Floki Inu gains momentum: Is a 180% price explosion next?

- An analyst has predicted that FLOKI could gain up to 180%.

- Rising Open Interest signaled growing investor confidence, but fluctuating active addresses raised concerns about sustained momentum.

Floki Inu [FLOKI], a popular memecoin in the cryptocurrency space, has been experiencing a steady increase in its price over the past week.

As of the last 24 hours, FLOKI’s price has risen by 2.6%, bringing it to a press time trading value of $0.0001372.

This recent uptick is part of a broader uptrend that has seen the token surge to as high as $0.0001431 earlier in the week.

The continued bullish performance of FLOKI has drawn attention from various analysts in the crypto community, who are now speculating on the token’s potential for further gains.

Technical outlook suggests a 180% rally

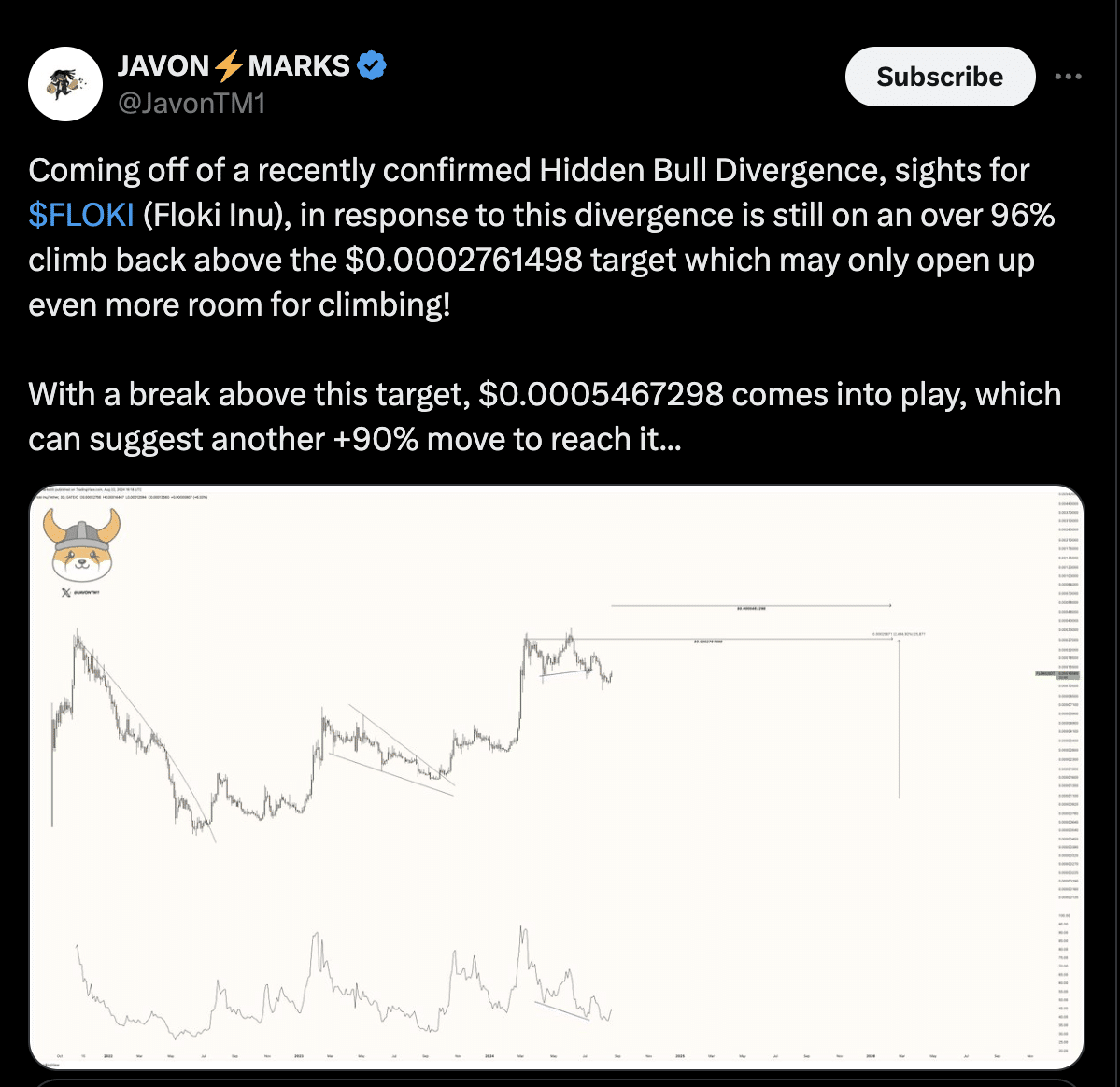

Javon Marks, a crypto analyst, has recently shared his outlook on FLOKI via X (formerly Twitter), highlighting the possibility of significant price movement in the near future.

Marks pointed out that FLOKI is coming off a recently confirmed Hidden Bull Divergence, a technical pattern often seen as a precursor to bullish price action.

According to Marks, FLOKI could be poised for a substantial climb, potentially targeting a price of $0.0002761498, which would represent a gain of over 96% from its current level.

Marks further suggested that a break above this target could open the door for even more upside, with the possibility of reaching $0.0005467298, indicating an additional 90% increase.

Fundamental analysis on FLOKI

While the technical outlook for FLOKI appears promising, assessing the token’s fundamentals can determine whether the asset is truly positioned for such a significant upward move.

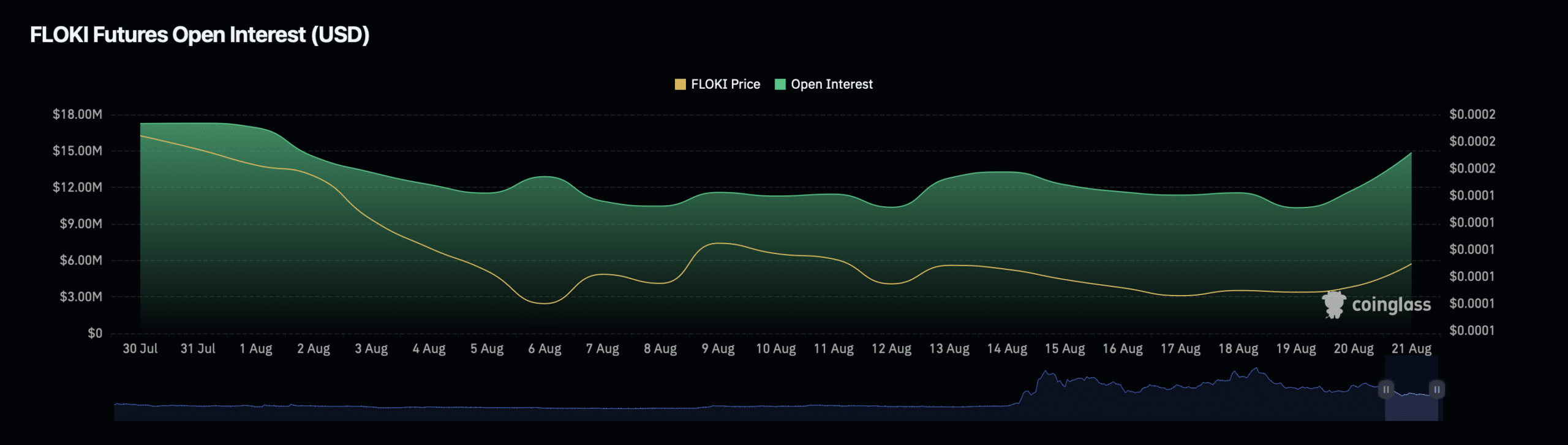

An example of this is FLOKI’s Open Interest, which refers to the total number of outstanding derivative contracts for the asset.

Data from Coinglass shows that FLOKI’s Open Interest has increased by 12.34% over the past day, reaching a press time valuation of $15.76 million.

This rise in Open Interest coincided with a surge in the asset’s Open Interest volume, which has jumped by 60% during the same period to a press time valuation of $109.44 million.

The increase in Open Interest and volume suggested growing investor interest and participation in FLOKI’s market.

When Open Interest rises alongside price, it often indicates that new capital is flowing into the market, which can lead to further price appreciation.

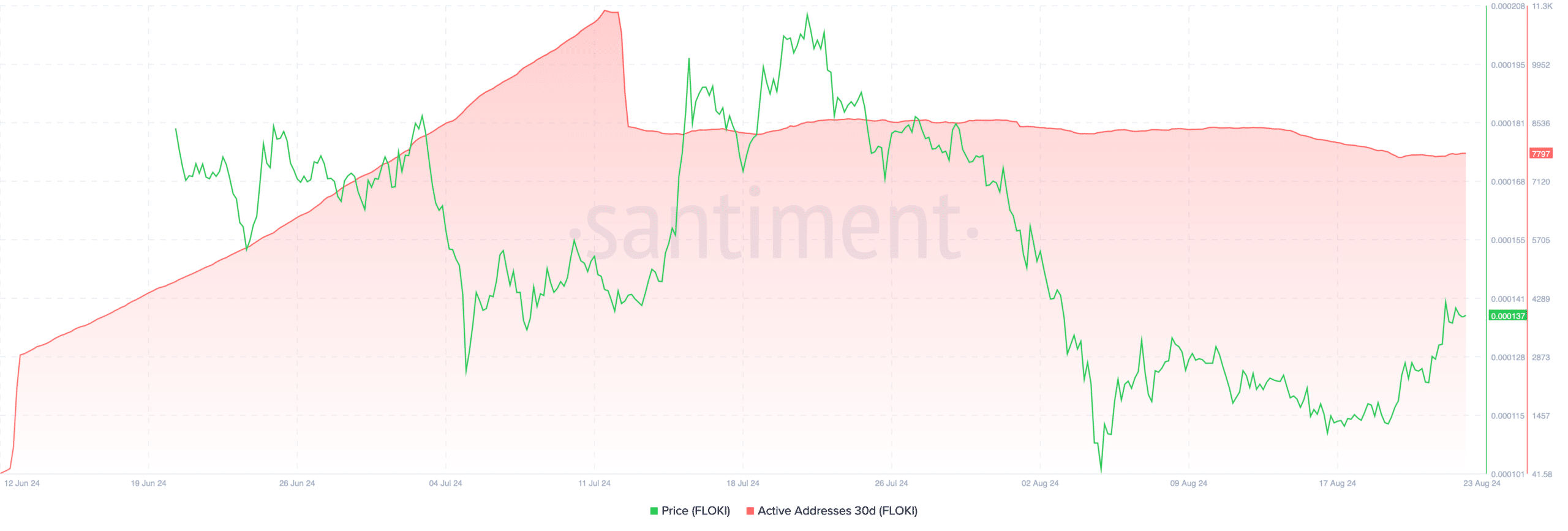

Another important metric to consider is the number of active addresses, which provides insight into the level of user engagement with the asset.

According to data from Santiment, FLOKI’s number of active addresses has been fluctuating within a range, particularly after reaching a high of over 11.2k on the 12th of July.

Since then, the number of active addresses has settled just below 8k.

This range-bound behavior in active addresses suggests that while there is still significant interest in FLOKI, the level of user activity has not yet returned to its previous peak.

The fluctuation in active addresses could have implications for FLOKI’s price.

A stable or increasing number of active addresses generally indicates strong user engagement and demand, which can support price stability or growth.

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

Conversely, a decline or stagnation in active addresses might suggest waning interest, potentially putting downward pressure on the price.

For FLOKI, maintaining or increasing the number of active addresses will be crucial for sustaining its current price levels and achieving the bullish targets suggested by analysts like Javon Marks.