Frax Finance forays into the RWA space – What now?

- Frax Finance strengthened its competitive stance in DeFi by integrating Real World Assets (RWA).

- Positive performance metrics and a promising RWA strategy boosted Frax’s potential in the DeFi sector.

The DeFi sector has been getting increasingly competitive as newcomers continue to join the space and old protocols continue to make improvements. To better compete with the crowding sector, Frax Finance decided to incorporate RWAs (real World Assets) into its protocol.

Realistic or not, here’s FXS’ market cap in BTC terms

Delving into the Real World

Frax Finance’s latest iteration, Frax v3, was designed with the goal of achieving full collateralization through the utilization of assets such as RWAs.

It heavily relies on AMO smart contracts and incorporates a mix of permissionless, non-custodial subprotocols to maintain its overall stability.

The protocol integrates internal stability mechanisms like Fraxlend and Fraxswap, while external support from Curve adds an additional layer of stability.

The Frax Finance RWA strategy comprises four asset categories: short-dated U.S. T-bills, Federal Reserve Overnight Repurchase Agreements (Reverse Repo), USD held at Federal Reserve Banks, and Money Market Mutual Funds.

This strategy aims to provide a reliable income source by collaborating with FinresPBC, which focuses on low-risk, cash-equivalent assets that closely match the IORB rate.

FRAX v3 Moves Towards RWA ⬇️

"@fraxfinance v3 represents the latest iteration of its dollar-pegged stablecoin, aiming for it to be fully collateralized by exogenous collateralization.

At its core, it relies on AMO smart contracts and a mix of permissionless, non-custodial… pic.twitter.com/8YPFXGo2Ve

— Delphi Digital (@Delphi_Digital) October 13, 2023

The sFRAX vault offers users staking opportunities with the potential to earn returns in FRAX stablecoins. This approach tracks the IORB rate of the U.S. Federal Reserve, a recognized risk-free rate, to provide traditional on-chain yields for the FRAX stablecoin.

State of the protocol

Frax Finance’s recent performance metrics indicated a positive trend. Over the last month, the protocol witnessed substantial growth in activity, increasing by 109.1%. Additionally, the protocol’s revenue grew by 13.7%, solidifying its competitive position within the DeFi ecosystem.

Is your portfolio green? Check out the Frax Finance Profit Calculator

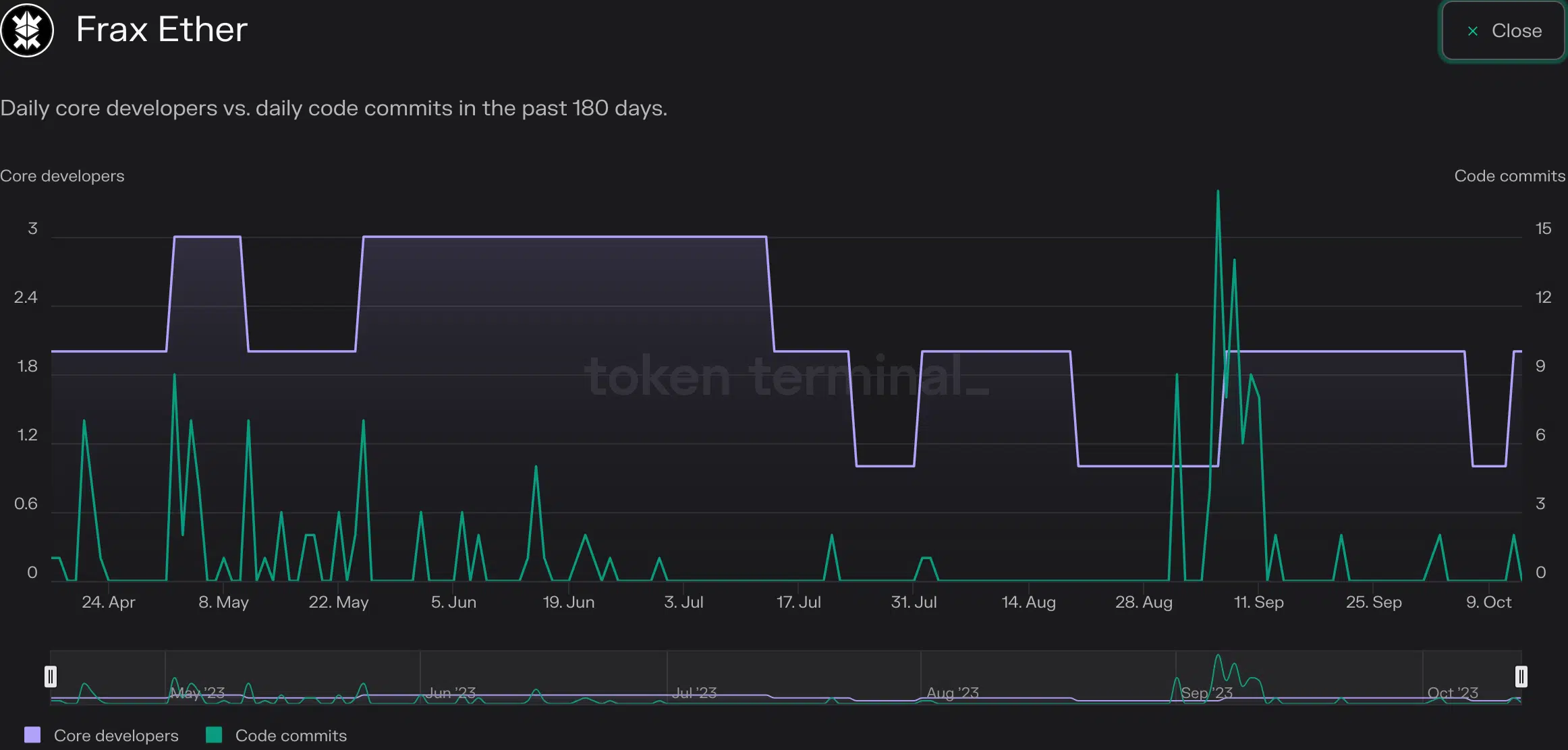

However, the decline in development activity is noteworthy. Over the last month, the number of code commits fell by 33%. While this dip in development activity may raise questions about the protocol’s future innovations, the overall performance metrics remain encouraging.

In terms of the Frax token’s performance, recent days showed an upward trend. This positive price movement and a significant surge in trading volume signal renewed market interest and growing confidence in the Frax Finance protocol’s strategic shift towards RWA integration.