Analysis

Hamster Kombat down 30.7% in a week – Is there hope for a recovery?

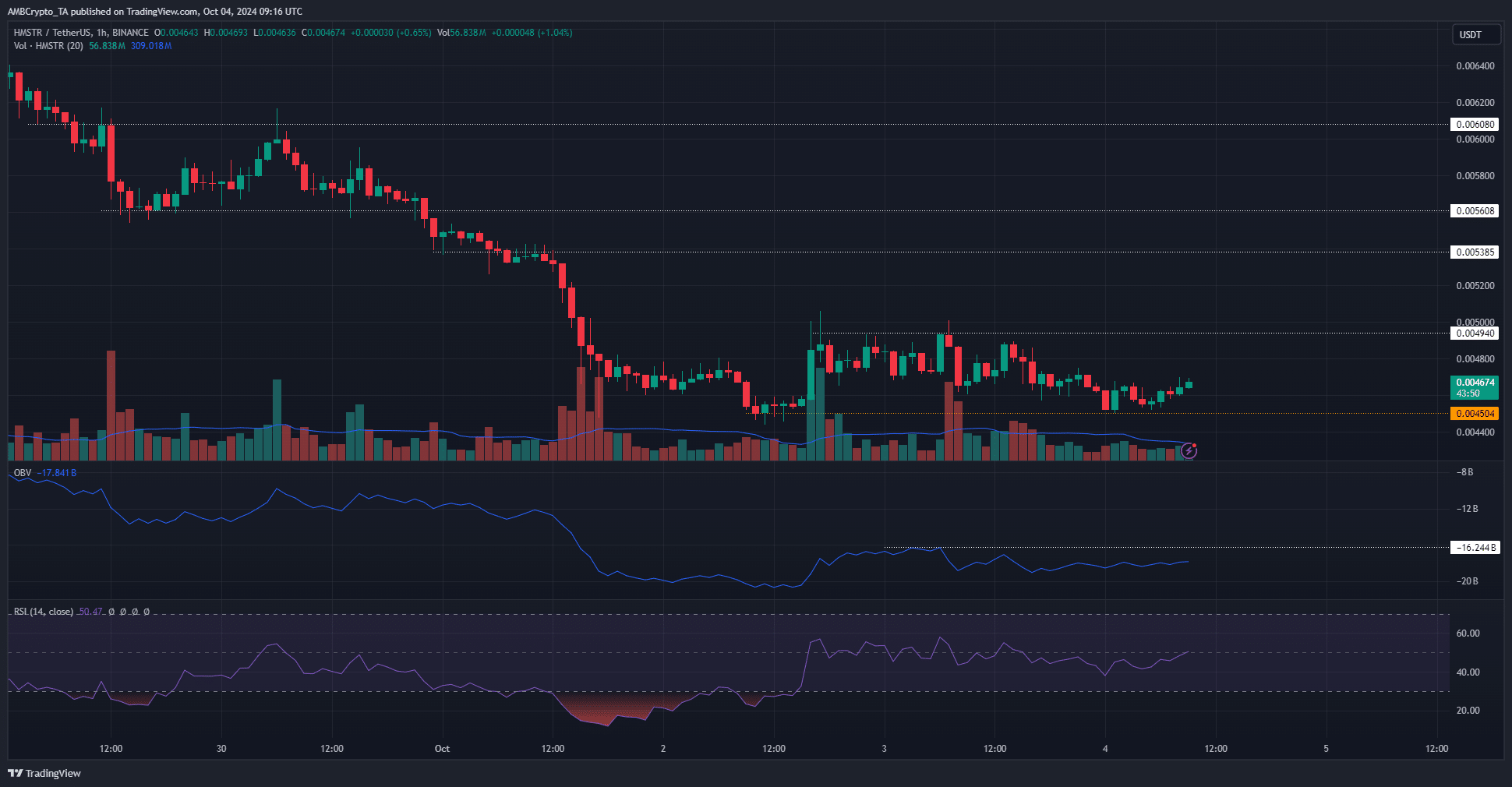

The steady decline in the spot demand meant that Hamster Kombat might struggle to defend the $0.0045 support.

- Hamster Kombat has neutral momentum and a bearish short-term structure.

- An influx of demand and a move above $0.0049 would be a buying opportunity targeting $0.0056.

Hamster Kombat [HMSTR] was in a downtrend on the lower timeframes. Since 28th September, the coin has depreciated by 30.7%. In the past 48 hours, the price has consolidated above the $0.004 support level.

The trading volume of the $300 million market cap token was below average over the previous trading day. This needed to change before a bullish reversal could be expected.

Bearish market structure and range formation

The price move below $0.0046 on Thursday flipped the hourly market structure bearishly. The trend of the past week was also bearish. The OBV was unable to break a local high. This would be the first strong signal that a move upward is likely.

The RSI meandered about the neutral 50 zone in the past two days, showing an indecisive market. A Bitcoin [BTC] turnaround from the $60k support zone could revitalize the altcoin market.

In turn, this could give HMSTR bulls the conviction to go long in larger numbers. A breakout past the $0.0049 and a retest would offer a buying opportunity targeting the series of lower highs Hamster Kombat posted over the past week.

Bullish speculation about Hamster increases

Source: Coinalyze

In the past 12 hours, the Open Interest rose from $44.7 million to $49.58 million. During this time, the HMSTR token tested the $0.0045 support level and bounced by 2%. The funding rate remained positive, showing that the speculation was likely bullish.

Realistic or not, here’s HMSTR’s market cap in BTC’s terms

On the other hand the spot CVD was in a steady decline. Hence, Hamster Kombat is more likely to range between $0.0045 and $0.00494 over the next few days.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion