GMX’s growth in TVL is a matter of joy, but there’s a caveat

- GMX’s registered a year-to-date growth of 43% in its total value locked.

- The network growth fell considerably over the last month.

According to DeFiLlama, GMX whizzed past competition to become the top derivative exchange in terms of total value locked (TVL).

GMX’s year-to-date growth in TVL was promising as it jumped 43% to the press time value of $1.08 billion, surging well ahead of the second-placed dYdX.

TOP 10 Derivatives projects by TVLhttps://t.co/jjwF8aWrV9 pic.twitter.com/RWXckDq7JT

— DefiLlama.com (@DefiLlama) March 4, 2023

Is your portfolio green? Check the GMX Profit Calculator

TVL growth outpaces user growth

This implied that network activity was significantly less when compared to its TVL.

Another way of looking at this was the low Market Cap to TVL Ratio of GMX, which stood at 0.52, at the time of writing. This meant that the project was undervalued and there was scope for further investments.

GMX could go downhill?

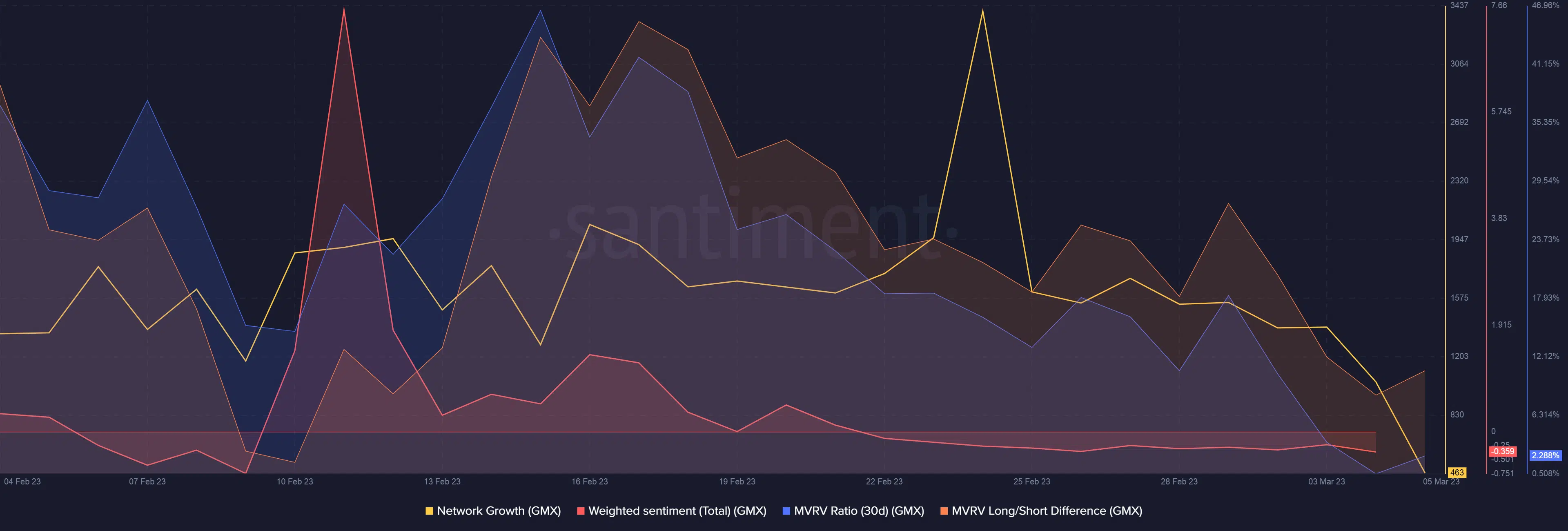

GMX’s network growth fell considerably over the last month, signaling that new addresses stayed away.

One reason could be the declining profitability of the network as revealed by the falling MVRV Ratio. The prospect of fewer returns on the holdings could have dissuaded new users from adopting GMX.

As a result of these factors, investors’ sentiment turned negative towards the latter part of February.

How much are 1,10,100 GMXs worth today?

At the time of writing, GMX was down 1.45% in the 24-hour period, as per CoinMarketCap. The price retreated more than 20% since hitting its all-time high of $84 on 18 February.

The Relative Strength Index (RSI) dropped steadily in the same time period and rested below neutral 50 at press time. The Moving Average Convergence Divergence (MACD) was in danger of slipping into a bearish zone.

The indicators suggested a bearish outlook for the coin. A dip below the indicated support level at $63 will validate this bias.