GMX’s network parameters get a new lease of life but problems could arise if…

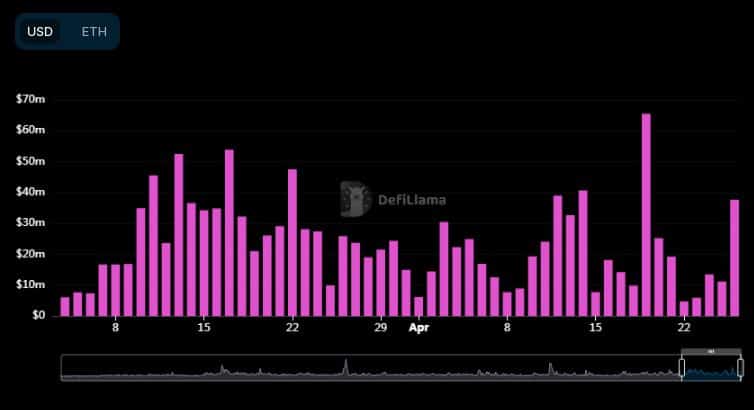

- GMX’s trading volume snapped a one-week declining trend to hit $37.67 million on 26 April.

- Owing to Bitcoin’s flash crash, GMX plunged to $70 for a brief period, but recovered to $73.29 at press time.

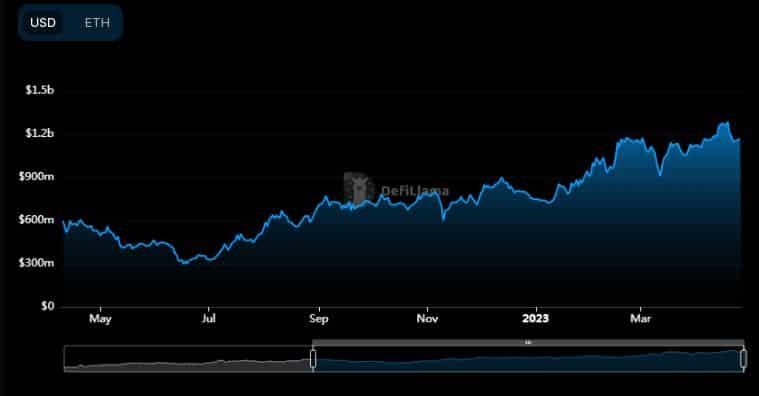

GMX has taken giant strides in 2023 to cement itself as the leading decentralized derivative exchange. On a year-to-date (YTD) basis, the total amount locked (TVL) on its smart contracts soared more than 50%, settling at $1.18 billion at press time, data from DeFiLlama showed.

Read GMX’s Price Prediction 2023-24

Infact, the protocol’s TVL reached an all-time high of $1.28 billion on 19 April. Moreover, GMX has contributed generously to the growth of Arbitrum [ARB], occupying more than 36% share of the layer-2 solution’s total TVL.

Network parameters record growth

The interest in the DeFi protocol could be due to its integration with Chainlink’s [LINK] low-latency oracles, the proposal for which was unanimously approved by the community members.

The new oracles will give traders access to real-time price data on GMX V2 by cutting down delays significantly. The solution will also help in cutting down transaction settlement time and mitigate front running.

The effect of this high-profile partnership was reflected in GMX’s trading volume which snapped a one-week declining trend to hit $37.67 million. This also marked a whopping 236% gain in the last 24 hours.

The sharp growth in volume was driven by an increase in transactional activity on the derivative exchange. The total number of transactions broke past 13k on 26 April. This represented a jump of 56% over the last 24 hours and over 36% over the last week.

Additionally, there was steady growth in the number of new users coming on to the platform over the last week, signifying growing adoption.

Incentive to sell GMX increases

Owing to Bitcoin’s [BTC] flash crash on Wednesday, GMX plunged to $70 for a brief period, but recovered to $73.29 at the time of writing, data from CoinMarketCap showed.

It should be noted that the token surged 9% following the approval of Chainlink’s proposal. Hence, there were high chances that token could recommence its upward momentum.

Realistic or not, here’s GMX market cap in BTC terms

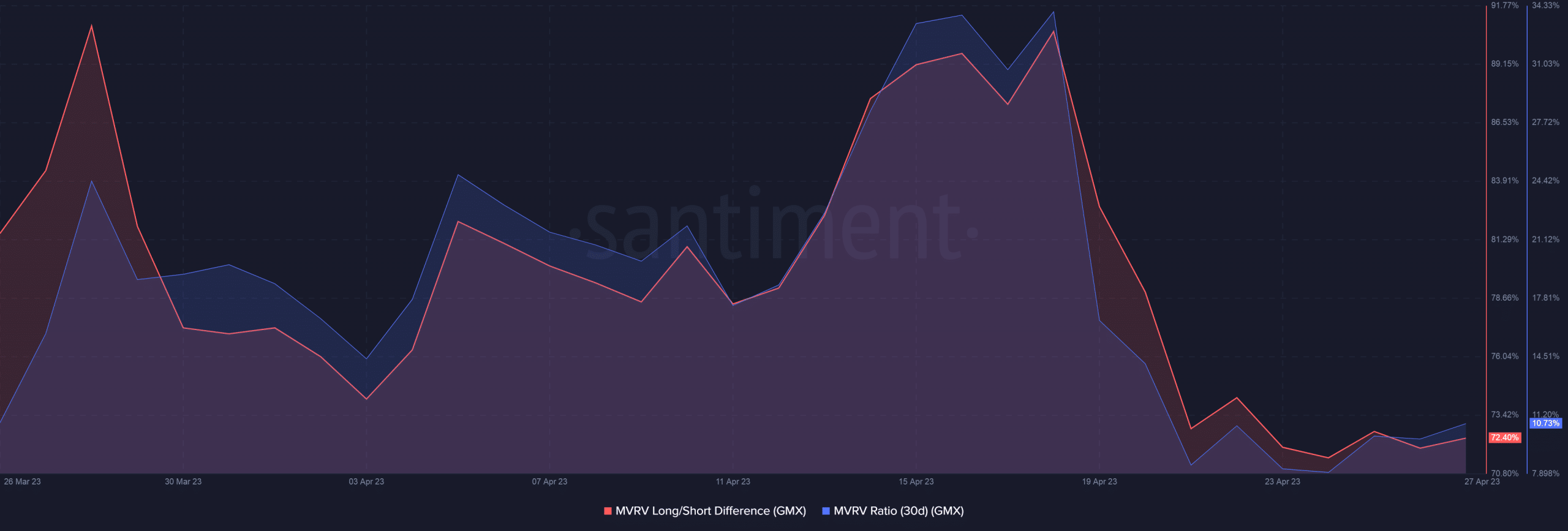

Data from Santiment further showed that GMX holders on average would realize high profits on their token sales as the MVRV Ratio was 10.73%. The positive value of the MVRV Long/Short Difference indicated that long-term holders would realize higher profits than short-term holders.

This meant that holders could dump their tokens in the near term which could adversely impact GMX’s price.

![Kaspa [KAS] on a long-term downtrend? Here's why it should worry investors!](https://ambcrypto.com/wp-content/uploads/2025/06/Kaspa-Featured-400x240.webp)