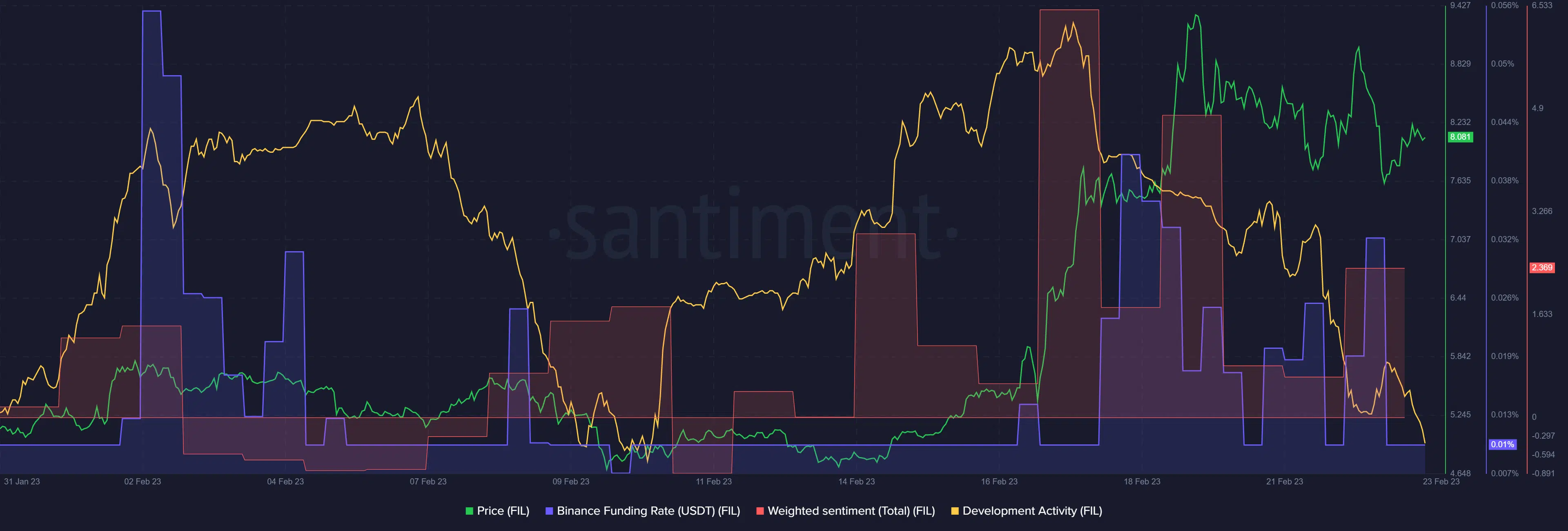

According to Santiment, FIL’s development activity declined from 16 February. Similarly, the weighted sentiment fell as demand fluctuated, as shown by the Funding Rate.

But the Funding Rate remained positive, and sentiment improved, denoting the mild bullish sentiment at press time. Any further increase in demand and positive sentiment could push FIL towards the 50% Fib level. But investors should track BTC price action before making moves.