Grayscale ETHE outflows’ tapering will have THIS effect on Ethereum’s price

- World’s largest altcoin dropped below $3,000 on the back of negative market sentiment

- Receding outflows could be key now

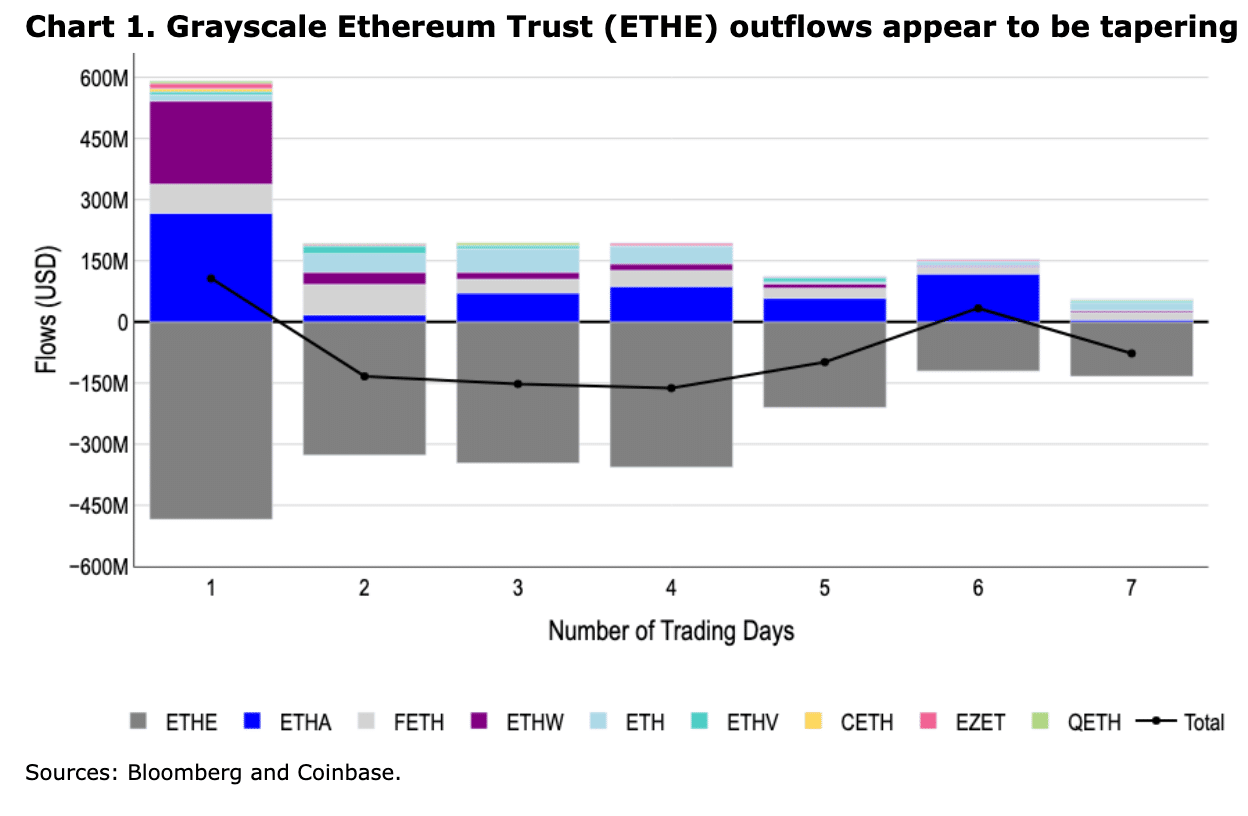

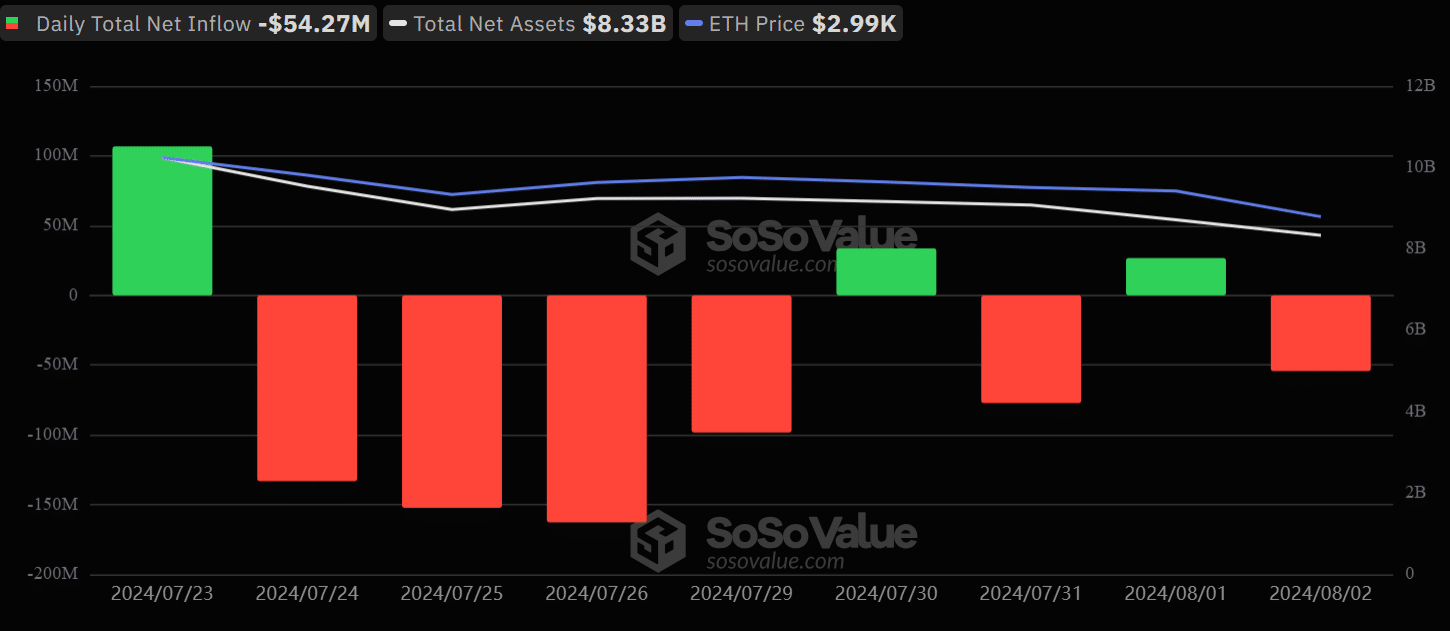

U.S spot Ethereum ETFs recorded a significant decline in outflows in the second week of trading, compared to its debut week. In the first week, the products saw net outflows of $341.3 million, exclusively driven by Grayscale’s bleeding from its ETHE and Mini Trust (ETH) products.

In particular, ETHE drove $1.5 billion in outflows in the first week of trading. However, the dumping declined in the second week – A sign that ETHE outflows could be ‘tapering,’ according to Coinbase analysts.

“Note that the ETHE outflows have been declining day-to-day, which reinforces our belief that these outflows have been front-loaded compared to what we saw with Grayscale Bitcoin Trust (GBTC) earlier in the year.”

Will tapering Grayscale outflows help ETH’s price?

For perspective, total Grayscale outflows in the first week were $1.94 billion—$1.5 billion from ETHE and a $448 million dump on Mini Trust (ETH).

In the second week, ETHE saw $603 million in outflows, while ETH shed $175.5 million. This meant that outflows dropped below $800 million in the second week. In short, the massive investor exodus from Grayscale eased as the second week rolled in.

In fact, Coinbase analysts had previously projected that Grayscale ETF outflows would ease by the second week, comparing their patterns to those of GBTC.

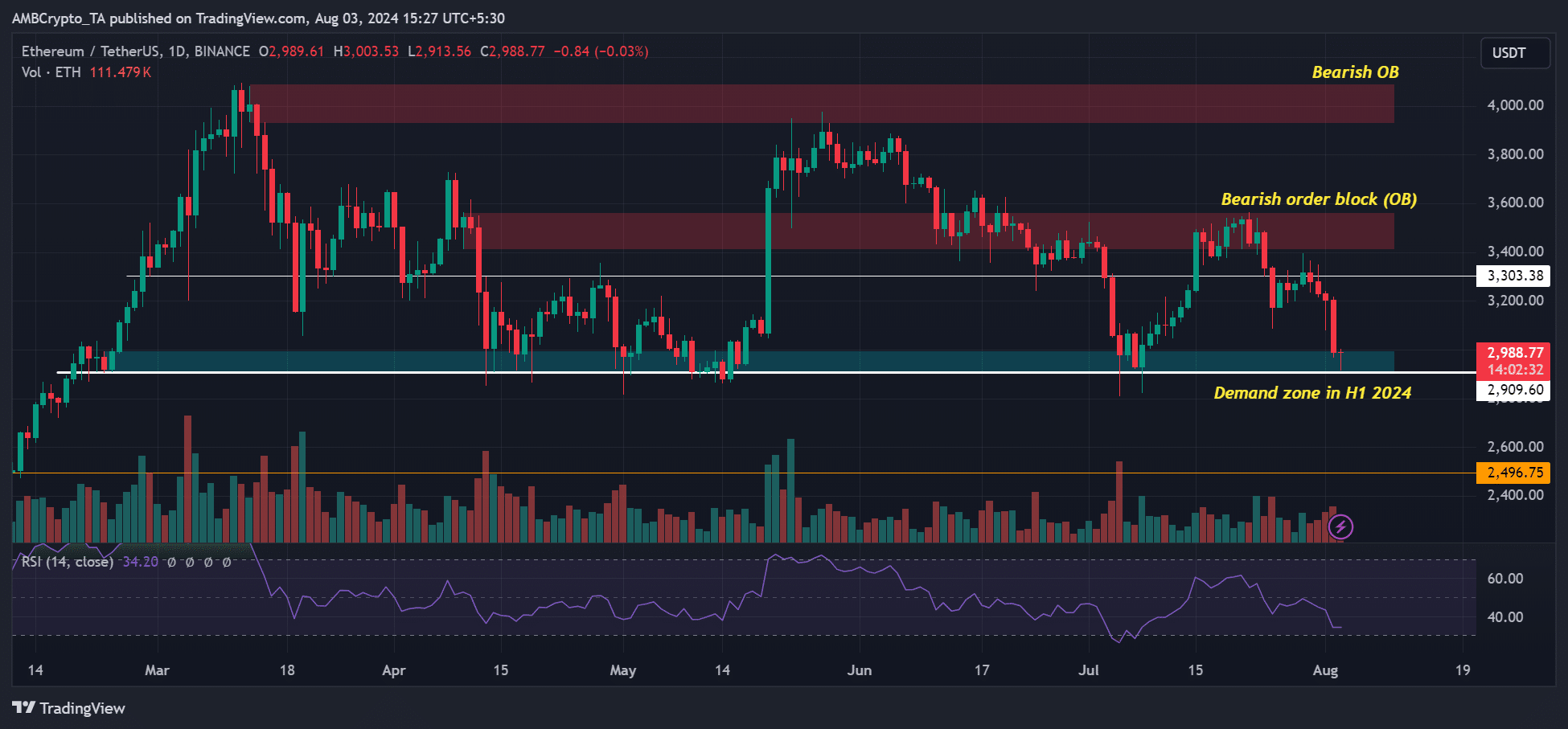

While this projection seems to be playing out right now, ETH’s price has remained muted amidst cautious investor sentiment across the U.S and Asian markets.

Excluding ETHE, the spot ETH ETF has seen over $1.5 billion, according to Farside Investors data. However, thanks to the market’s overwhelming negative sentiment, the altcoin’s price dropped below $3k.

At press time, ETH seemed to be re-testing $3,000 on the charts, a level which doubled as a crucial demand zone in 2024 for the fifth time. This has effectively reversed all its July gains.

Whether the tapering of Grayscale outflows will initiate a rebound at the demand level remains to be seen though.