GameStop takes lead over Dogecoin with impressive rally – What now?

- GameStop’s social dominance was higher than Dogecoin’s, propelling a higher demand.

- GME was overbought, indicating a possible decline to $0.015 while DOGE’s momentum was bearish.

GameStop [GME] stole the show from Dogecoin [DOGE] and other memecoins in the market between the 8th and 9th of June. According to CoinMarketCap, GME’s price increased by 28.25% in the last 24 hours.

However, it is necessary to point out that the GameStop referred to here is not the same as the GME stock. Instead, this is a memecoin developed on the Solana blockchain. It was built in honor of GameStop stock trader Keith Gill.

At press time, GME’s value was $0.019 with a market cap of $124.66 million. As of this writing, GME spiked while many memecoins including DOGE experienced notable downturns.

More hype for the kitty

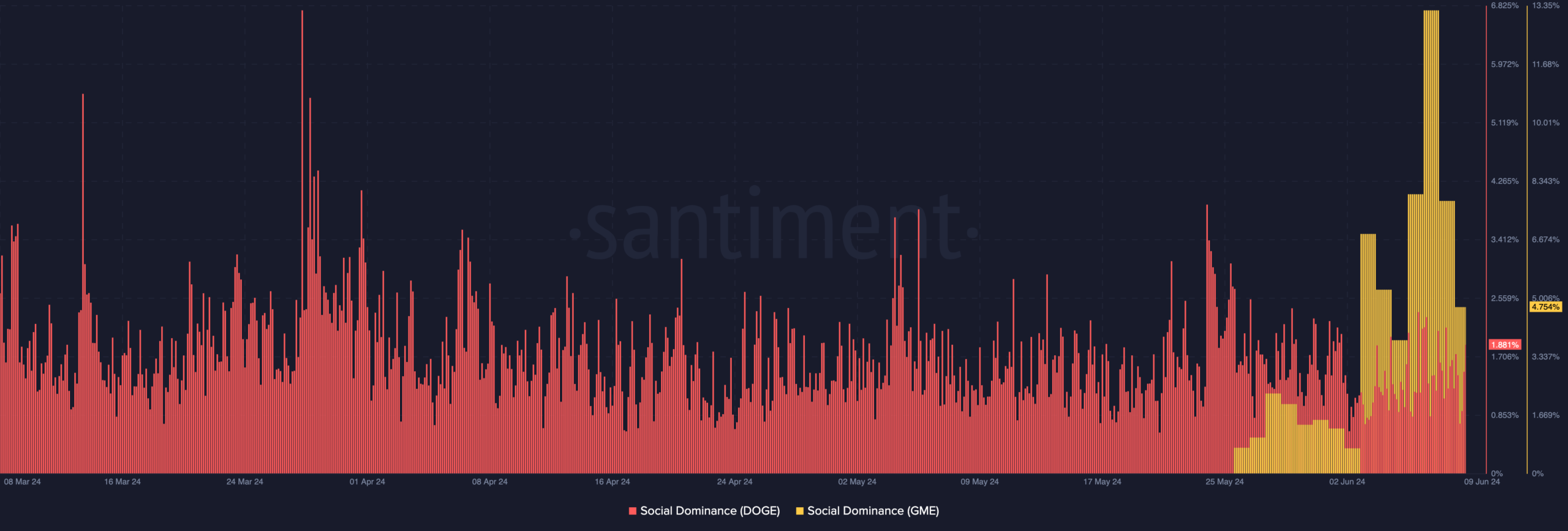

AMBCrypto discovered the reasons for this performance. Based on our findings, the attention around the cryptocurrency was still at a high level. However, for DOGE, discussions about it was nowhere near GameStop.

The social dominance was one metric that proved this position. According to Santiment, Dogecoin’s social dominance was 1.881%. For GameStop, it was 4.754%.

Furthermore, the significant difference implied that demand for GME could remain higher than DOGE. Beyond that, AMBCrypto observed that the reading was a notable drop from 13.20% on the 7th of June.

At that time, GME hit a local top. As such, the decline could be a sign that, despite the memecoin dominance, the token is at a discount.

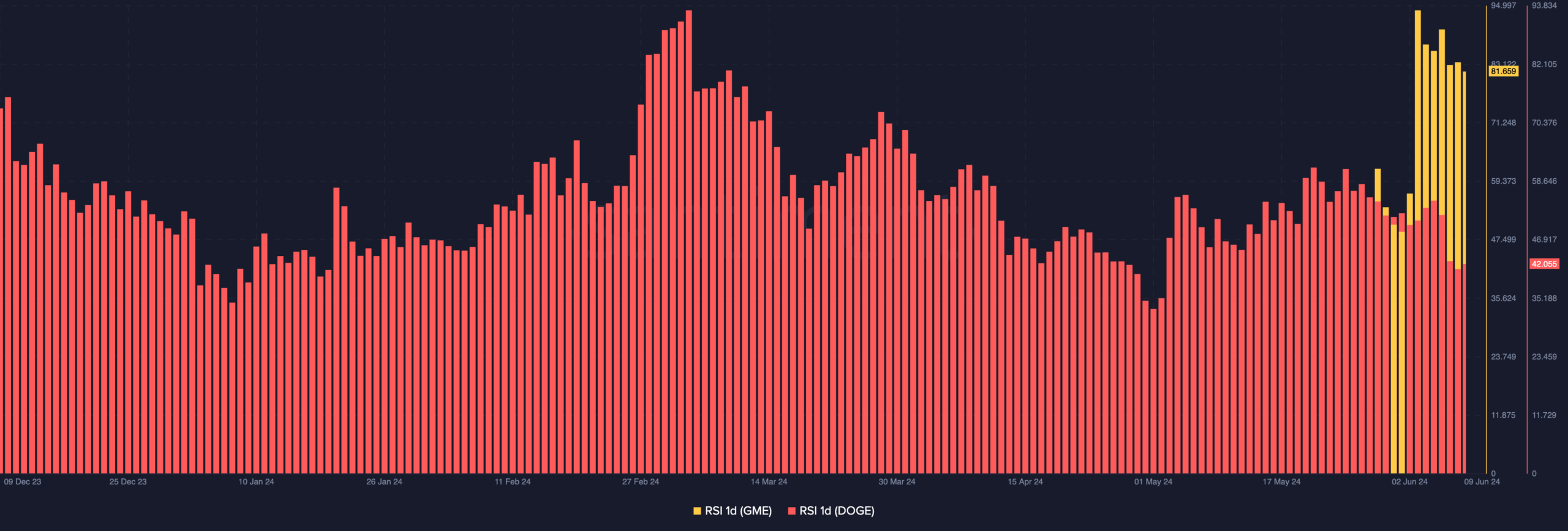

To check if this is valid, we checked the Relative Strength Index (RSI) on the daily chart. The RSI measures momentum, indicating if a cryptocurrency is in a bullish or bearish threshold.

DOGE and GME to go down

The indicator also shows if an asset is overbought or oversold. Reading at 30 or below indicate that a token is oversold. However, a reading at 70 or above suggests that it is oversold.

At press time, the RSI reading on GameStop’s daily chart was 81.65, indicating that it was overbought. Therefore, profit-taking could increase in the short-term.

If this happens, the price of the token could slide to $0.015. For Dogecoin, the RSI was 42.05, suggesting that the momentum was bearish.

With a decrease in demand and bearish momentum, DOGE could be looking at a decrease to $0.12. However, this prediction could be invalidated if buying pressure increases.

Should that happen, Dogecoin’s price could head toward $0.16. Meanwhile, GameStop’s market remained far below that of Dogecoin.

In addition, the memecoin might not get close to the DOGE’s market value. This was because the narrative around GME does not look like one that might last.

Is your portfolio green? Check the Dogecoin Profit Calculator

Just like how several memecoins have come and gone, the GME narrative might fizzle.

But Dogecoin, on the other hand, might remain a top 10 cryptocurrency till the end of this cycle.