FLOKI price prediction – November’s rally is lost, but here’s what’s coming next!

- FLOKI seemed to have a bullish structure on the daily timeframe

- It retested the $0.000202 support, but lacked the demand to push higher

FLOKI, at the time of writing, was up 2.37% for the day as Bitcoin [BTC] tried valiantly to climb past the $97k-mark. In fact, while Bitcoin displayed some short-term bullish momentum over the past two days, so did FLOKI.

The memecoin’s inability to break the high it made in March, however, and the following downtrend in June fueled fears that a similar scenario could be replayed.

FLOKI momentum and demand slow down

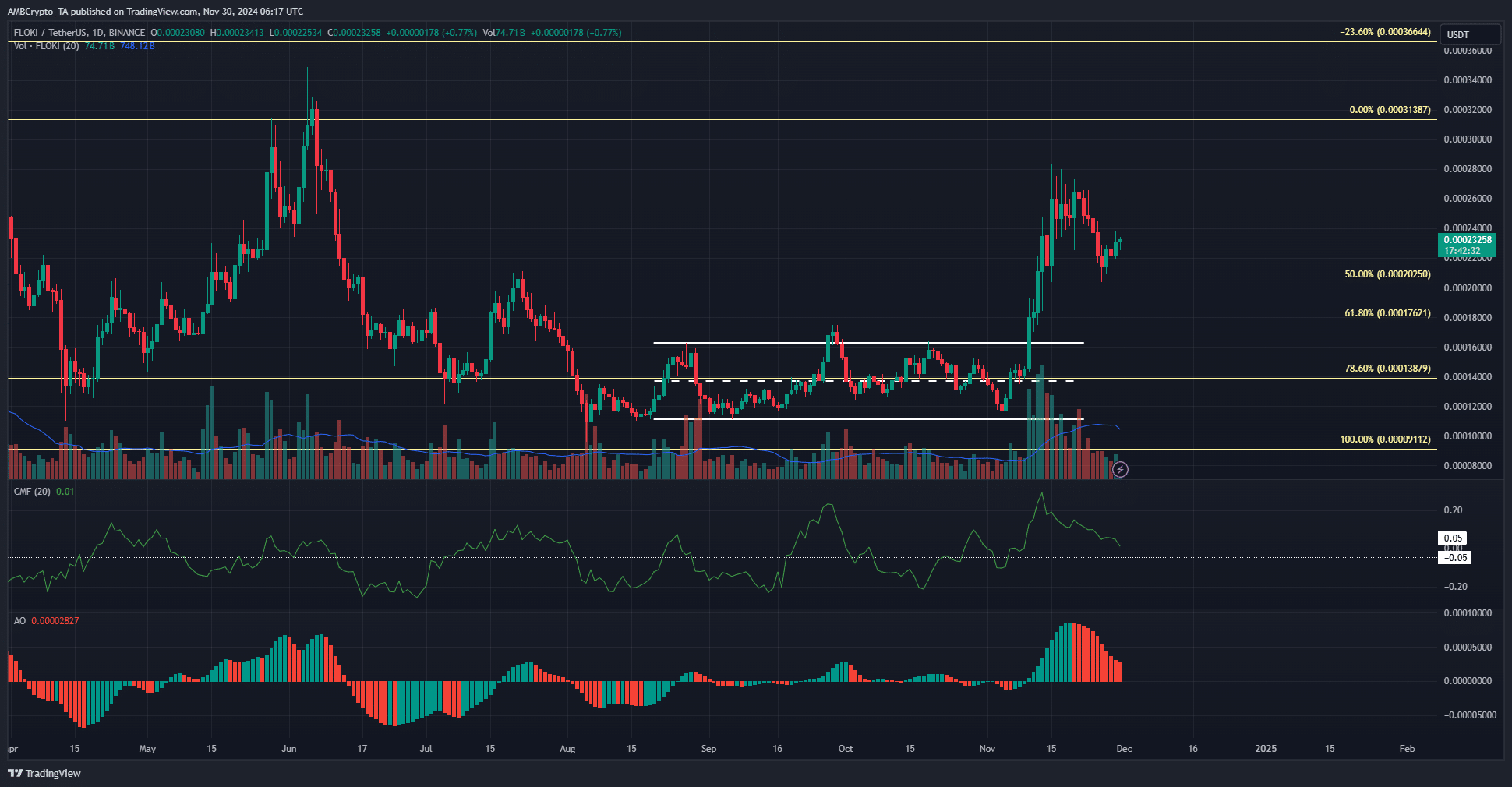

From August to November, FLOKI traded within a range (white) that extended from $0.000111 to $0.000165. This range’s mid-point coincided with the 78.6% retracement level at $0.000138.

The breakout beyond the range on 10 November occurred backed by high trading volume. This rally reached as high as $0.00029 on 21 November, but it has receded since then.

This price drop was accompanied by a fall in trading volume and buying pressure. The CMF on the daily timeframe has been in a steady slump over the past week and stood at +0.01 to show that capital flow was neutral.

The Awesome Oscillator also registered red bars on its histogram to capture the bearish momentum over the past few days. Together, they highlighted FLOKI’s retracement after its recent gains.

Liquidation map hinted at deeper retracement

Source: Coinglass

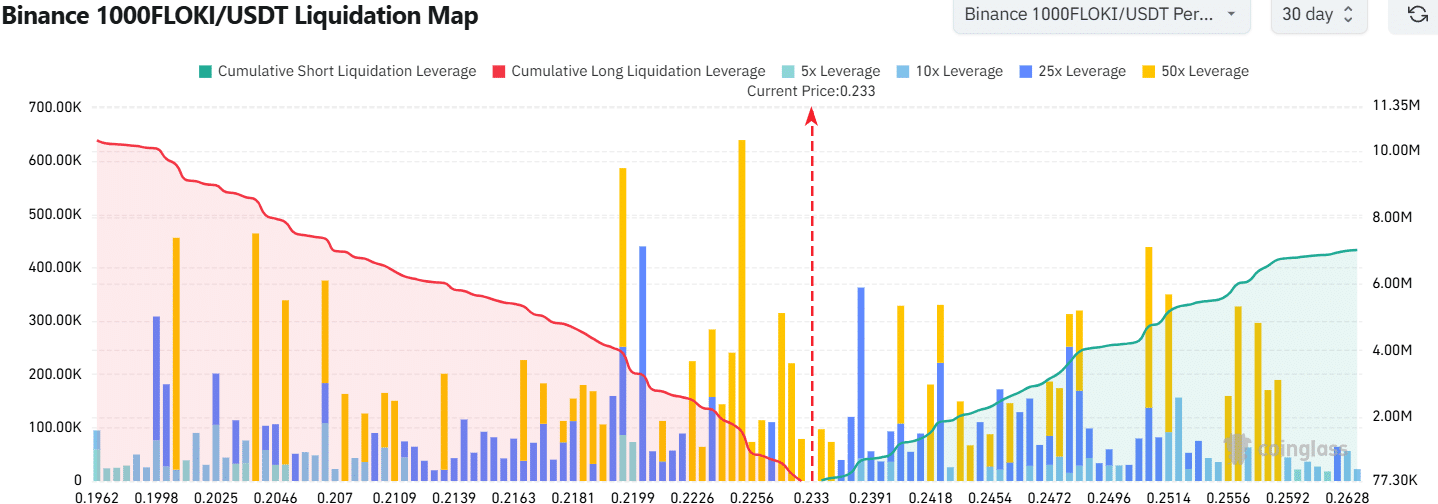

FLOKI’s 1-month liquidation map highlighted the nearby long and short position liquidations. The $0.000225 and $0.000219 levels were close by and had high leverage long positions’ liquidations.

Is your portfolio green? Check the FLOKI Profit Calculator

In particular, $0.219 had a relatively high cumulative long liquidation leverage, and could attract prices to it. To the north, the cumulative short liquidation leverage was smaller, but the $0.000248-$0.00025 area could see a short-term bearish reversal.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion