GMX: Will the dApp’s fortunes change as interest in AVAX and ARB soars

- GMX witnesses a surge in fees as demand for ARB and AVAX grew.

- Despite protocols growth, GMX tokens prices continue to decline.

GMX has been one of the most prominent dApps on the Arbitrum [ARB] network. However, as the ARB token was announced, there was a lot of speculation that it might impact GMX negatively.

Read GMX’s Price Prediction 2023-2024

Plot twist

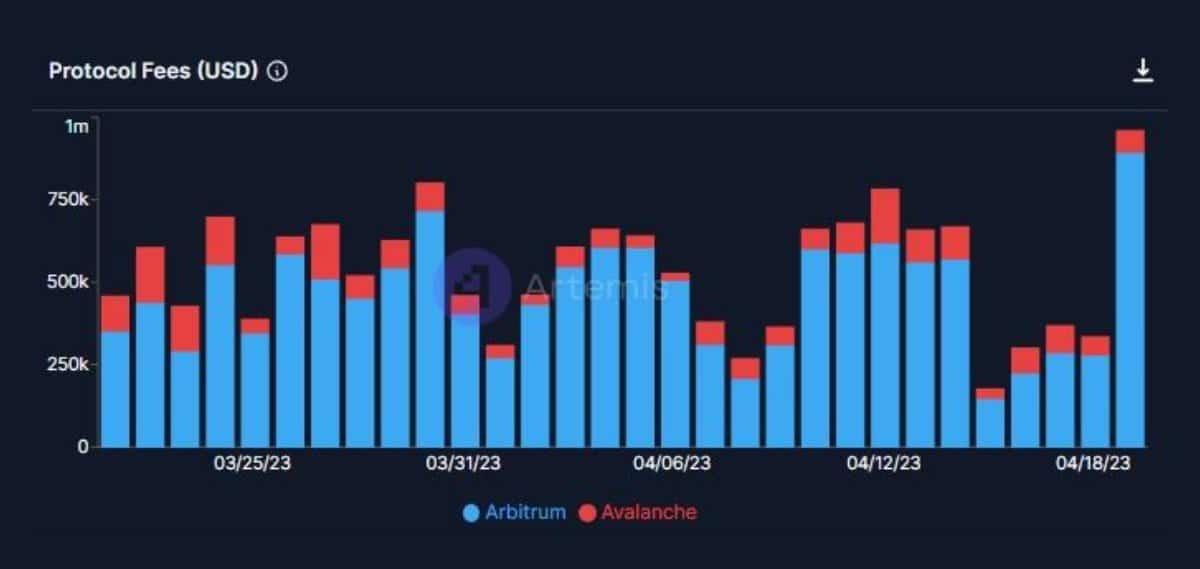

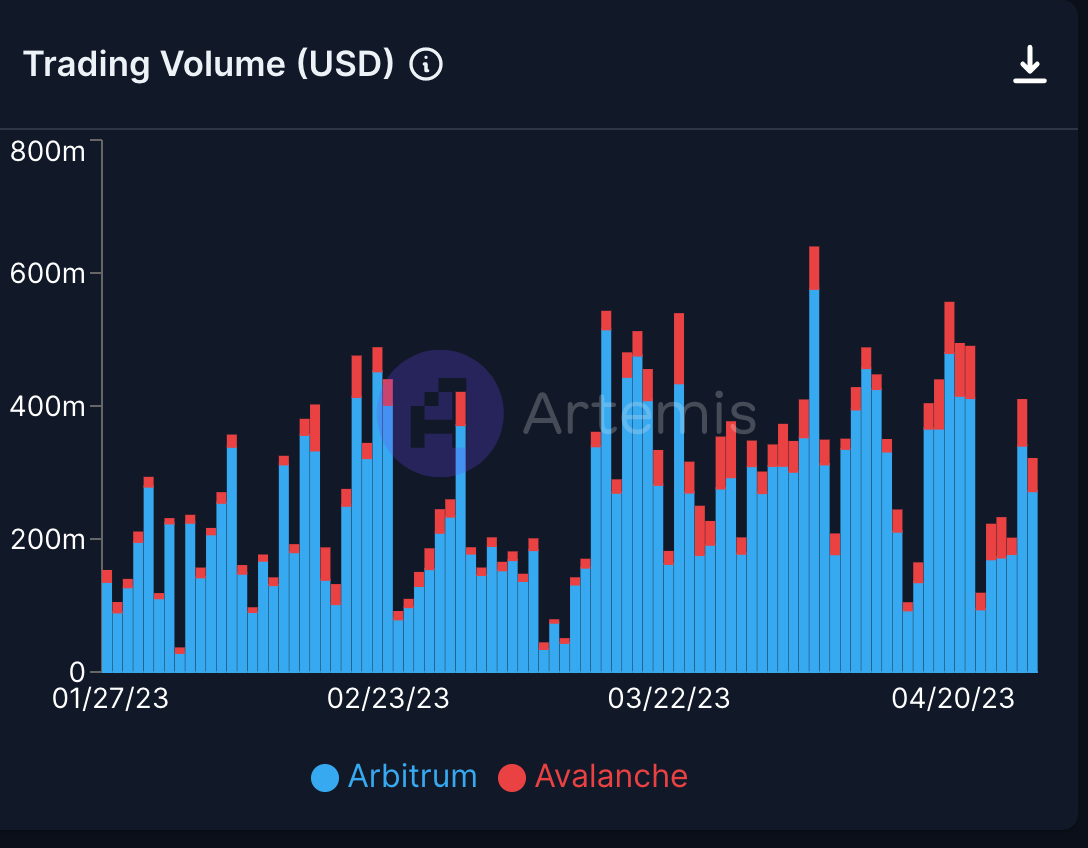

However, recent data suggested that the GMX protocol actually ended up benefiting from the surge in interest in ARB. According to data analytics platform Artemis, the fees generated by the GMX protocol through ARB and Avalanche [AVAX] surged materially over the past few days.

The high fees generated by GMX can have many implications.

Realistic or not, here’s GMX’s market cap in BTC’s terms

First, it indicates that the platform is experiencing higher trading volumes, potentially leading to increased revenue and liquidity. This can make the platform more attractive to users and investors, as it can provide greater opportunities for trading and profit.

GMX: Analyzing the metrics

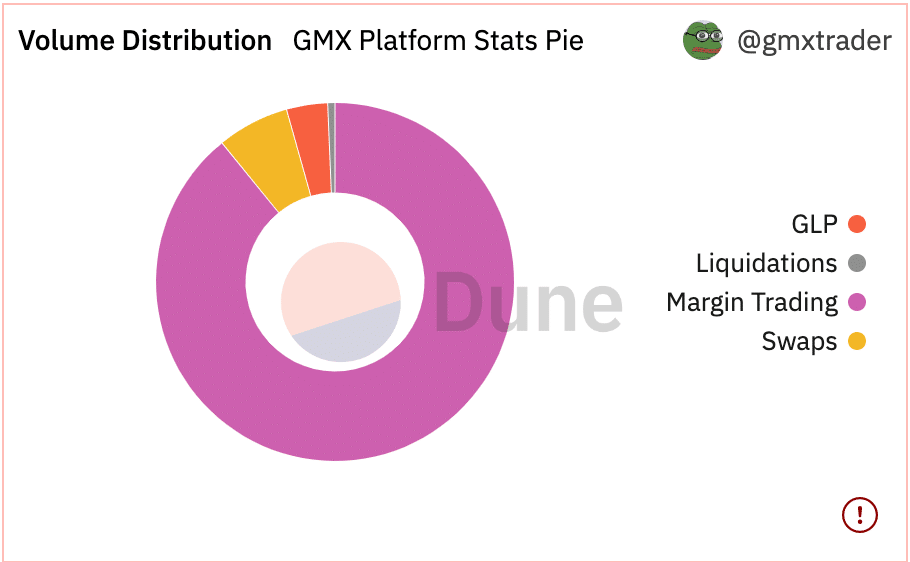

The GMX protocol’s high trading volumes can be attributed to several factors, such as liquidations, swaps, and margin trading. However, the largest contributor to the increased trading volumes is margin trading. Margin trading refers to a trading method where users can borrow funds from the platform to trade assets with leverage, allowing them to potentially increase their profits.

However, high margin trading can also increase the platform’s risk exposure. Margin trading involves borrowing funds to trade assets with leverage, which can result in significant losses if the trades do not perform as expected.

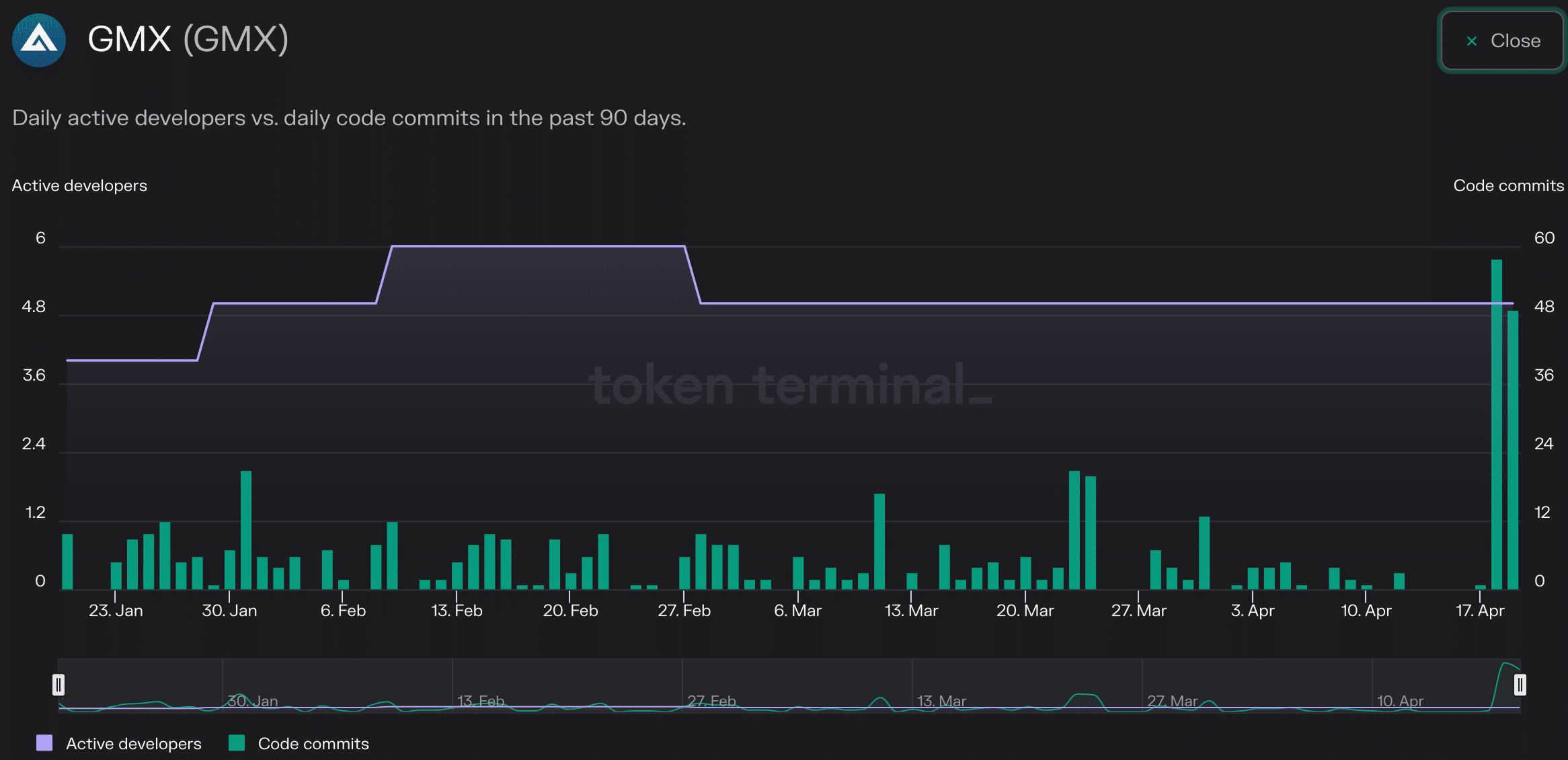

The GMX protocol is using the increased revenue generated by higher fees to improve its infrastructure. According to Token Terminal’s data, there has been a 25% increase in active developers and an 85.5% increase in code commits over the past few months. This suggests that the platform is investing in its development and improving its technology to meet user demand effectively.

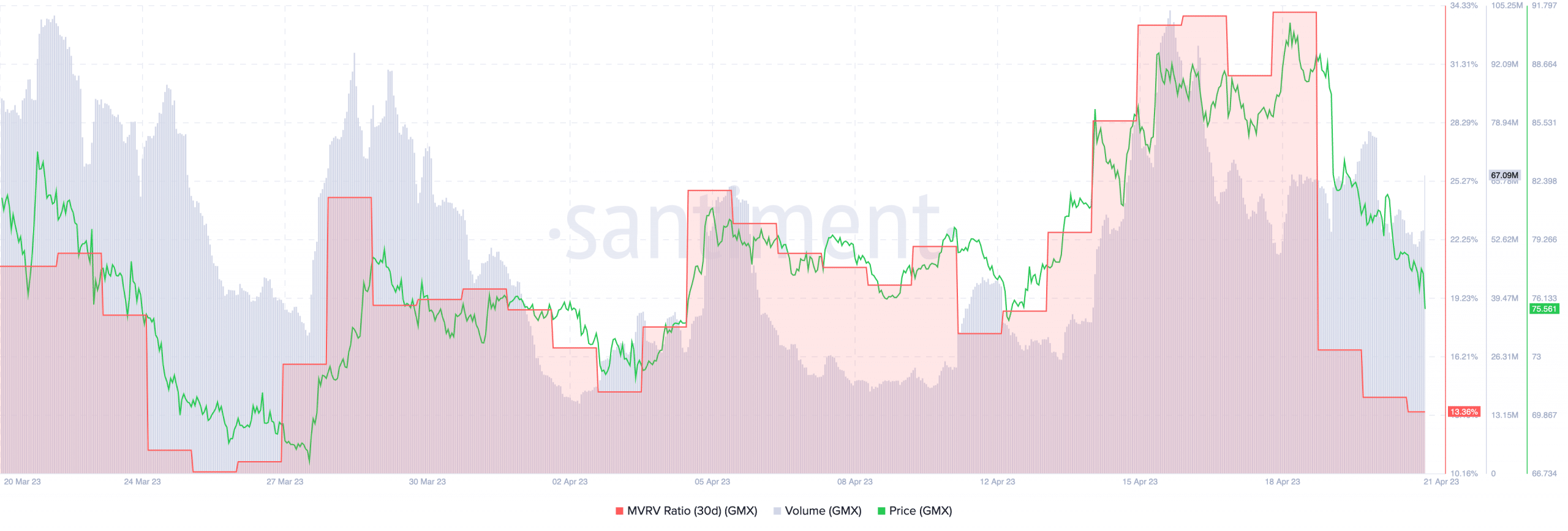

In contrast to the protocol, the token wasn’t doing as well. According to Santiment’s data, the price of GMX fell considerably over the past few days. Additionally, the volume of the token also declined during this period. However, the overall MVRV ratio remained positive, implying that there were addresses that still had an incentive to sell despite declining prices.