FTM’s breakout – Examining if altcoin’s on-chain metrics back its rally odds

- FTM’s symmetrical triangle pattern hinted at a potential breakout, with $0.93 as key resistance

- On-chain metrics were largely bullish, though low active address growth suggested caution

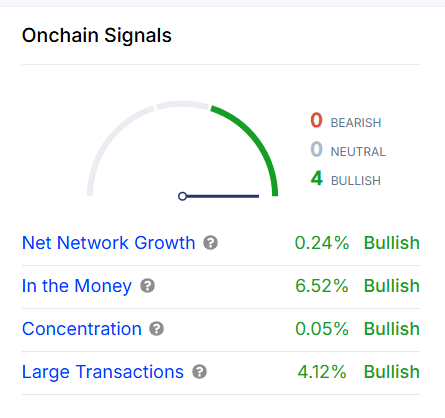

Fantom [FTM], at the time of writing, was showing promising signs of a potential breakout from a symmetrical triangle pattern, one supported by strong on-chain metrics and technical indicators. In fact, recent data revealed a “Mostly Bullish” sentiment, with four key on-chain signals – Net network growth, in the money, concentration, and large transactions—all suggesting a positive outlook.

With a press time price of $0.7459, after falling by 5.26%, FTM’s performance now hinges on whether it can overcome critical resistance levels. However, not all indicators fully supported an imminent breakout, adding some uncertainty.

Technical analysis – Is FTM ready for a breakout?

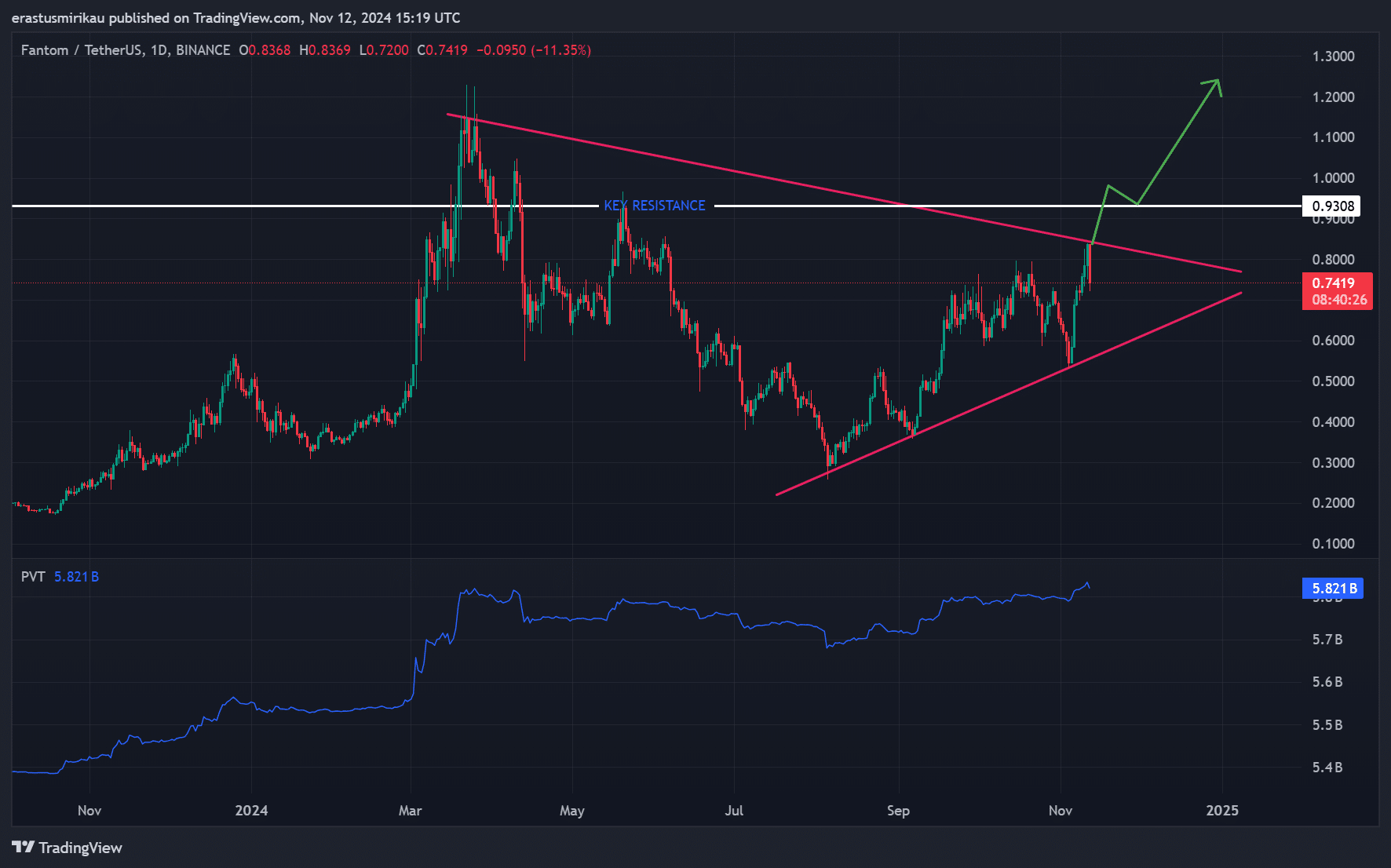

FTM’s price action seemed to be forming a symmetrical triangle pattern – Often a sign of an impending breakout. This pattern, marked by converging trendlines, suggested that FTM might soon make a significant move. If this triangle breaks upwards, it could confirm bullish momentum. However, breaking through established resistance levels will be crucial to validate this movement.

FTM faces a significant resistance level at $0.93, which has historically acted as a ceiling for upward movement. A decisive break above this level could encourage further gains, with a potential target around $1.20 based on previous price action. Consequently, failing to clear this resistance could see FTM trapped within the current consolidation phase.

The price volume trend (PVT) revealed steady growth, indicating a hike in buying interest. This metric pointed to underlying bullish sentiment, suggesting that a breakout could gain strength if accompanied by a surge in trading volume. However, without a major volume spike, the breakout may lack the momentum needed for sustainability.

FTM on-chain metrics support a cautiously bullish sentiment

The on-chain metrics largely supported a bullish outlook, though with some caution. Net network growth was up by 0.24%, showing a steady influx of new users. Additionally, 6.52% of FTM addresses remain “In the Money,” reducing the likelihood of sell pressure from profitable holders, which often supports price stability.

The large transaction metric was up by 4.12%, highlighting interest from institutional and high-net-worth investors – A positive sign for future price action. Concentration among large holders at 0.05% also implied that whales have been retaining their positions, underscoring confidence in FTM’s long-term potential.

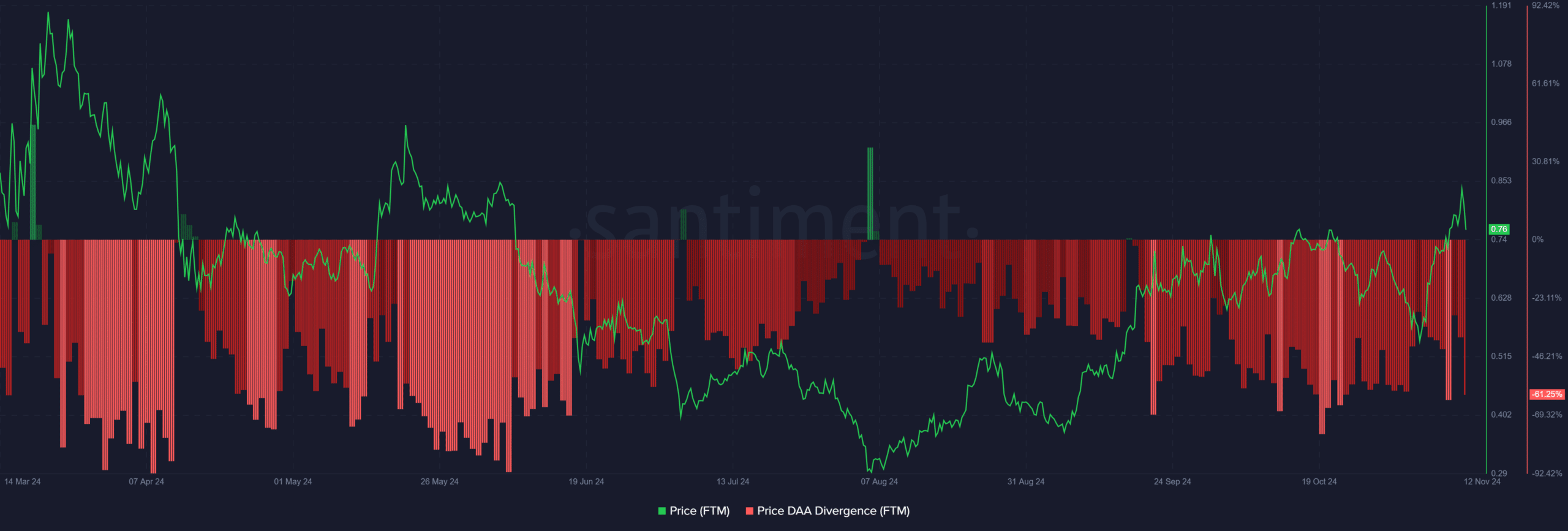

Price-DAA divergence signals caution

The price-daily active addresses (DAA) divergence had a reading of -61.25%, indicating that the price outpaced user activity growth. This divergence is a cautionary signal, suggesting that FTM’s price movement might not be fully supported by network activity, which could limit upward momentum.

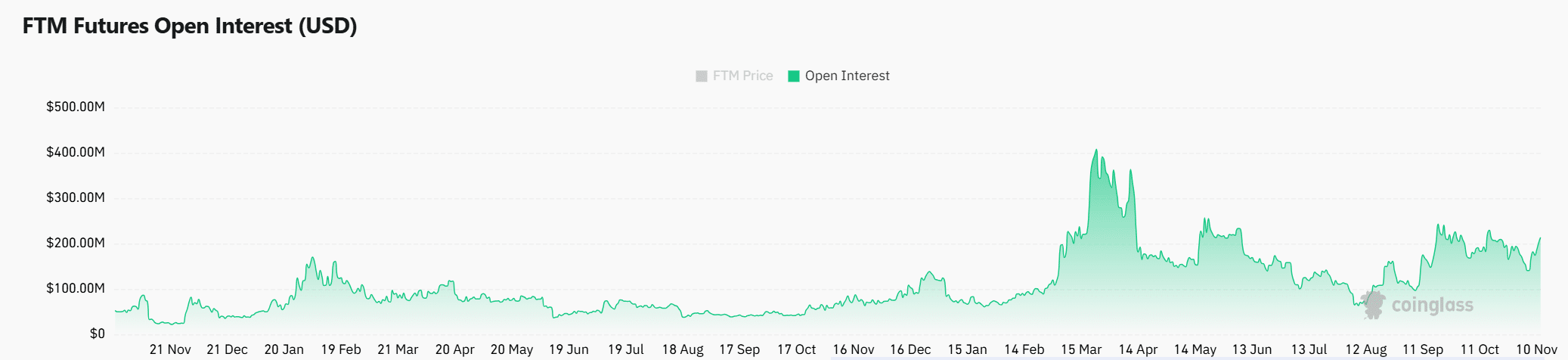

Market sentiment with Open Interest in focus

At the time of writing, the Open Interest for FTM Futures stood at $193.63 million, with a fall of 2.79%. This dip in Open Interest highlighted some caution among traders, suggesting that market participants may be hesitant to commit strongly in either direction, This could affect FTM’s ability to sustain a breakout.

Read Fantom’s [FTM] Price Prediction 2024-25

A mixed outlook with cautious optimism

Based on the data analyzed, FTM flashed both bullish and cautionary signals. While technical patterns and on-chain metrics leaned towards a potential breakout, the low daily active address growth and slight decline in Open Interest suggested caution.

Therefore, a confirmed breakout above $0.93 is crucial to validate further gains. Otherwise, FTM’s price might remain in its current consolidation range.