News

FOMC triggers $600M crypto outflows: Bitcoin loses, while ETH gains!

Ethereum recorded inflows totaling $13 million while Bitcoin logged $621 million in outflows.

- Outflows from crypto funds climbed to a three-month high last week.

- While BTC recorded significant outflows, inflows into ETH-backed products were above $10 million.

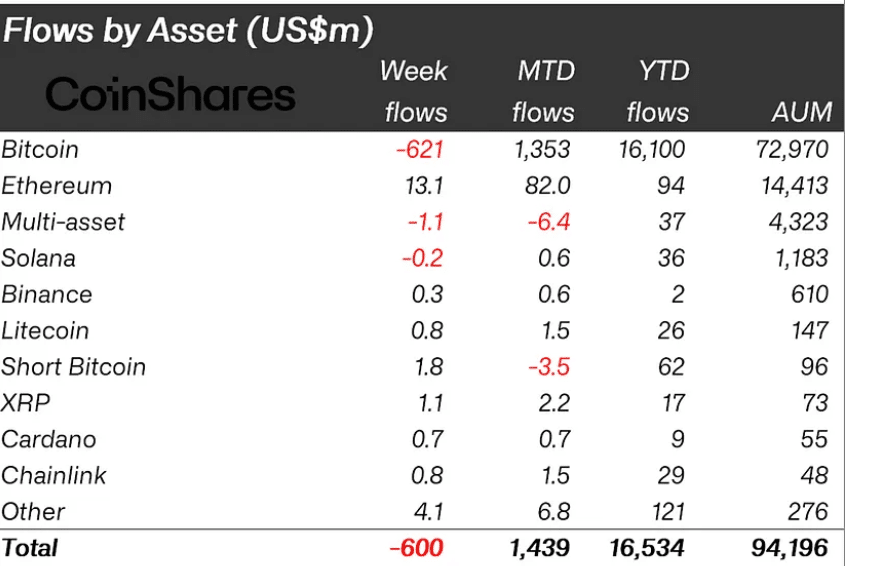

Digital asset investment products recorded outflows totaling $600 million last week, digital asset investment firm CoinShares found in its new report

.According to the report, last week’s figures represented the largest weekly outflows from cryptocurrency funds since 22nd March.

This was due to “a more hawkish-than-expected FOMC meeting, prompting investors to scale back their exposure to fixed-supply assets,” CoinShares noted.

AMBCrypto earlier reported that after a two-day meeting, Federal Open Market Committee members decided to keep rates between 5.25% and 5.50% for the seventh consecutive time.

At the end of the period observed by CoinShares, the total assets under management (AUM) for crypto-related investment products was $94 billion. This marked a 6% decline from the $100 billion recorded the previous week.

Also, trading volumes plummeted due to the decline in trading activity during the week under review.

CoinShares found that:

“Trading volumes remain(ed) lower at US$11bn for the week, compared to US$22bn weekly average this year, but well above the US$2bn a week last year.”

Regionally, most of last week’s outflows from crypto funds came from the United States. Outflows from that region totaled $565 million, representing 94% of all sums removed from digital assets products during that period.

How did Bitcoin and Ethereum fare?

Last week, Bitcoin-backed investment products saw recorded outflows of $621 million. This surge in outflows led to a decline in the leading coin’s year-to-date (YTD) flows.

At $16.1 billion at the end of the period under review, BTC’s YTD flows had dropped by 4% from the previous week.

Regarding short-Bitcoin products, they recorded inflows during that period.

CoinShares stated,

“The bearishness also prompted US$1.8m inflows into short-bitcoin.”

Interestingly, the altcoin market fared considerably better. As noted in the report, the leading altcoin, Ethereum [ETH], recorded inflows totaling $13 million during the week under review, bringing the coin’s YTD flows to $94 million.

Other altcoins such as LDO, XRP, LINK, and BNB recorded inflows of $2 million, $1 million, $800,000, and $300,000.