FLOKI price prediction – Identifying the odds of an 8% weekend surge

- FLOKI could see a short squeeze and a price bounce of close to 8% over the weekend

- Price action since April gave clues for a FLOKI consolidation around $0.00014

FLOKI suffered double-digit losses, like most large-cap altcoins in the crypto market. The precipitous Bitcoin [BTC] price drop due to bearish expectations and a potential recession fanned the fearful sentiment.

At press time, the memecoin was trading just above a support level that has served faithfully since mid-April. Will the buyers come to the rescue again, or are the bears too strong this time?

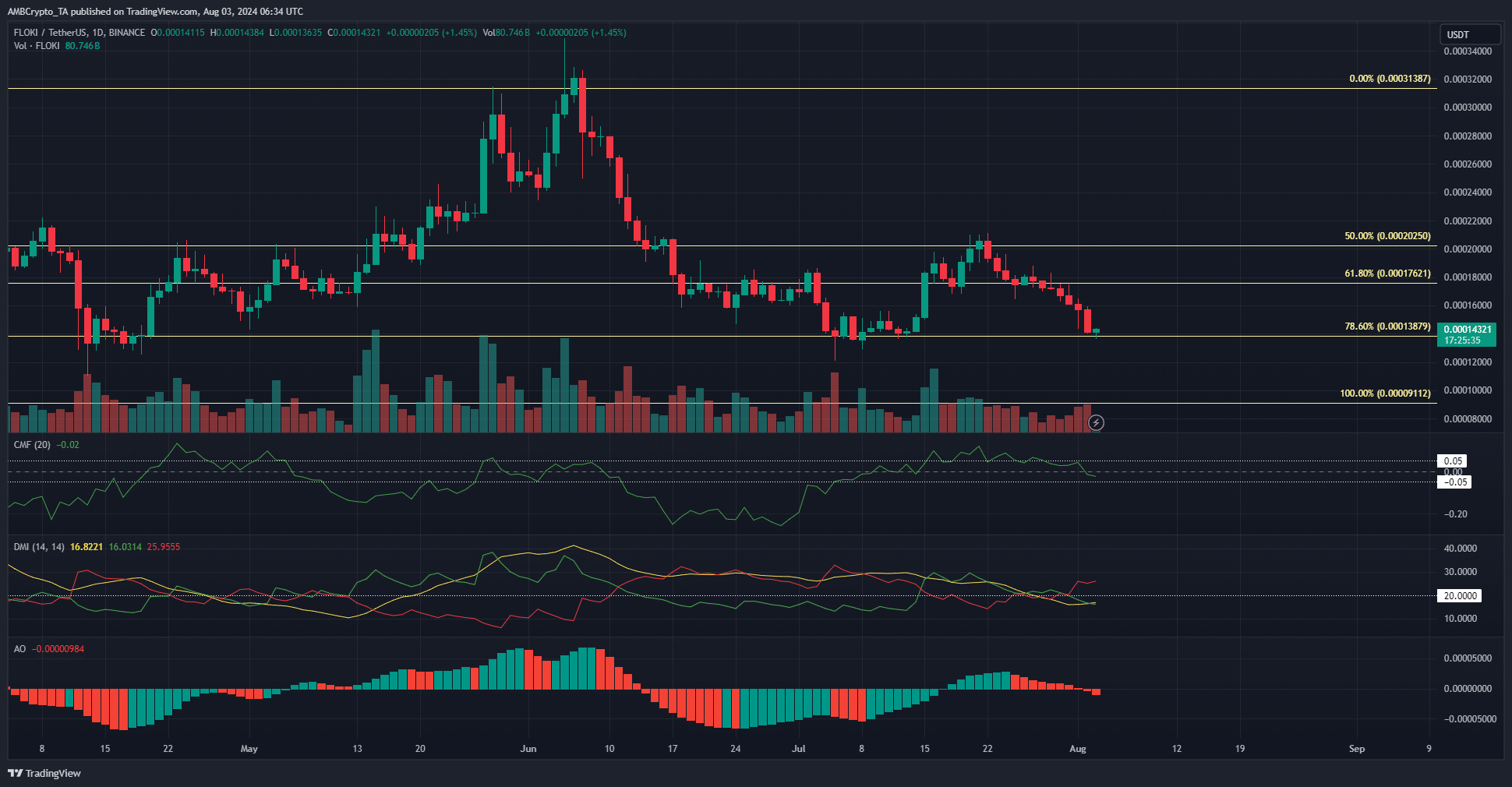

Fibonacci level could see a FLOKI price consolidation

The 78.6% retracement level at $0.000138 was tested for the third time since April. The past two retests did not see an immediate recovery. Instead, the price consolidated for a few days around the Fib level before climbing upwards on the back of high trading volume.

At press time, the downtrend was dominant. The -DI (red) crossed above the +DI (green) on the DMI indicator. The Awesome Oscillator fell below neutral zero to show that bearish strength was growing.

The CMF was at -0.02, and a drop below -0.05 would denote significant capital flow out of the market. At press time, a neutral CMF reading held up the expectations of consolidation.

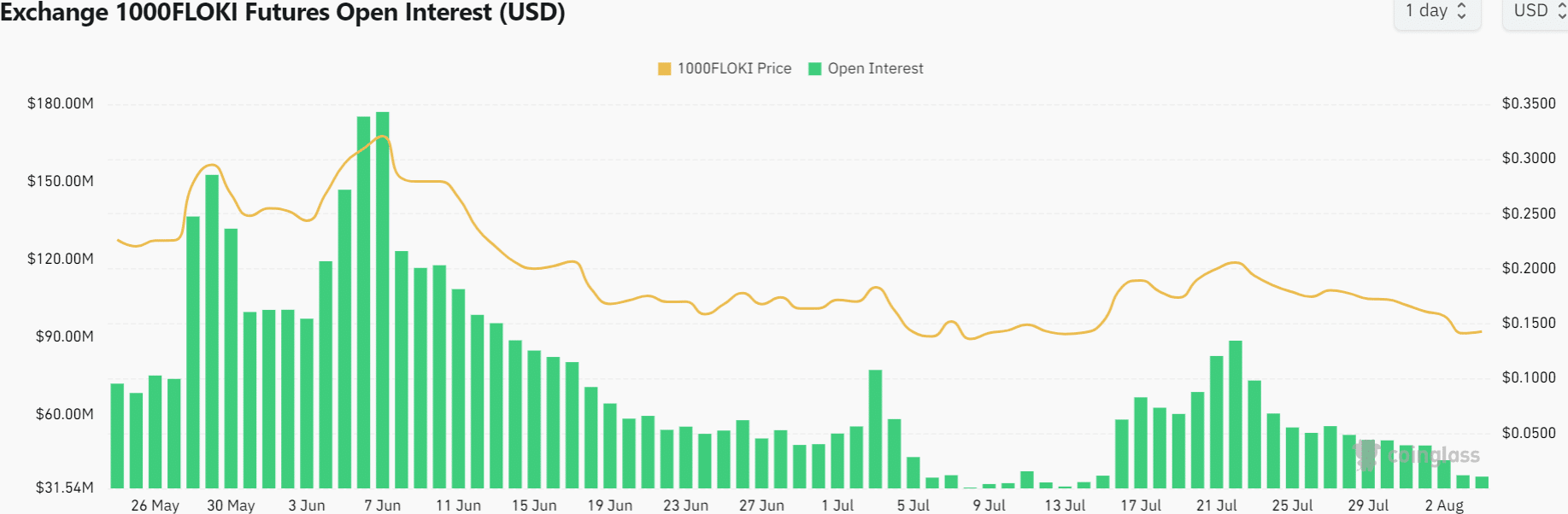

Low Open Interest showed traders were not convinced of a price recovery

Source: Coinglass

In July, FLOKI bounced from $0.000135 to $0.000206 and saw the Open Interest climb from $36 million to $88.6 million. Since then, both the OI and the price have been heading south – A sign of bearish sentiment.

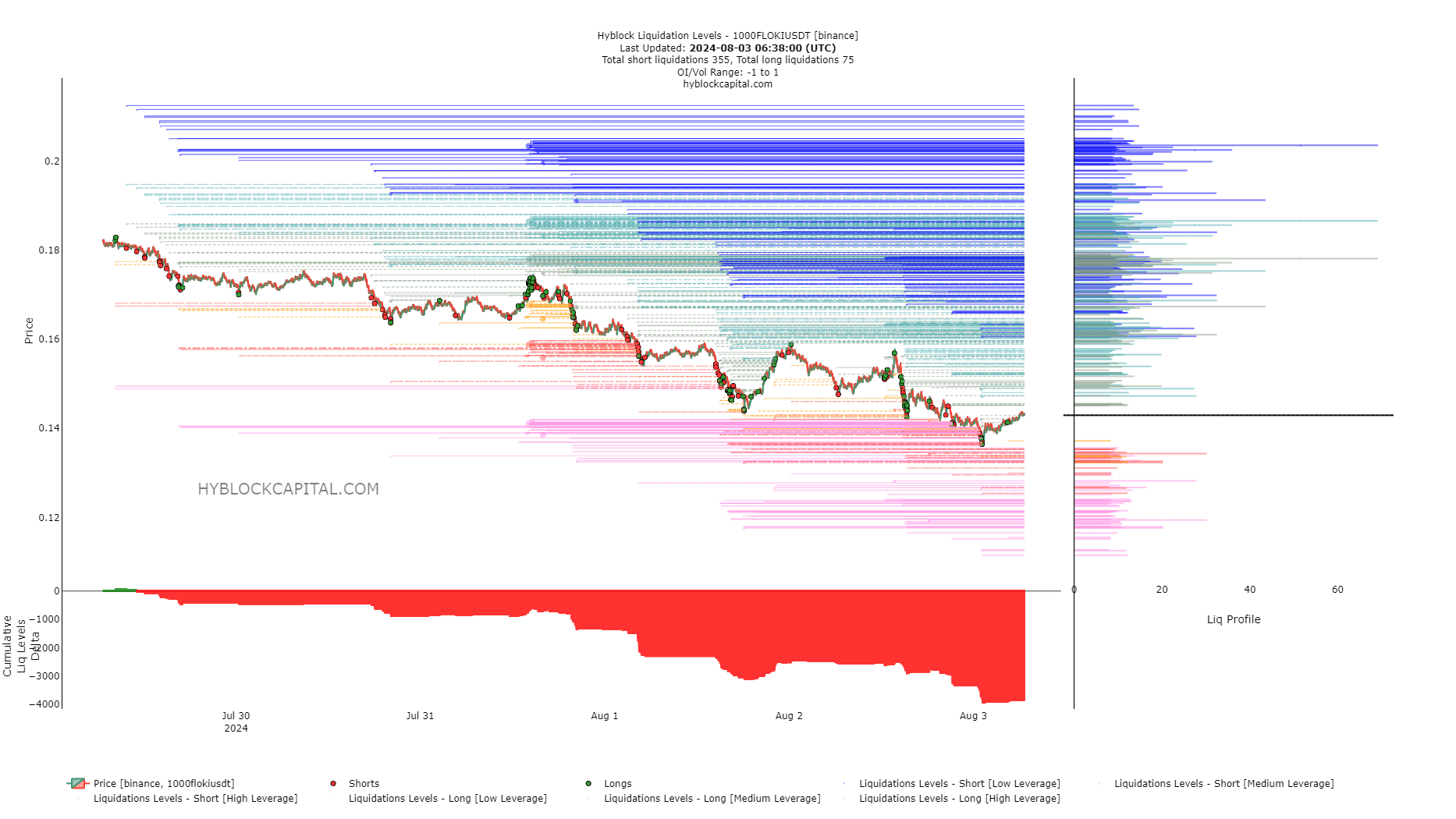

Source: Hyblock

Over the last two days, the short liquidation positions outnumbered the long ones considerably. Futures traders expected further price drops, which set up ideal conditions for a short squeeze.

Is your portfolio green? Check the Floki Profit Calculator

The closest and largest pools of liquidity were at $0.000178 and $0.000186, marking them as the bullish targets. However, it is more likely that the $0.00015 resistance would drive the bulls back in case of such a bounce. This could lead to a FLOKI consolidation phase.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.