Analysis

Going short on Ethereum in 2023? Here’s what you need to know

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

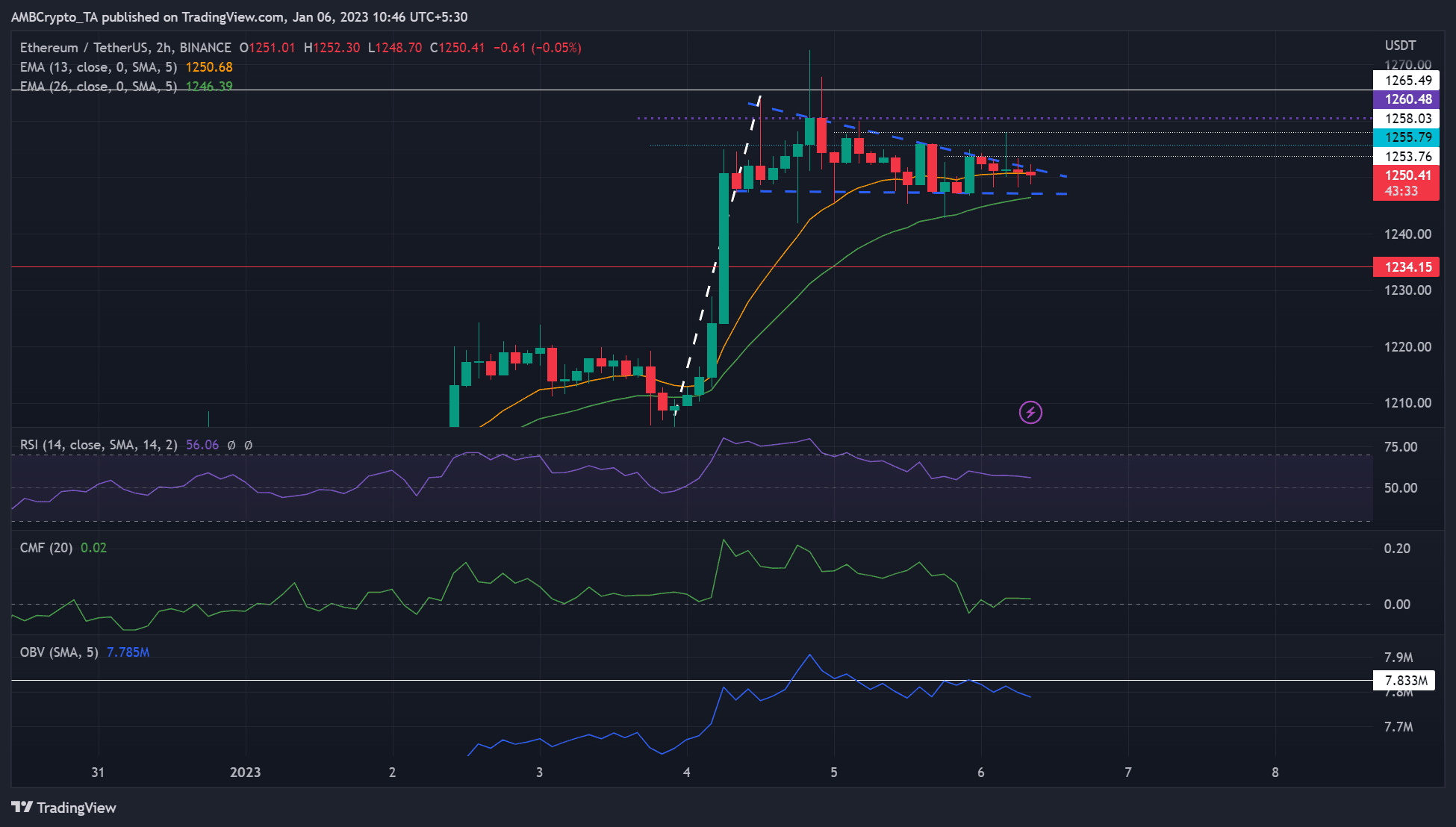

- ETH was in a short-term price correction.

- It could retest the $1,247 support or drop lower.

- A patterned breakout on the upside would invalidate the bias.

Bitcoin’s [BTC] attempt to break the $17K resistance on 4 January tipped Ethereum [ETH] to aim at the $1,300 mark. However, BTC faced rejection at $16.95K, blocking ETH’s rally at $1,270.

The price action for the past few hours formed a descending triangle pattern on the 2-hour chart alongside a flagpole that could be deemed an overall bullish pennant pattern.

However, investors should be cautious because technical indicators didn’t indicate bullish momentum in the next few hours.

Read Ethereum’s [ETH] Price Prediction 2023-24

A bullish pennant: Is an upside breakout likely?

A patterned breakout to the upside and associated gains were unlikely, as suggested by technical indicators.

In particular, the On Balance Volume (OBV) dipped, meaning buying pressure was limited. The RSI had also retreated gradually from the overbought zone and was near the midpoint, indicating buying pressure had eased.

Although the Chaikin Money Flow (CMF) crossed above the zero mark, it moved sideways and remained close to the neutral level. It showed buyers had the upper hand but not outstanding leverage to keep sellers in check.

Therefore, sellers could push ETH lower to retest $1,247 support or 26-period EMA of $1,246.39. However, a bearish BTC could push ETC even lower to a patterned breakout at the bearish target of $1,234.15.

But a convincing patterned breakout on the upside would invalidate the bias. Such an upswing will aim at the $1,265.49 target, but bulls must clear several obstacles.

Are your holdings flashing green? Check the

ETH Profit CalculatorETH saw increased demand in derivatives markets

Despite the price correction, ETH still recorded an increased demand in the derivatives markets, as indicated by a positive and elevated Binance Funding Rate for the ETH/USDT pair.

In addition, the daily active address remained relatively unchanged despite the dip in OBV seen on the 2-hour price chart.

Therefore, investors should monitor a convincing CMF break below the zero mark to confirm a further downtrend before entering any short positions. In addition, a bullish BTC would invalidate the bias and tip ETH for an uptrend; hence worth tracking too.