Altcoin

FTT targets $3.4, but challenges lie ahead — What happens now?

FTT may be set for another impressive surge, similar to its performance over the past two months.

- FTT is positioned for a potential rally, trading off a demand zone that has catalyzed upward price movements.

- However, FTT could experience a temporary pullback into a support zone.

In the last month alone, FTX token [FTT] has soared by 61.43%, a remarkable gain that is uncommon in the current market over such a short period.

According to AMBCrypto’s analysis, this bullish momentum is just beginning, which means that FTT could be gearing up for another significant price increase, as explained below.

Demand zone set to drive buying impulse

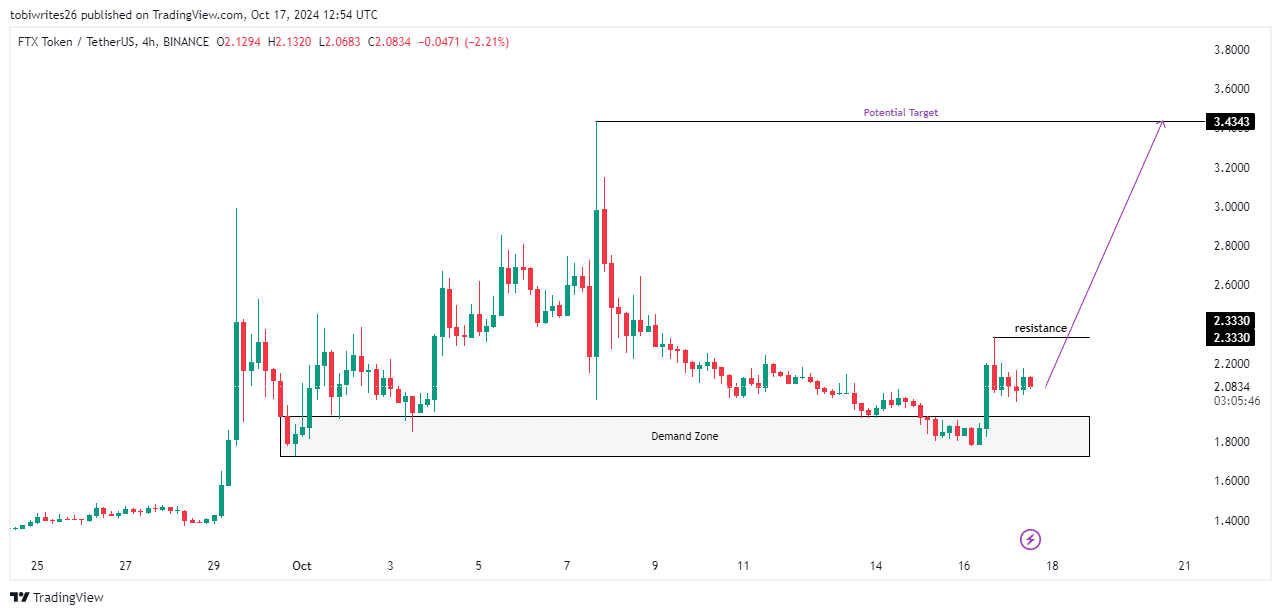

FTT was trading within a demand zone at press time, a price range known to attract significant buying pressure and catalyze upward movement, as seen in two previous instances.

This demand zone spans from $1.9305 to $1.7289. Recently, FTT has shown respect for this level, resulting in a price increase of 15.36%.

If buying momentum persists, FTT is likely to target an upper resistance level at $3.4343. However, traders should be aware of potential minor resistance at $2.3330, just above the current price.

Active buyers to drive FTT higher

Further analysis from AMBCrypto revealed that traders were actively buying FTT, which could propel its price upward as sentiment on key metrics by Coinglass, such as Funding Rate and Open Interest, improves.

As of press time, the Funding Rate stood at a positive 0.0449%. A positive Funding Rate occurs when the price of a cryptocurrency’s futures contract exceeds its spot price.

In this scenario, long traders—those betting on price increases—pay a fee to short traders, indicating bullish sentiment surrounding FTT.

Contributing to this optimism is the growing Open Interest, which has increased by 2.69%, reaching $1.1 million. This suggests that more long contracts are being opened, and existing positions are being maintained.

With traders actively funding their purchases of FTT despite bearish sentiment, a major rally appears imminent.

Caution advised despite bullish outlook

While bullish sentiment surrounds the market, it is crucial for investors to remain cautious as the Accumulation/Distribution (A/D) indicator approaches a significant resistance trendline.

Is your portfolio green? Check out the FTT Profit Calculator

If the price rallies to this level—potentially coinciding with the previously mentioned minor resistance at $2.3330—FTT may experience a minor drawdown to $2.0486 support before resuming its upward trajectory.

However, for the support at $2.0486 to hold, market sentiment must remain bullish.