FLOKI price prediction – Why the memecoin remains in a range

- FLOKI has been unable to match the performance of Dogecoin or Pepe.

- The weakened demand of the past two weeks was a concern for FLOKI bulls.

FLOKI [FLOKI] bulls had driven an impressive rally in the first half of November. Since then, the momentum has slowed down.

The bullish FLOKI price prediction was further hurt by the fact that the meme coin was unable to set new highs for 2024, despite the bullish fervor across the market.

Since the 5th of November, FLOKI is up by 97% despite the pullback that began in mid-November.

This is an impressive performance, but still falls short of the likes of Dogecoin [DOGE] or Pepe [PEPE] which are both up 164% in the past month.

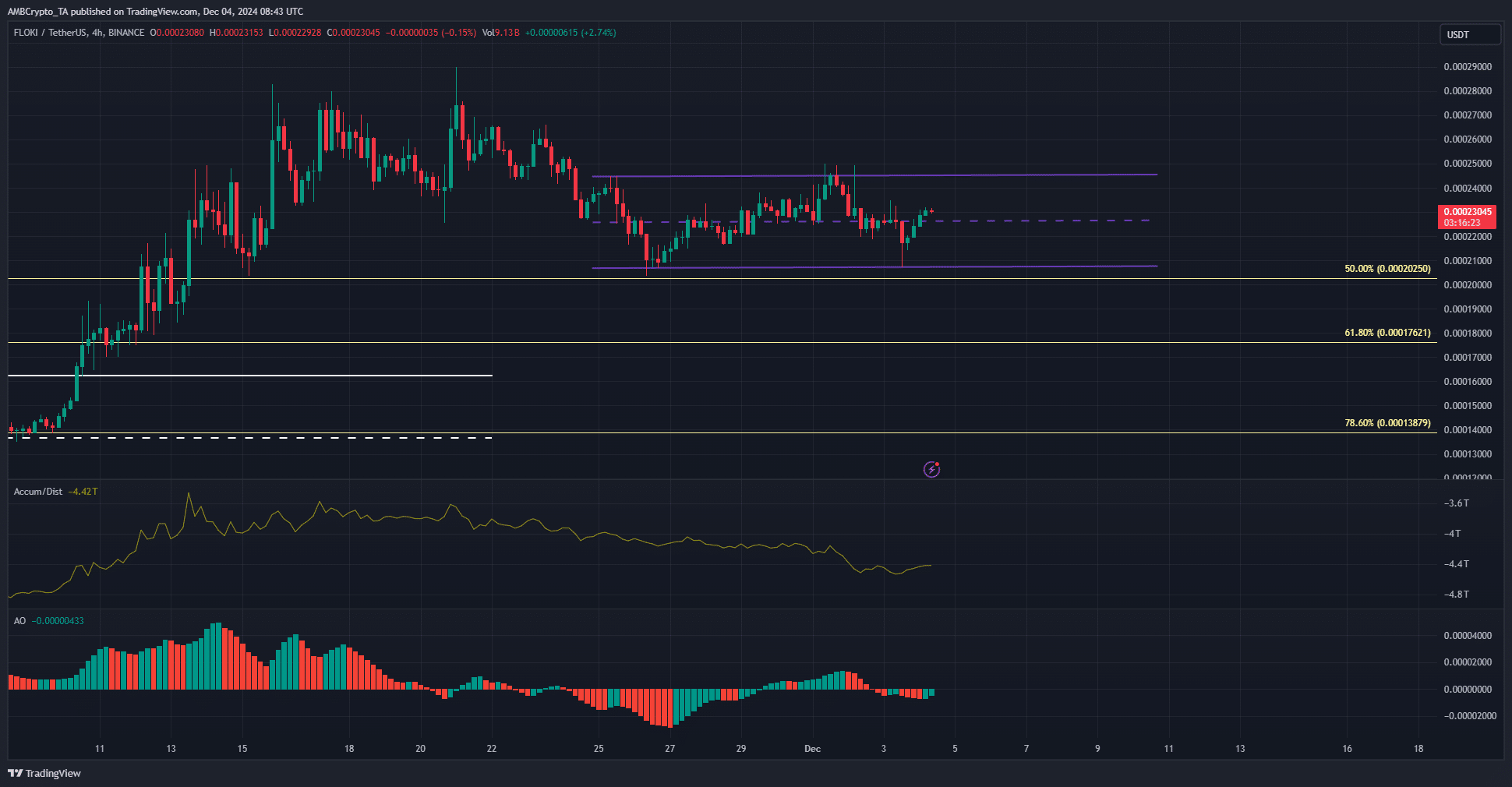

Five-month resistance zone flipped to demand

One lament that FLOKI investors may have is that the token has not set new highs for the year, unlike the other two.

This meant that the gains could potentially be much higher for the other two, especially PEPE, compared to FLOKI.

On the other hand, it was an encouraging development that the $0.000205 level was flipped to demand. This level represented the 50% Fibonacci retracement level from the rally in March.

The Awesome Oscillator was above zero to show bullish momentum on the daily timeframe, despite the 20% pullback from the local highs.

The A/D indicator saw a sizeable pullback, but has established a higher timeframe uptrend.

On the 4-hour chart, a range formation was spotted. The mid-range level at $0.000226 has been flipped to support, but the A/D indicator was in a slump. This reflected a lack of buying pressure.

The Awesome Oscillator noted weak bearish momentum on the H4 timeframe.

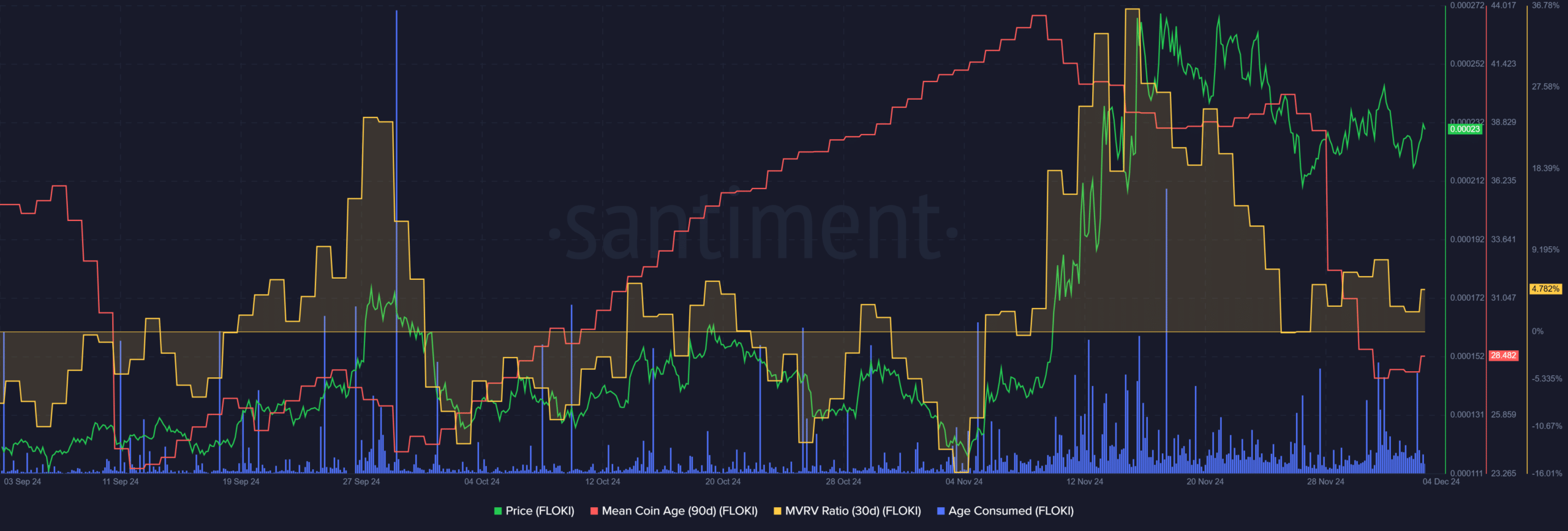

Metrics signaled distribution

Source: Santiment

The 30-day MVRV has cooled down after making 3-month highs in mid-November. This rise corresponded to the rapid gains FLOKI made. The consolidation within the range saw the MVRV ratio fall lower.

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

However, there was reason for the FLOKI price prediction to be bearish in the short-term. The mean coin age saw a sudden drop on the 28th of November.

The age consumed metric also saw spikes, showing selling pressure from holders.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion