Gemini buys $120M in altcoins, including ETH – 2025 Altcoin season in mind?

- Gemini appears to be building a huge altcoin stash dominated by ETH

- Is it a signal of early positioning for a likely 2025 altcoin rally?

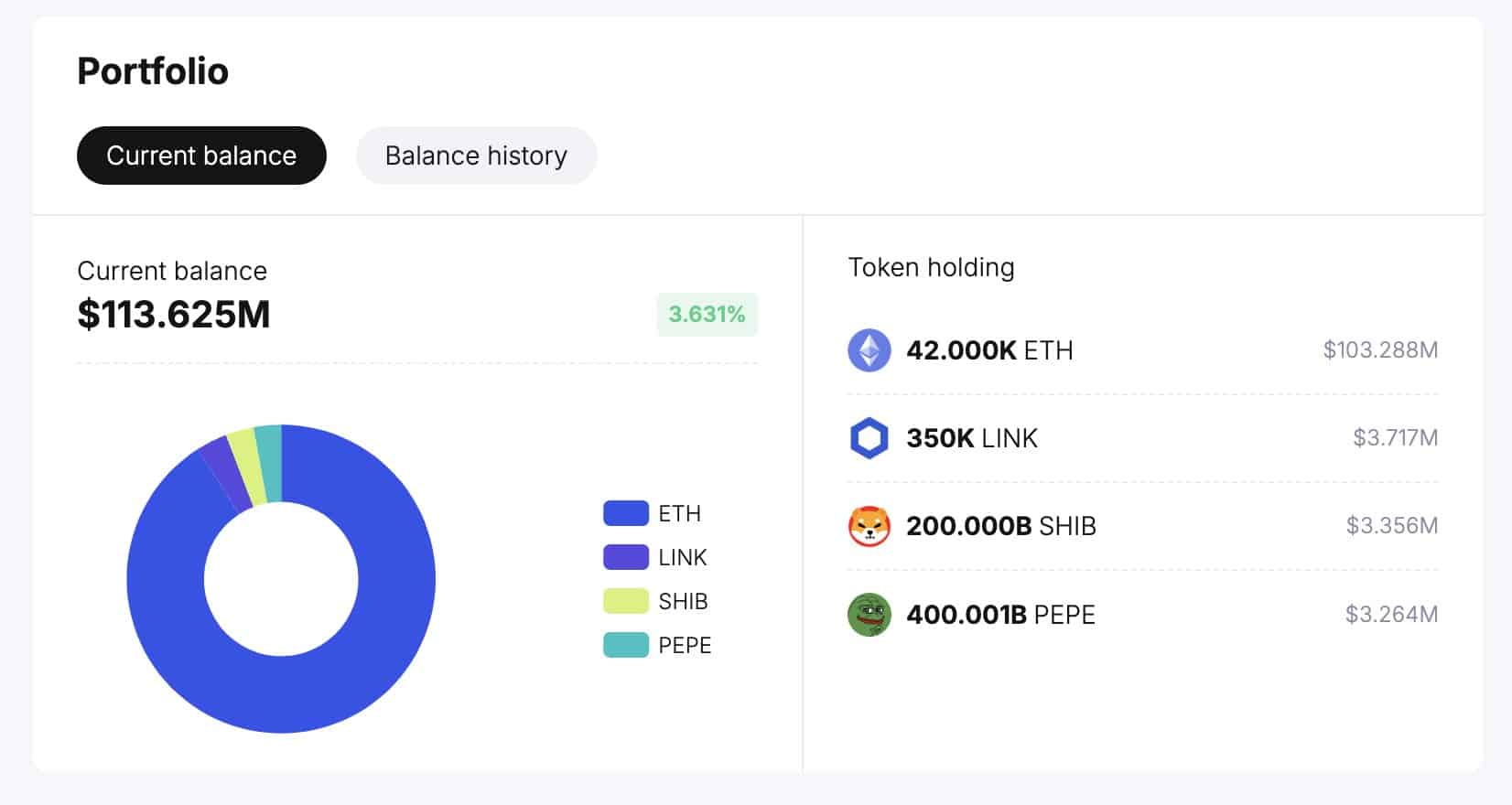

Gemini exchange has accumulated nearly $120 million worth of altcoins, including Ethereum [ETH], Chainlink [LINK] and memecoins like Shiba Inu [SHIB] and Pepe [PEPE].

According to Spot On Chain, ETH dominated Gemini’s altcoin stash, with the exchange scooping a whopping $103 million in the last 18 days.

As expected, this massive altcoin buying spree has raised the question – Is the exchange or its top clients preparing for the much-awaited altcoin season?

Is an altcoin rally likely in 2025?

Most analysts seemed to be looking forward to the start of the Fed easing cycle as a likely trigger for the altcoin season run-up.

Well, there was momentum among some altcoins from September, as some posted double-digit recovery gains. However, the positive results weren’t consistent across the entire altcoin market.

The recent surge in Bitcoin’s dominance to a new high of 60% could further delay the expected altcoin rally in 2024. According to some market observers, a likely altcoin run-up might be attempted in early 2025.

Benjamin Cowen, a popular market analyst, echoed a similar sentiment. Based on historical trends, Cowen claimed that altcoins could weaken further towards the end of 2024 and attempt a rebound in 2025. He said,

“The altcoin reckoning should be over by December 2024 (2nd week of January 2025 at the latest).”

If so, the ongoing weakening among high-quality altcoins could offer great discounted buys to maximize the likely altcoin run in 2025.

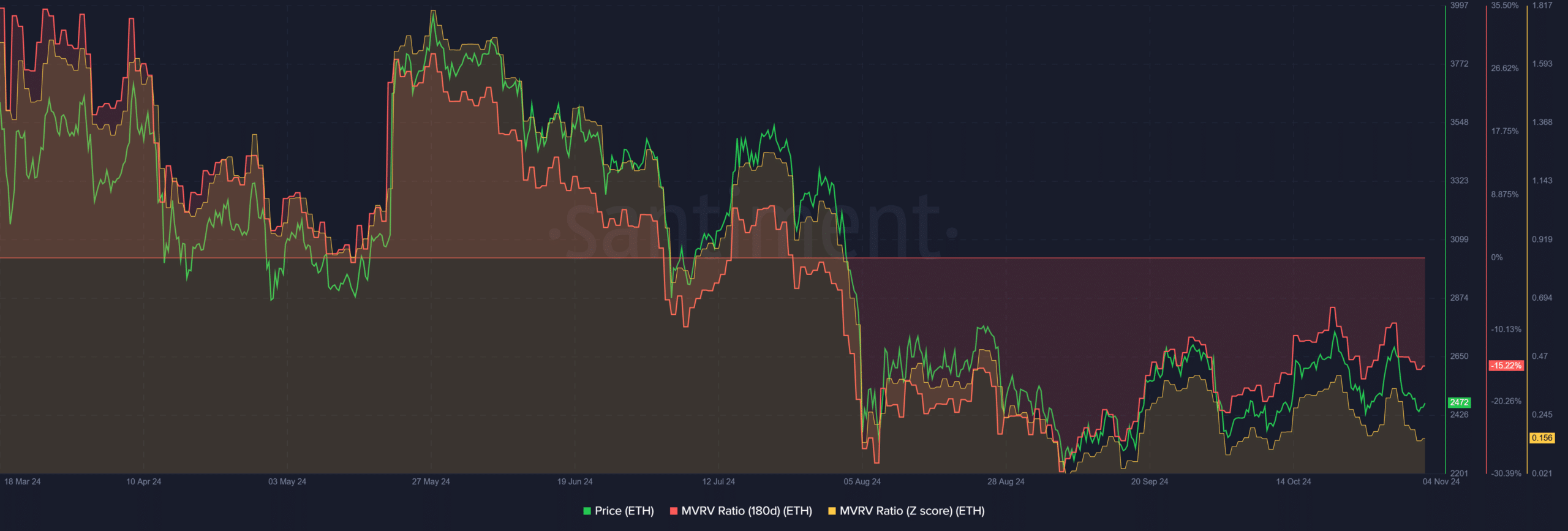

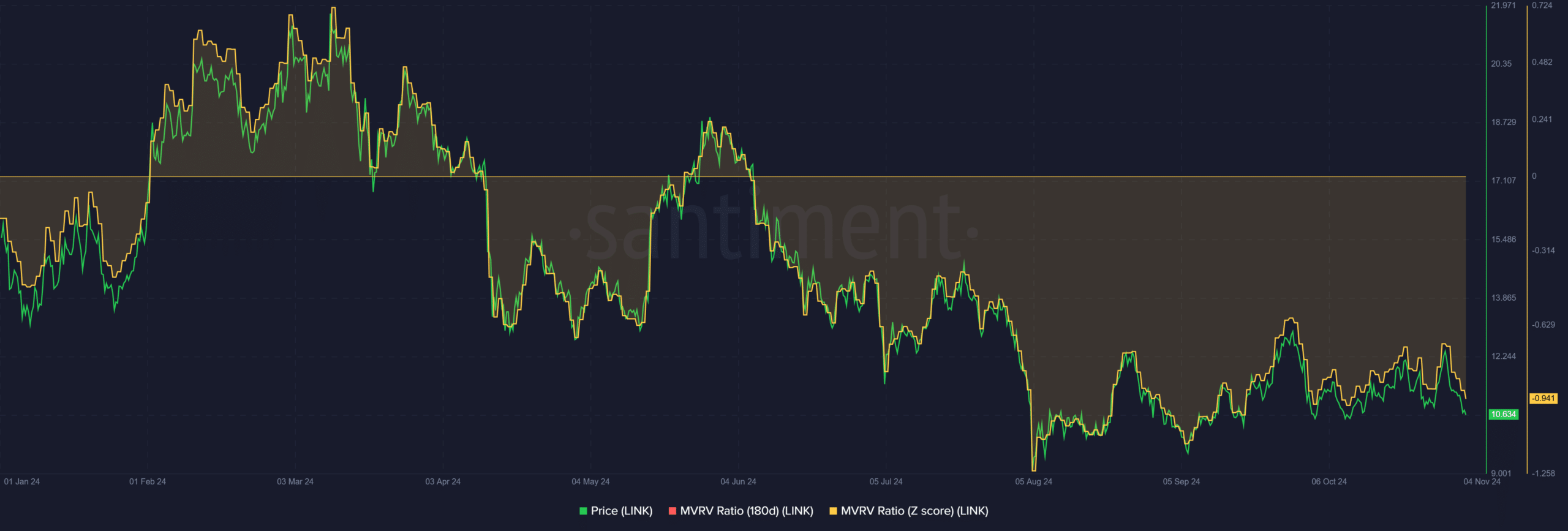

Interestingly, the select altcoins that Gemini massively accumulated showed irresistible discounts. For example, ETH seems to be grossly undervalued, as indicated by the negative MVRV (Market Value to Realized Value) and MVRV Z score readings.

The metric gauges the asset’s press time price against the average cost of all acquired assets.

A higher value indicates “overvalued” as more holders are in profit and can sell. On the contrary, negative readings suggest “undervaluation.”

Read Ethereum [ETH] Price Prediction 2024-2025

The press time ETH readings were -15% for the 180-day MVRV and yearly lows for the MVRV Z score. This implied that ETH may be relatively undervalued or “cheap” at its current prices.

In fact, analyst Ali Martinez also highlighted the great risk-reward ratio ETH could offer if it defends the $2,400 support and hits $6k.

Similarly, LINK was relatively cheap too, given its negative MVRV Z score reading. In short, if the 2025 altcoin rally plays out as projected, the top altcoins in Gemini’s stash could offer asymmetric rewards.