Binance

From FUD to ATH: Checking BNB’s remarkable recovery to $700

It is quite interesting that Binance Coin broke into new price ranges as the prison sentence of its former CEO begins.

- Binance hits different ATHs in the last 24 hours.

- BNB has hit the $700 price range.

Binance Coin [BNB] experienced several positive bounces in the last few days, with 4th June’s move pushing its price into a record-breaking range. This new price range has attracted more traders, leading to a surge in Open Interest to its highest level in months.

Binance breaks into new ATH

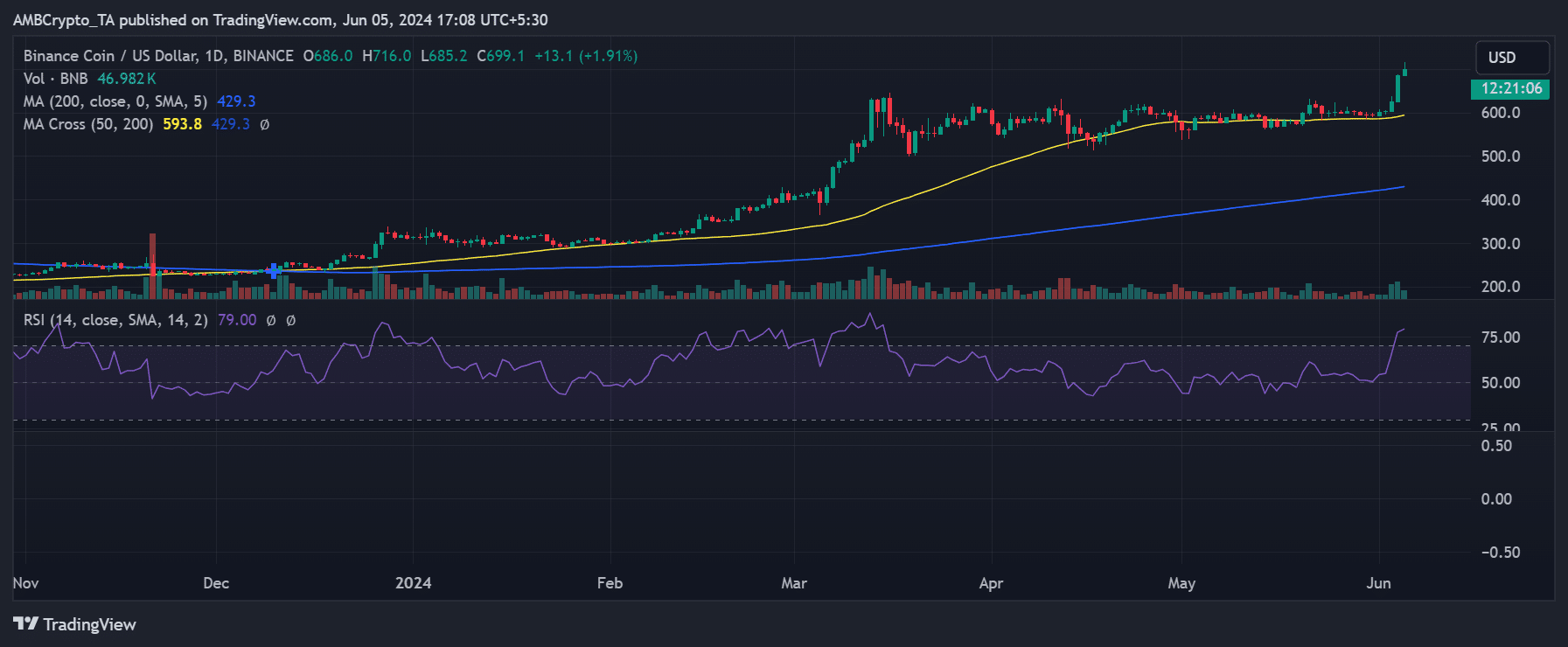

An analysis of Binance Coin’s price trend shows that it has experienced five consecutive days of uptrends. The most significant increase occurred on 4th June, when BNB saw a 9.53% rise.

The chart showed that the over 9% increase on 4th June took BNB’s price from around $626 to over $680. This price surge marked a new all-time high for BNB, making it the first altcoin to achieve a significant ATH in this cycle after Bitcoin.

This milestone is particularly notable given the FUD (Fear, Uncertainty, and Doubt) that surrounded it at a point. The FUD started after the US Department of Justice indicted its former CEO, Changpeng Zhao, and the company.

As of this writing, Binance (BNB) has reached another all-time high, trading at around $700 after an increase of over 2%.

The price is now clearly above its short moving average (yellow line) and is in the overbought zone. Analysis of its Relative Strength Index (RSI) indicated it was above 70, signifying a strong bull trend and an overbought state.

Binance’s Open Interest crosses $1 billion

An analysis of Binance’s Open Interest showed a significant reaction to the recent price spike.

According to a chart on Coinglass, BNB’s Open Interest surged to over $1 billion. The volume of Open Interest is particularly noteworthy as it is the highest level seen over a year.

This indicates that the price spike triggered a substantial cash inflow into BNB.

The large cash inflow also indicates increased participation from traders on the derivatives side. Most traders are betting on BNB’s price increasing further, which is a bullish signal.

Additionally, the chart on Coinglass showed that short position traders have suffered significant losses in the last 24 hours with the recent price spike.

The chart revealed that the volume of liquidations for short positions was over $6 million, while the volume for long positions was less than $300,000.

Volume hits highest points in over a month

An analysis of Binance’s volume showed significant momentum in the past few days. In the last 24 hours, the volume has reached levels not seen in over a month.

Read Binance (BNB) Price Prediction 2024-25

As of this writing, the volume was over $4 billion, with the last significant increase occurring in April.

This rise in volume indicates heightened activity in the spot trading market, which could drive the price higher.