First U.S. XRP ETF debuts – Will it impact prices positively?

- The first U.S. XRP ETF will go live, offering investors twice-daily exposure to price moves.

- Market participants appeared cautious on XRP after recent sell-offs.

The U.S. will welcome its first Ripple [XRP] ETF (exchange-traded fund) on the 8th of April.

According to the asset manager Teucrium, the product will offer investors twice-daily returns on their XRP exposure without directly owning the underlying crypto.

Part of the issuer’s statement read,

“The Teucrium 2x Long Daily XRP ETF (XXRP) seeks daily investment results, before fees and expenses, that correspond to two times (2x) the daily price performance of XRP for a single day, not for any other period.”

Good for broader XRP adoption?

However, Bloomberg ETF analyst James Seyffart clarified that the products would be based on swaps, not futures.

The main difference between the two models is accessibility. Swaps are traded privately through OTC (over-the-counter) providers to limited investors, while Futures can be offered via public exchanges.

Even so, the debut could increase XRP’s exposure to investors.

The move comes just days after the SEC dismissed Ripple’s lawsuit. Now, market participants highly anticipate a potential approval (75%) of U.S. spot XRP ETF in 2025.

Similarly, Bloomberg’s Eric Balchunas echoed a similar sentiment and stated,

“Spot XRP still not approved, although our odds are pretty high.”

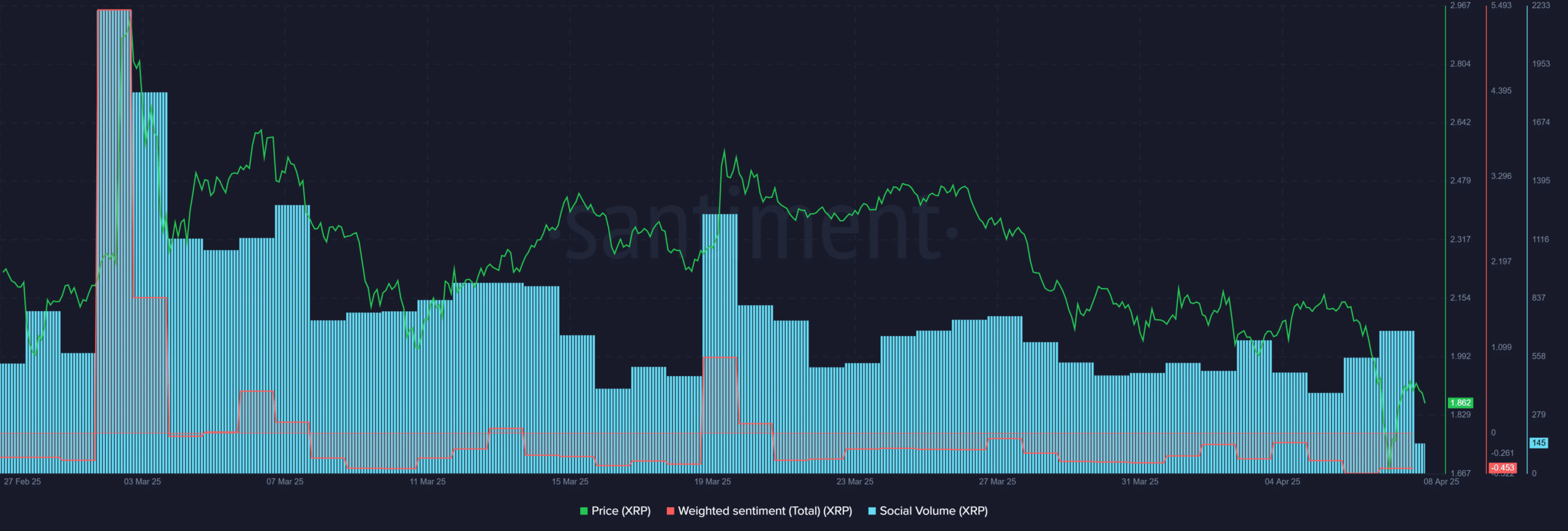

On the market front, social interest in XRP surged ahead of the XRP ETF debut, but overall sentiment remained negative. Simply put, retail was cautious about the altcoin in the short term.

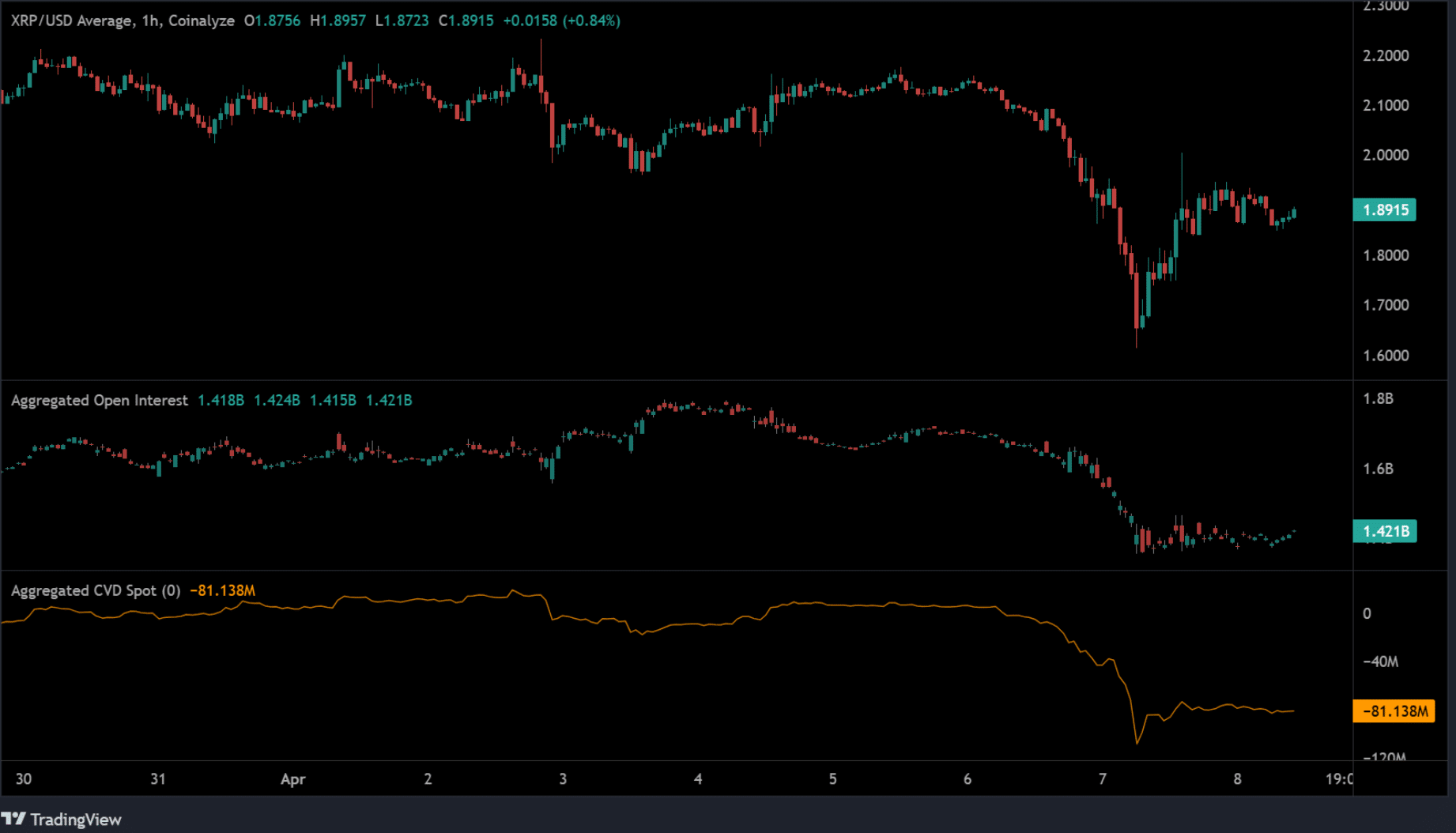

The weak demand was also evident in derivatives and spot markets. Spot CVD (Cumulative Volume Delta, spot demand) and Open Interest (OI, derivative demand) indicators have been southbound in April.

With recent exchange inflows, the altcoin wasn’t entirely safe from short sellers yet.

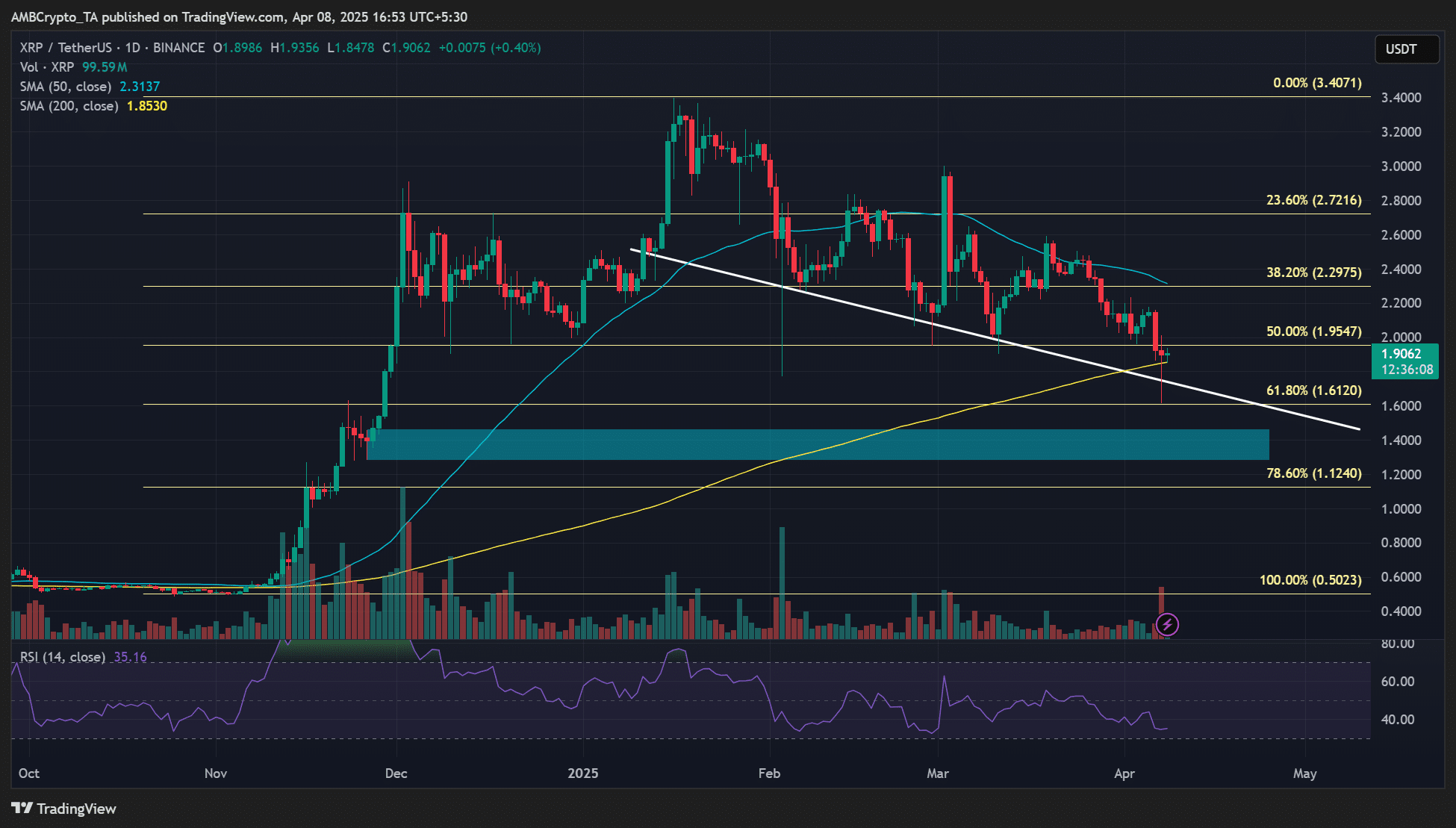

From a price chart perspective, XRP had a bearish market structure with a series of lower lows. However, bulls quickly scooped up the recent dump near the 200-day SMA (Simply Moving Average).

Put differently, losing the dynamic support of the 200-day SMA and the trendline support (white) could expose XRP to further downside risk to $1.5.