Gemini offers $2.18B refund: Earn users to receive 97% of assets

- Earn users received $2.18 billion in digital assets as part of the repayment.

- Gemini’s announcement follows FTX’s plan to repay its creditors.

In an unexpected development, crypto exchange Gemini revealed plans to reimburse users affected by its discontinued crypto lending program – the Gemini Earn program.

The company, owned by the tech billionaire twins Cameron and Tyler Winklevoss, made the announcement through a blog post.

In a recent post on X, Gemini Trust Co. noted,

“Today, we are pleased to announce that initial Earn distributions — approximately 97% of the digital assets owed to you as of the suspension date (November 16, 2022) — are now available in your Gemini account.”

It further elaborated,

Geminis’ repayment plan

The founders highlighted that on the 29th of May, Earn users received $2.18 billion in digital assets. This initial distribution represents 97% of the assets owed to Earn users, surpassing the amount held when Genesis suspended withdrawals by $1 billion.

This achievement marks an impressive 232% recovery from the point when Genesis halted withdrawals.

The story so far

Launched in early 2021, Gemini’s Earn program enabled users to lend cryptocurrencies to Genesis Global Capital, LLC (GGC), which then re-lent these assets.

Despite Gemini’s assurances of due diligence, GGC’s default and subsequent bankruptcy in November 2022 exposed oversight failures and insufficient reserves, leaving over 200,000 users, including nearly 30,000 New Yorkers, unable to access their funds.

Similarly, a few weeks ago, FTX, the crypto exchange that filed for bankruptcy last year, announced a substantial plan to repay its creditors, potentially revitalizing the crypto market.

On 8th May, it was revealed that the exchange is planning to repay approximately 98% of its creditors, amounting to as much as $16.3 billion.

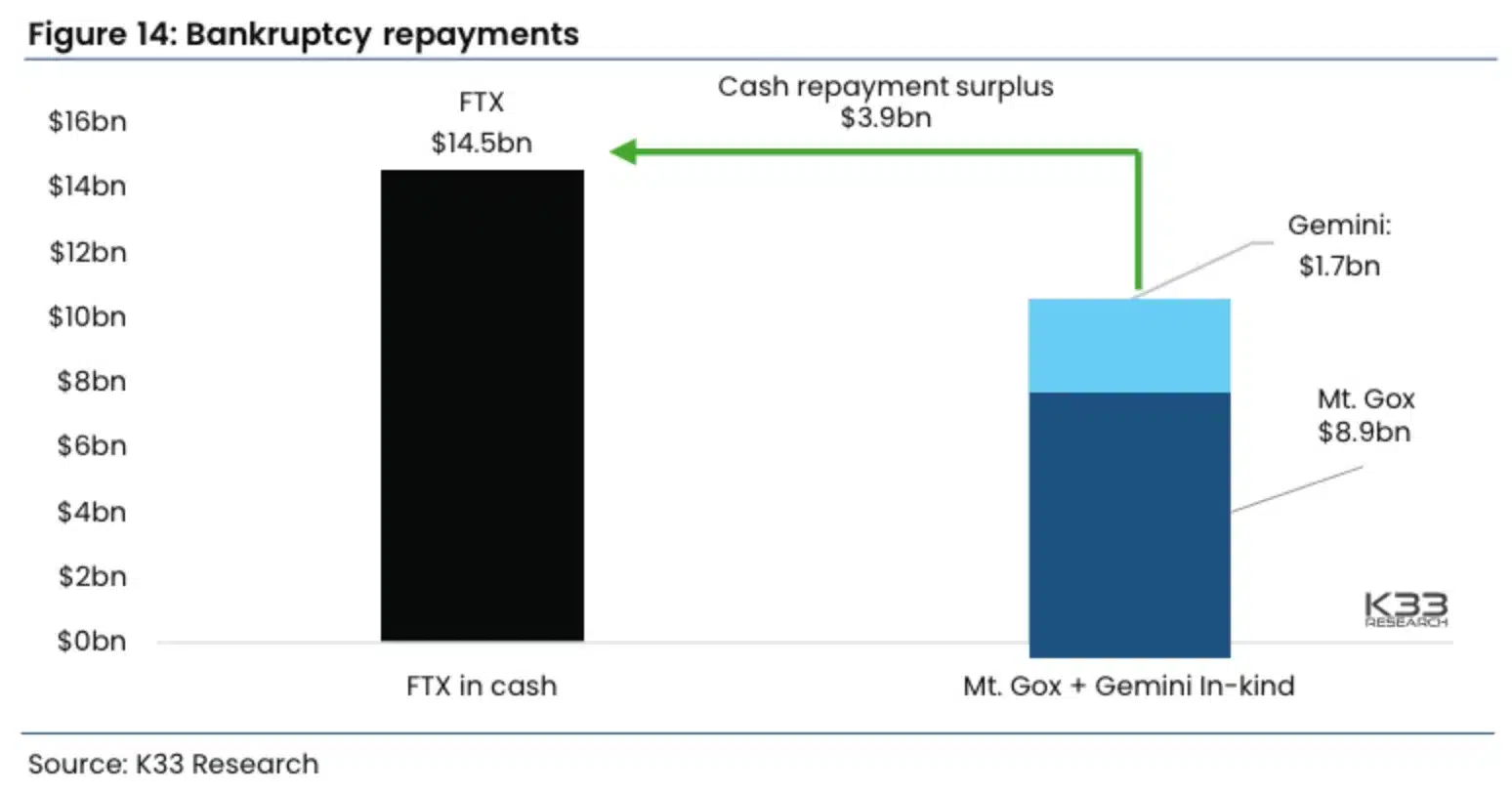

While some anticipated that the cash repayments might negatively impact the overall market, K33 Research’s analysts believe that not all creditor repayments have a bearish effect.

They argue that FTX’s cash-based repayments will differ from the crypto-based repayments planned by other entities like Mt. Gox and Gemini, which are collectively valued at $10.6 billion.