FTX and CFTC reach a $12.7B settlement: What happens now?

- FTX and CFTC have reached a $12.7 billion settlement.

- FTX filled for bankruptcy in 2022, and regulators filled civil lawsuits against the firm.

After two years of legal battle and investor frustration, FTX has settled with CFTC. The recent deal aims to resolve one of the most significant bankruptcy claims.

Accordingly, the CFTC aimed to recover monetary value to repay creditors amounting to $12.7B, and the agency has not been seeking financial penalties.

Details of the settlement

According to court documents, bankrupt crypto companies FTX and CFTC (commodity Futures Trading Commission) have reached a settlement. The crypto firm will pay $12.7 billion to end one of the largest lawsuits.

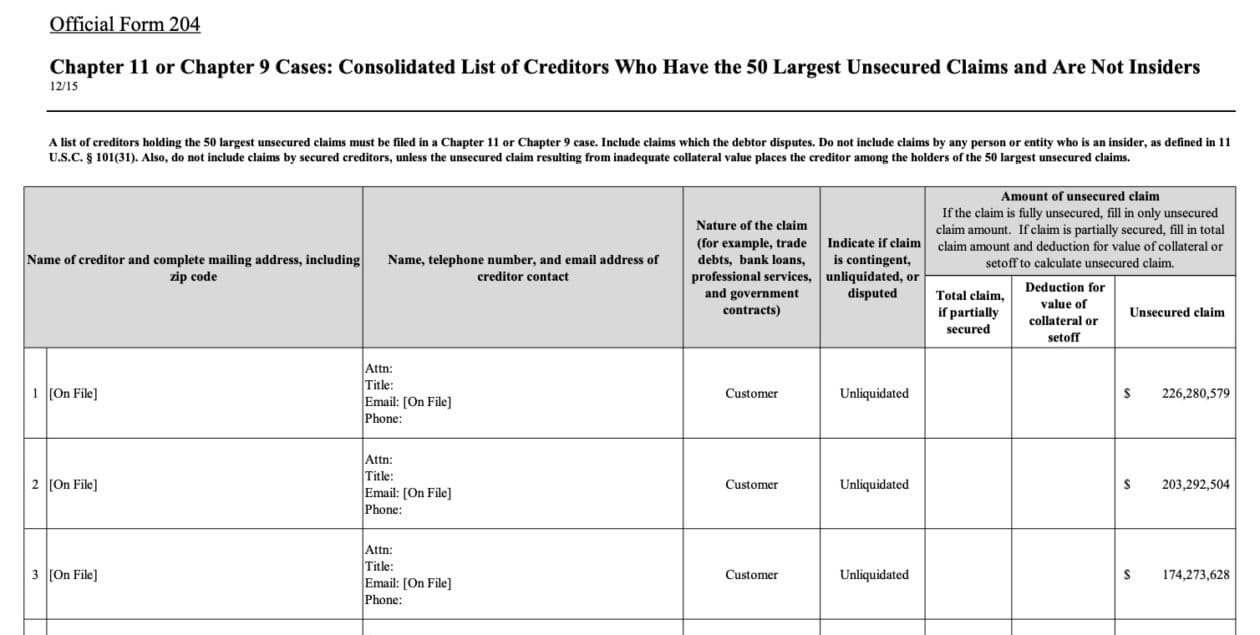

Based on released documents from the bankruptcy court regarding the digital asset behemoth that collapsed in 2022, it will have to pay $4B in disgorgement fees.

Additionally, the firm will pay $8.7 billion in restitution fees, which will wait for further approval from the court.

FTX vs. CFTC case

Before filing for bankruptcy in 2022, FTX was a significant crypto firms. Customers could sell, buy, or invest through the firm’s crypto services by betting on various digital tokens’ price movements.

However, the company filed for bankruptcy in November 2022. Allegedly, the firm had misinformed investors regarding their financial situation.

FTX used investors’ money to bet through its sister company, Alameda Research. The incident led to the arrest of the company’s co-founder, Sam Bankman Fried, who was later sentenced to 25 years in prison.

In the same month, 101 affiliated debtors filed a voluntary petition for relief under Chapter 11 of the US bankruptcy code in Delaware’s district court.

Impact on defrauded customers

Notably, FTX has faced various regulators in court following the collapse. The CFTC argued that the company had defrauded customers of their investments.

Therefore, the recent settlement is a major relief for FTX investors after two years of waiting.

The major creditors are hoping to earn a 166% interest on their funds, factoring in the market cap and price surges in various cryptos.

Until next month, creditors will decide on their preferred mode of payment, as other case factors are subject to the court’s approval.