Here’s why FTM might soon go past $2 next

- FTM’s number of new addresses fell and development activity declined.

- FTM was overbought, indicating that its value might retrace.

The price of Fantom [FTM] rose by 5.55% in 24 hours after the smart contract platform disclosed some details about the Sonic upgrade on the 25th of March.

Fantom describes Sonic as the next step in offering a better throughput.

For a while, anticipation around the upgrade has fueled a bullish sentiment around the token. This was also one of the reasons the price crossed $1, as AMBCrypto reported.

However, not many participants are aware of the in-depth details of the Sonic upgrade. So, on Monday, Michael Kong, CEO of the Fantom Foundation, published a blog, explaining what users should expect.

Dedication drops but the stakes are high

According to Kong, the upgrade would improve the bridging of tokens on the network. He also mentioned how it would enhance security, off-chain execution, and on-chain verification.

Kong explained that,

“Sonic will be used to create a new best-in-class shared sequencer for L1 and L2 chains, capable of processing over 180 million daily transactions with real, sub-second confirmation times, and serve as the foundation to relaunch Fantom as an entirely new community-centric brand.”

Before the recent memo, Fantom’s community displayed conviction that the development would drive traction to the project. Furthermore, demand for FTM has been increasing.

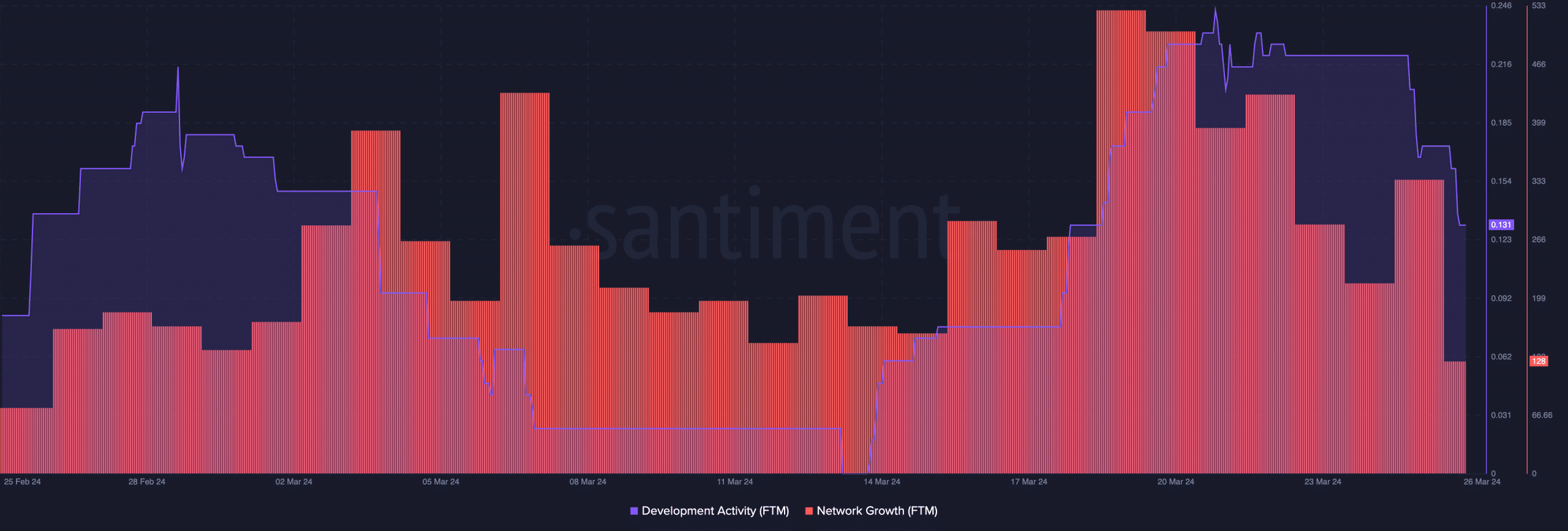

However, AMBCrypto discovered that development activity on Fantom has taken a chill pill from what it was before. On the 22nd of March, on-chain data obtained from Santiment showed that the metric was 0.24.

But as of this writing, the metric was down to 0.31. The decline implies that developers had slowed down their commitment to polishing Fantom.

Typically, this could be a bearish signal. If it stays the same, the price of FTM might be affected. Like the development activity, the network growth also fell.

FTM set to slow down

This metric tracks the number of new addresses making their first transactions on the network. Therefore, the decline implied that FTM adoption had experienced a bit of a downturn.

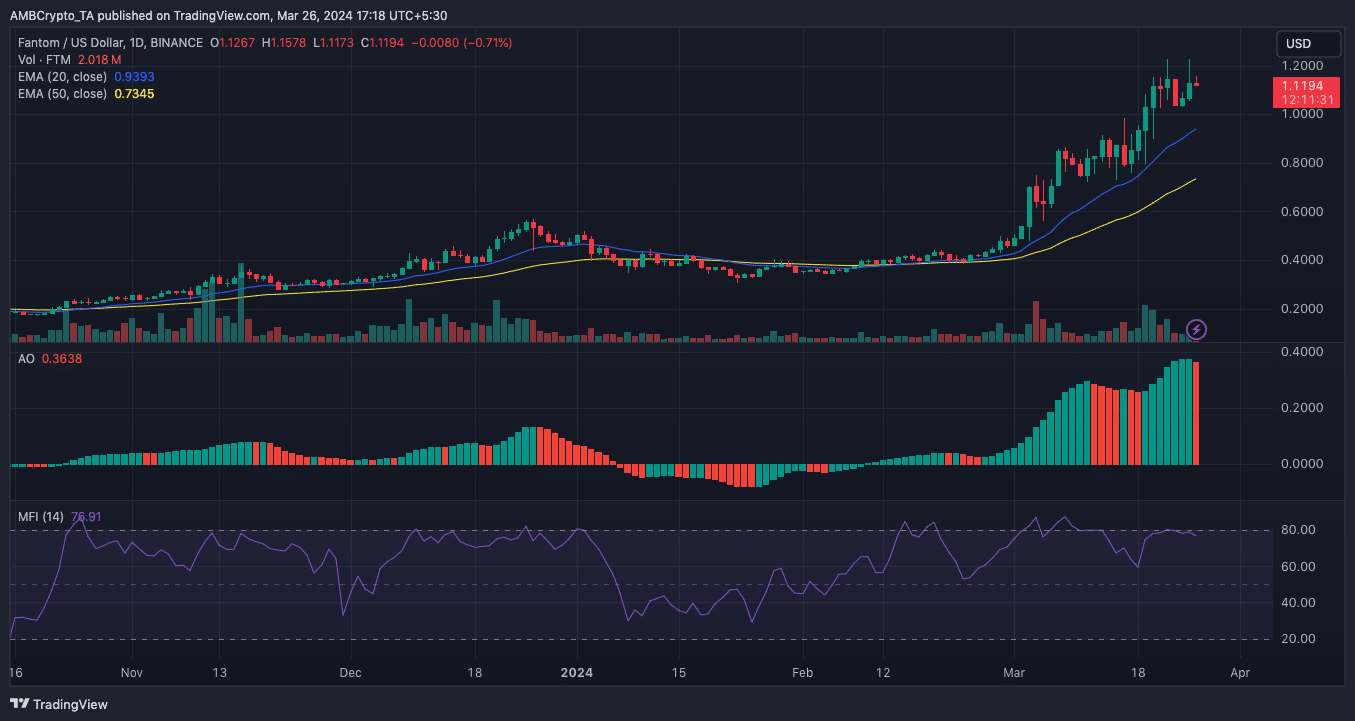

On the daily timeframe, the Exponential Moving Average (EMA) showed that FTM’s trend was bullish. This was because the 20 EMA (blue) had crossed over the 50 EMA (yellow).

Also, the Awesome Oscillator (AO) was positive, indicating an increasing upward momentum. However, a red histogram bar appeared, suggesting that the upward momentum might stall in the short term.

Realistic or not, here’s FTM’s market cap in ETH’s terms

In addition, AMBCrypto analyzed the Money Flow Index (MFI). At press time, the MFI was close to 80.00, suggesting that the token was overbought. With this trend, the price might likely retrace a bit.

However, there have been predictions that the upgrade would take the price to $2. But for now, there is no guarantee considering Fantom has not fixed data for the development.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/08/Bitcoin-BTC-400x240.webp)