GMX: The sudden surge in this metric could launch the DEX into the orbit

- GMX’s new all-time high in user fees was more than double its previous ATH.

- The native token was up 6% at press time as bullish sentiments prevailed.

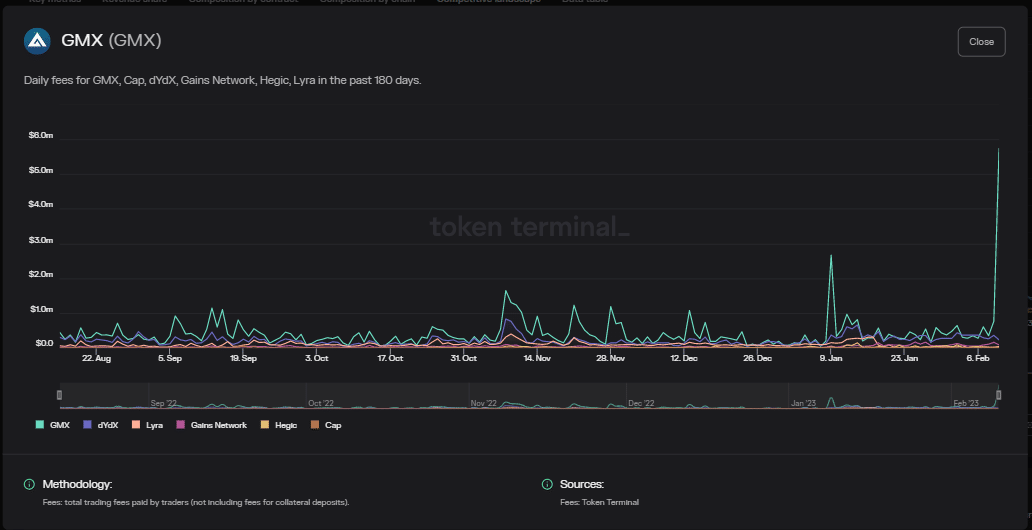

According to a tweet by DeFiLlama on 11 February, GMX, a decentralized exchange for spot and perpetual contracts, hit its new all-time high (ATH) in user fees at $5.64 million.

The noteworthy aspect of this ATH was that it was more than double its previous ATH.

Recent activity on @GMX_IO , including the closing of Andrew Kang's long positions of ETH and BTC, has resulted in a new all-time high for GMX on our Fees Dashboard. In the past 24 hours, GMX reached $5,641,320 in user fees, which is more than double its previous all-time high pic.twitter.com/HqW3ZMdSsL

— DefiLlama.com (@DefiLlama) February 11, 2023

Furthermore, data from Token Terminal pointed out that GMX comfortably surpassed other big players in the landscape, including dYdX. in terms of fees generated over the last few days.

Is your portfolio green? Check the GMX Profit Calculator

Why GMX seems enticing for investors

GMX has taken massive strides since its launch in September 2021. According to DappRadar’s report on DeFi protocols, GMX attracted considerable attention from traders because of its zero slippage and low cost.

As it aggregates prices from leading volume exchanges instead of using an automated market maker (AMM) like Uniswap[UNI] and Curve Finance [CRV], trading efficiency is maintained while executing market orders.

Another magnetic factor of GMX is the portion of the transaction fee that is allocated to holders of the native token. GMX users receive 30% of the total fees generated on the protocol. This was evident in the vertical rise in revenue for the token holders which followed the rise in fees.

However, the growth in total value locked wasn’t considerable and could be called steady at best.

Good days to come for the native token?

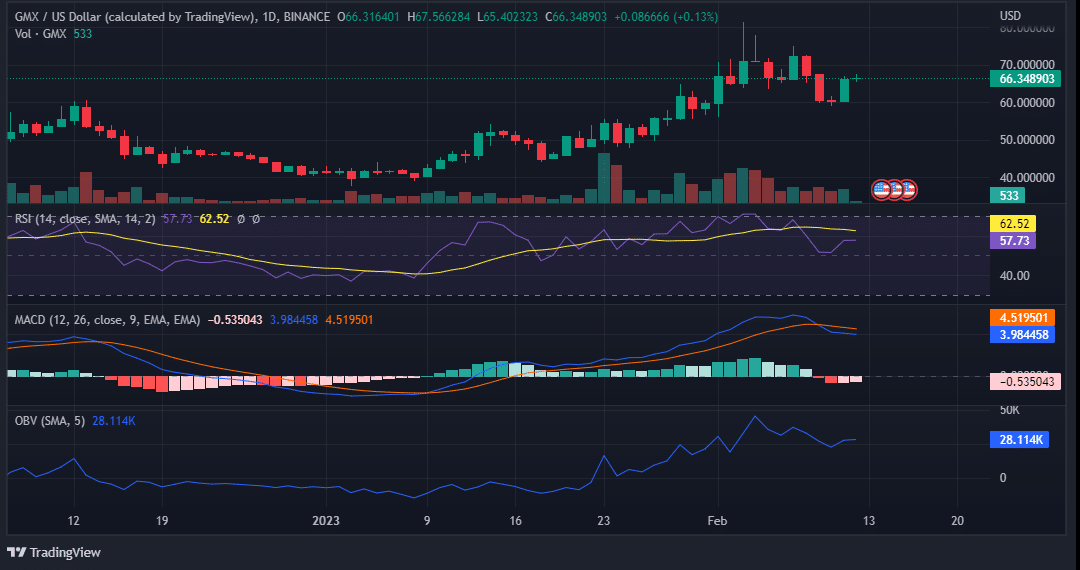

The growth in revenue was reflected in the price of GMX as well. At the time of writing, GMX jumped 5% over the past 24 hours to trade at $66. However, over the last seven days, the price retreated by 6%.

The Relative Strength Index (RSI) was well above the neutral 50 mark and moved sideways, suggesting that bulls could take over the market again.

The On Balance Volume (OBV) moved in an ascending trajectory signaling capital inflow into the market. Though the Moving Average Convergence Divergence (MACD) was below the signal line, a bullish crossover seemed likely.

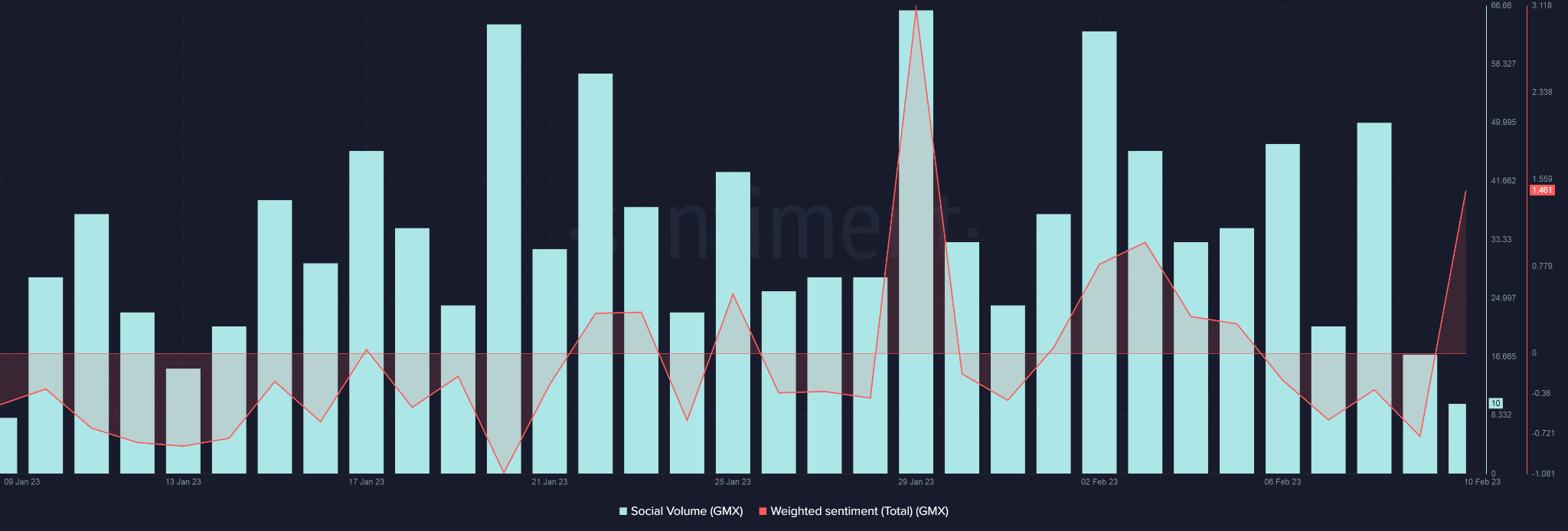

The weighted sentiment and social buzz for GMX lifted with the rise in the protocol fees, as revealed by data from Santiment. This lent credence to the bullish narrative of the token.

How much are 1,10,100 GMXs worth today?

Notably, GMX is the largest protocol on Arbitrum and this is the primary reason behind the layer-2 solution’s massive growth. It formed the lion’s share of the total value locked (TVL) on Arbitrum.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/08/Bitcoin-BTC-400x240.webp)