Altcoin

GMX retains spot as the leading protocol on Arbitrum, here’s why

- GMX has the highest TVL on Arbitrum.

- Its native token might see a price drawdown with buyers’ starting to experience exhaustion.

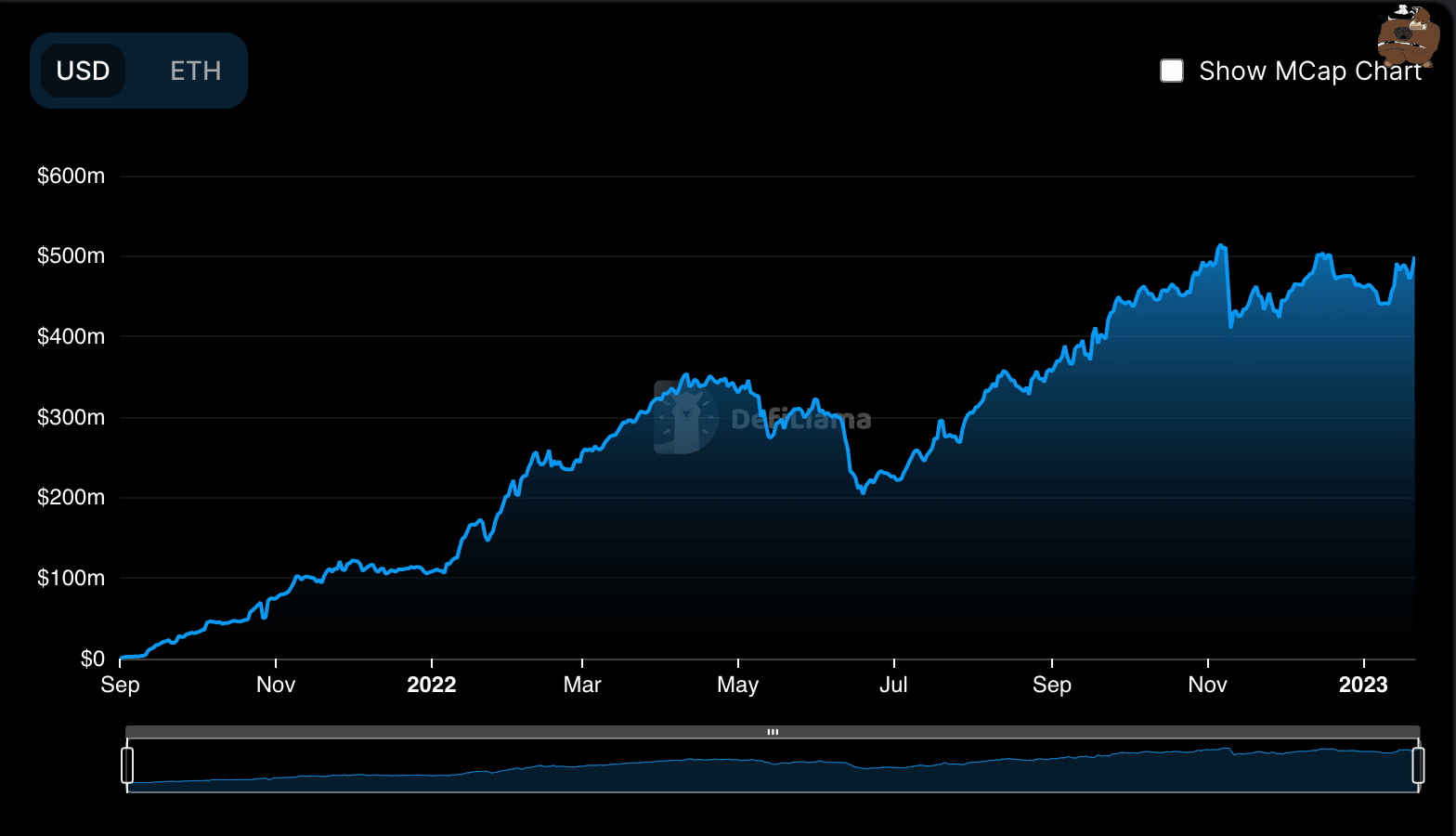

Despite the volatility in the decentralized finance (DeFi) market in 2022, GMX, a decentralized exchange for spot and perpetual trading on Arbitrum and Avalanche, has maintained its position as the project with the highest total value locked (TVL) on Arbitrum, according to data from DefiLlama.

Is your portfolio green? Check the GMX Profit Calculator

Since its launch in September 2021, GMX’s usage has steadily grown, leading to an increase in its total value locked (TVL). In fact, amid the market madness in the 2022 bear market, GMX’s TVL grew by over 300%.

GMX’s total value locked (TVL) grew significantly despite the bearish environment that plagued the market in 2022. It's currently the largest protocol on Arbitrum, with approximately $400M in TVL at the time of writing. pic.twitter.com/WQS4JuPRgZ

— The Block Research (@TheBlockRes) January 20, 2023

As of this writing, GMX’s TVL was $427.72 million giving it a 37.49% share of the overall TVL of $1.14 billion of the Arbitrum network.

Likewise, its deployment on Avalanche was ranked as the project with the fourth-largest TVL on the chain after Aave, Benqi, and Trader Joe. So far this year, GMX’s TVL on Arbitrum has grown by 8%, data from DefiLlama showed.

More users equal more cash

Since the year started, GMX has seen a tremendous rally in the count of total users on the DEX. Per data from

GMX Stats, the count of total users of the exchange has grown by 164% since 1 January. The daily counts of new and existing users on the DEX have consistently increased.Increased user activity has led to a growth in trading volume on the exchange. As of this writing, total trading volume on the DEX stood at $4.25 billion, having risen by over 9000% since the year began.

Furthermore, the fees paid to process transactions on the DEX have also increased. Since the start of the year, GMX has recorded cumulative transaction fees of $7.98 million.

How much are 1,10,100 GMXs worth today?

GMX price performance

At press time, GMX, the DEX’s utility, and governance token exchanged hands at $51.20. On a year-to-date basis, its value has increased by 23%, data from CoinMarketCap revealed.

An assessment of GMX’s performance on a daily chart revealed a steady uptick in the alt’s accumulation. At press time, key momentum indicators were positioned above their respective neutral zones in uptrends. For example, the Relative Strength Index (RSI) was pegged at 60.60. Likewise, GMX’s Money Flow Index (MFI) was spotted at 54.55.

Further, a look at the alt’s Directional Movement Index (DMI) confirmed that buyers had control of the market. The +DMI line (green) was positioned above the -DMI line (red).

Typically, when the +DMI line is above the -DMI line, it suggests that the buyers’ strength exceeded that of the sellers.At the time of writing, the Average Directional Index (ADX) for GMX, which is used to measure the strength of a trend in the market, was at 20. When an asset’s ADX is above 25, it indicates that the trend is strong, but if it is below 25, it suggests that the trend is weak or nonexistent. Therefore, with the ADX at 20, buyers’ strength might be declining. As a result, a price decrease may be imminent in the GMX market.