FLOKI confirms a ‘double-top’ pattern: Is it the right time to buy?

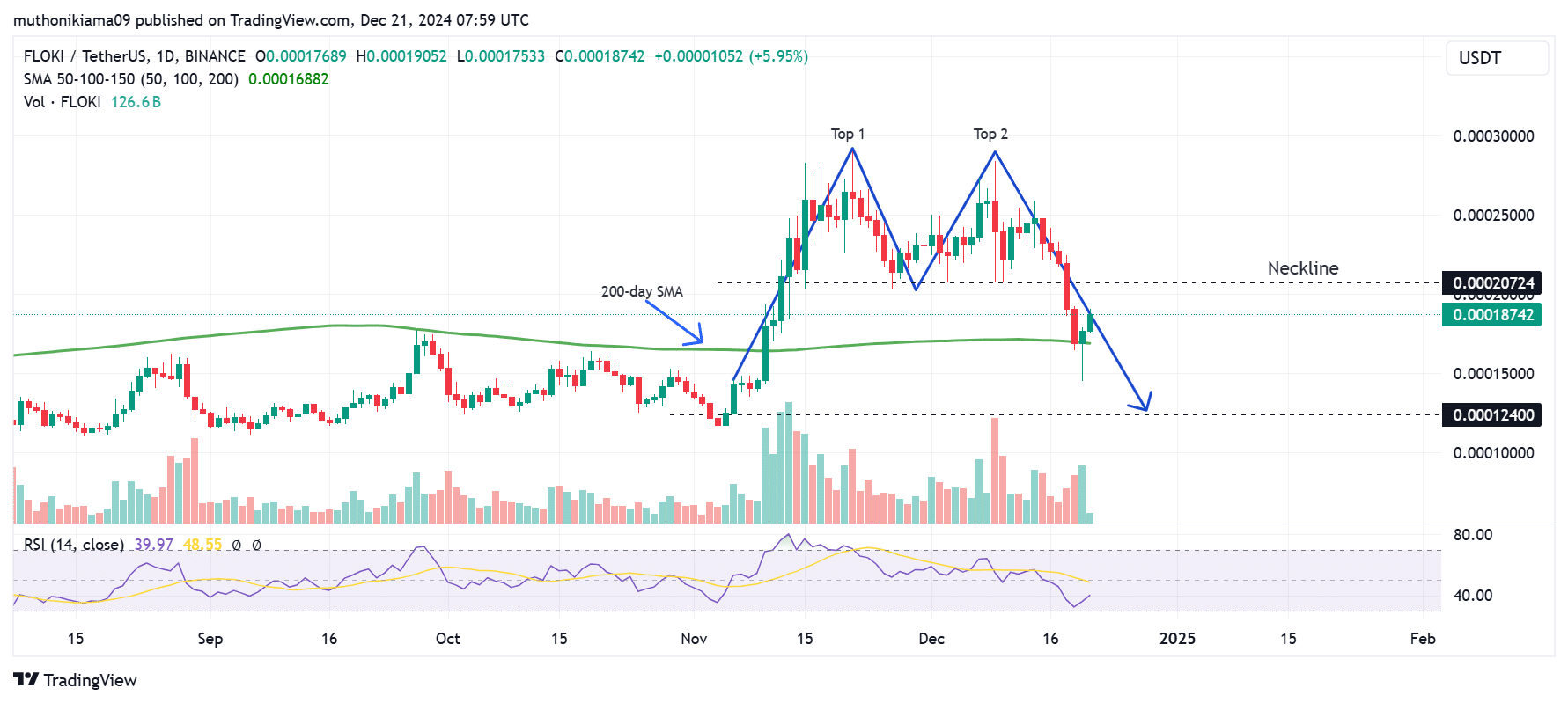

- FLOKI has formed a bearish double-top pattern on its one-day chart, which shows a prevailing downtrend.

- Despite the recent gains, open interest has declined, indicating a lack of conviction among traders.

Floki [FLOKI] has recovered from bearish trends, gaining 9% in the last 24 hours and trading at $0.000188 at press time. These gains mirrored a broader market recovery, with total crypto market capitalization increasing by 3.6% to over $3.4 trillion.

Despite these gains, FLOKI is still down by 21% over the past seven days. The one-day chart shows that while the short-term momentum is bullish, the long-term trend remains negative.

Analyzing FLOKI’s double-top pattern

FLOKI confirmed a double-top pattern after falling below the $0.000207 neckline earlier this week. However, this bearish trend has weakened following recent gains.

If FLOKI continues its uptrend, it will likely retest the neckline from below. If a breakout fails, the downtrend could resume, causing a dip to $0.000124.

Conversely, if the memecoin successfully breaks resistance at this neckline and continues to rise, it could invalidate the bearish thesis, leading to more gains.

Besides the crucial resistance level at the neckline, traders should also watch out for support at the 200-day Simple Moving Average (SMA) of $0.000166.

FLOKI has been trading above the 200-day SMA since mid-November. Going by past trends, this level has often acted as a strong resistance. If FLOKI drops below $0.000166, it could cause a negative market sentiment.

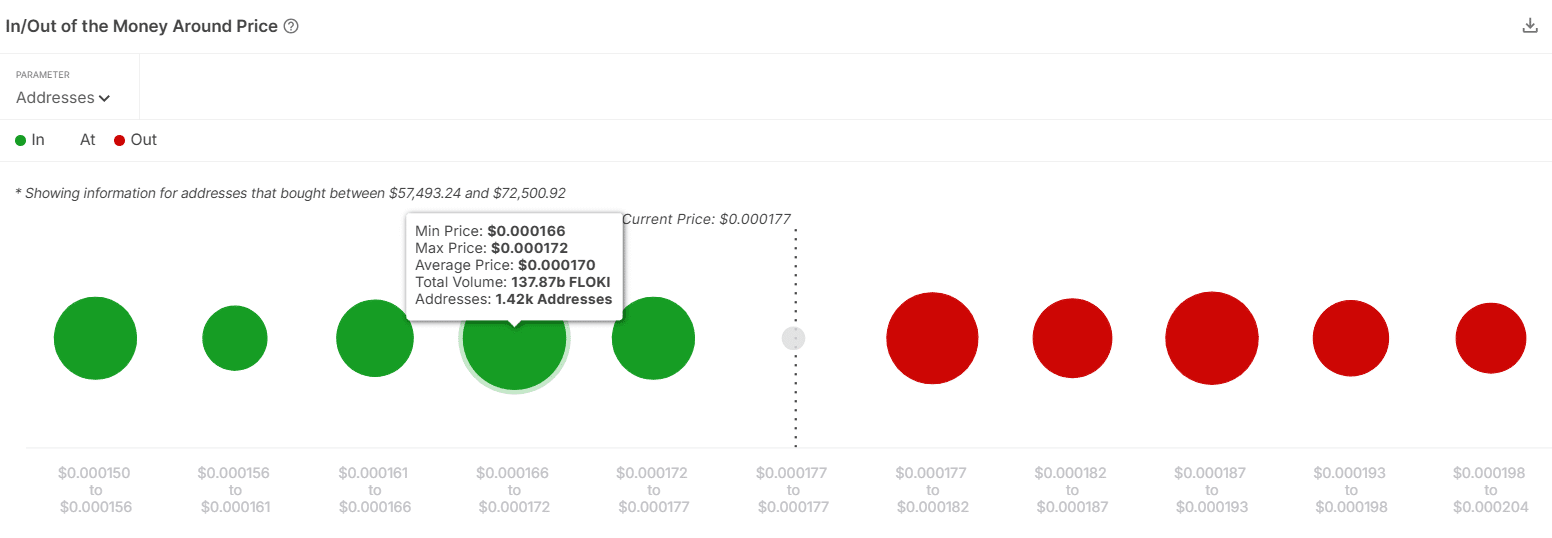

Key demand zone shows…

Many traders bought FLOKI between $0.000166 and $0.000172. According to IntoTheBlock data, 137 billion FLOKI tokens were purchased by 1,420 addresses at these price levels.

Due to the buying pressure in this zone, which is also slightly above the 200-day SMA, traders might choose to defend it by buying more. This could keep FLOKI trading above $0.000166.

Additionally, this zone could attract demand from new buyers who see it as an ideal entry point due to the high profitability of the wallets that are bought at these prices.

Conversely, a drop below this demand zone could result in panic selling as these addresses decide to sell to minimize losses.

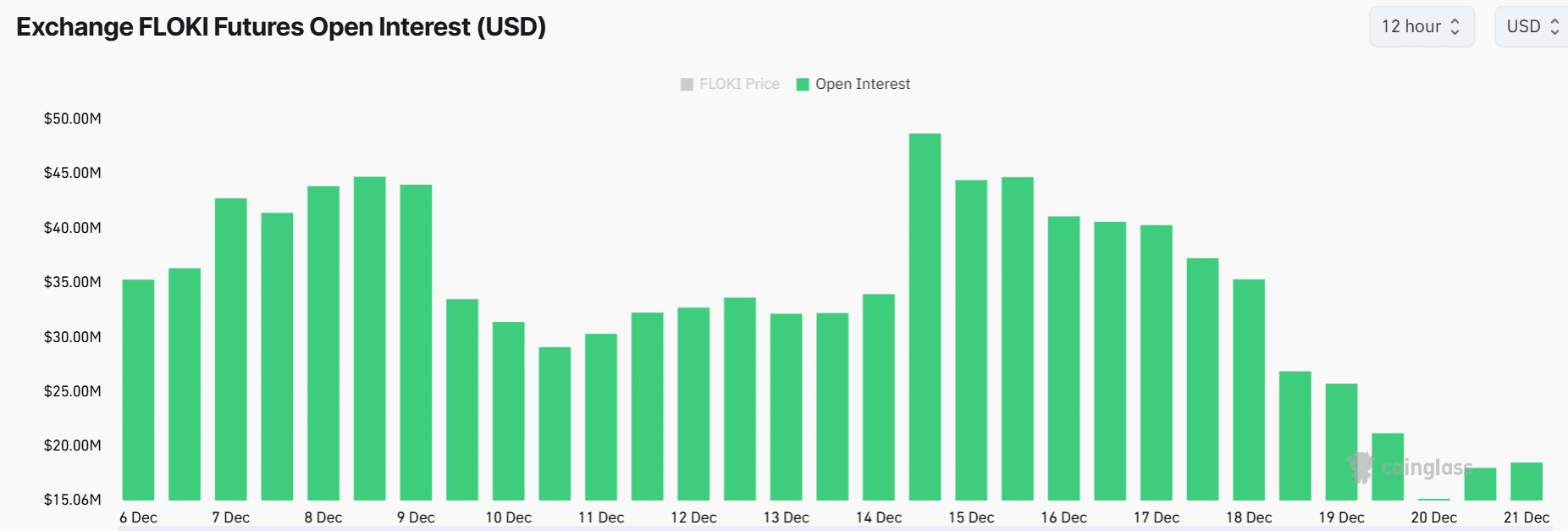

Falling Open Interest shows a lack of conviction

Open Interest (OI) tends to rise when the price is gaining. However, this has not been the case with FLOKI given that despite the 24-hour gains, OI had dropped by 10% at press time to $18M.

The falling OI also coincided with minimal liquidations of $255,000, indicating that the drop was not due to the forced closure of open positions.

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

This decline suggests a lack of conviction around FLOKI’s rally. Therefore, if market participation remains low, it could impact the sustainability of the uptrend.