Has Bitcoin become less risky than traditional finance assets?

- Bitcoin’s higher Sortino Ratio gave it an edge over traditional finance instruments.

- Bitcoin’s 30-day volatility plunged to 15.47%, half of what it used to be a year ago.

Winds of change were blowing in the crypto market as Bitcoin [BTC], once notorious for its high-risk factor, began to emerge as an appealing long-term investment tool.

Is your portfolio green? Check out the BTC Profit Calculator

Bitcoin becomes a reliable bet

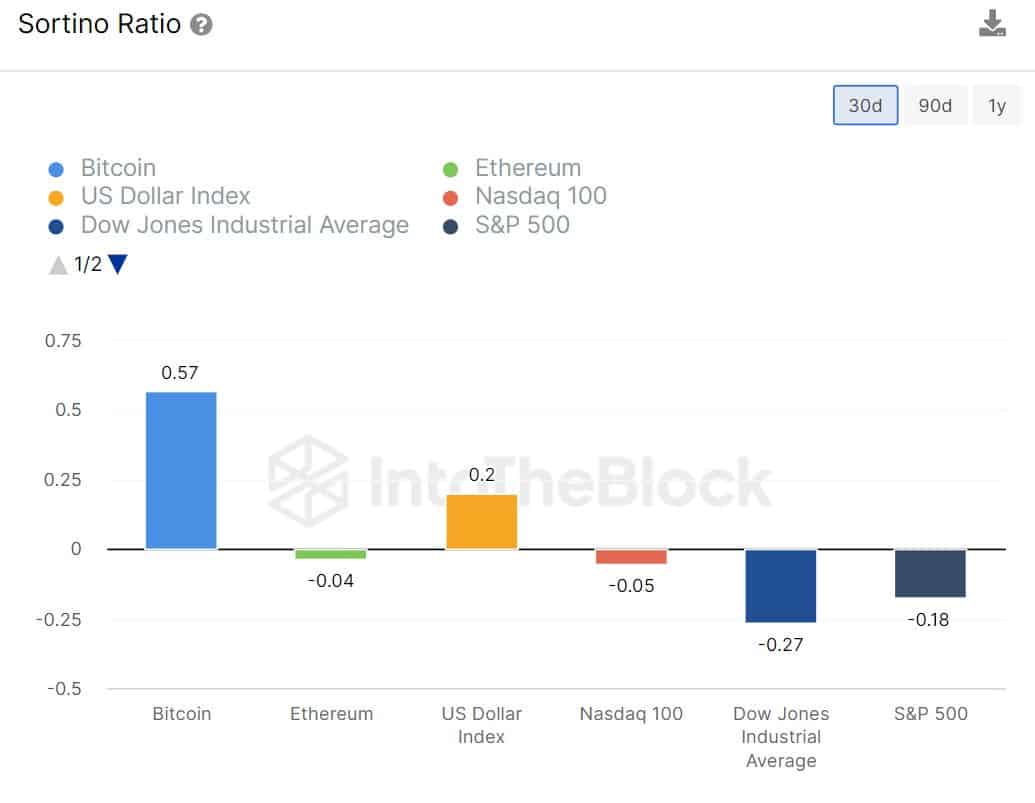

According to a post by on-chain analytics firm IntoTheBlock dated 11 October, the king coin had the highest Sortino Ratio when compared to mainstream financial instruments of the market.

Bitcoin’s value of 0.57 turned out to the best in the list which included major stock indices like the Nasdaq 1oo and S&P 500 and the U.S. Dollar Index (DXY)

The Sortino ratio measures the risk-adjusted return of an investment asset and is widely used metric in traditional finance. Put simply, it compares the performance of the asset relative to its downside risk.

Sortino ratio is used to evaluate investment portfolios with high volatility. The investor would prefer the one with the higher Sortino ratio because it means that the investment is earning more return per unit of the bad risk that it takes on.

Clearly, Bitcoin’s higher Sortino Ratio gave it an edge over traditional finance instruments. Moreover, many of these entities showed negative Sortino Ratios, suggesting that investors might not be rewarded at all for the risk taken with the investment.

Wild swings a thing of the past?

The sharp drop in potential risks with cryptos could be linked to the ongoing low volatility regime of the market. Barring intermittent bouts of high activity, Bitcoin remained subdued for the last two quarters.

As of this writing, Bitcoin’s 30-day volatility was 15.47%, half of what it used to be a year ago. Moreover, Bitcoin was less volatile than tech stocks, and nearer to other mainstream assets.

Read BTC’s Price Prediction 2023-24

Will ownership increase further?

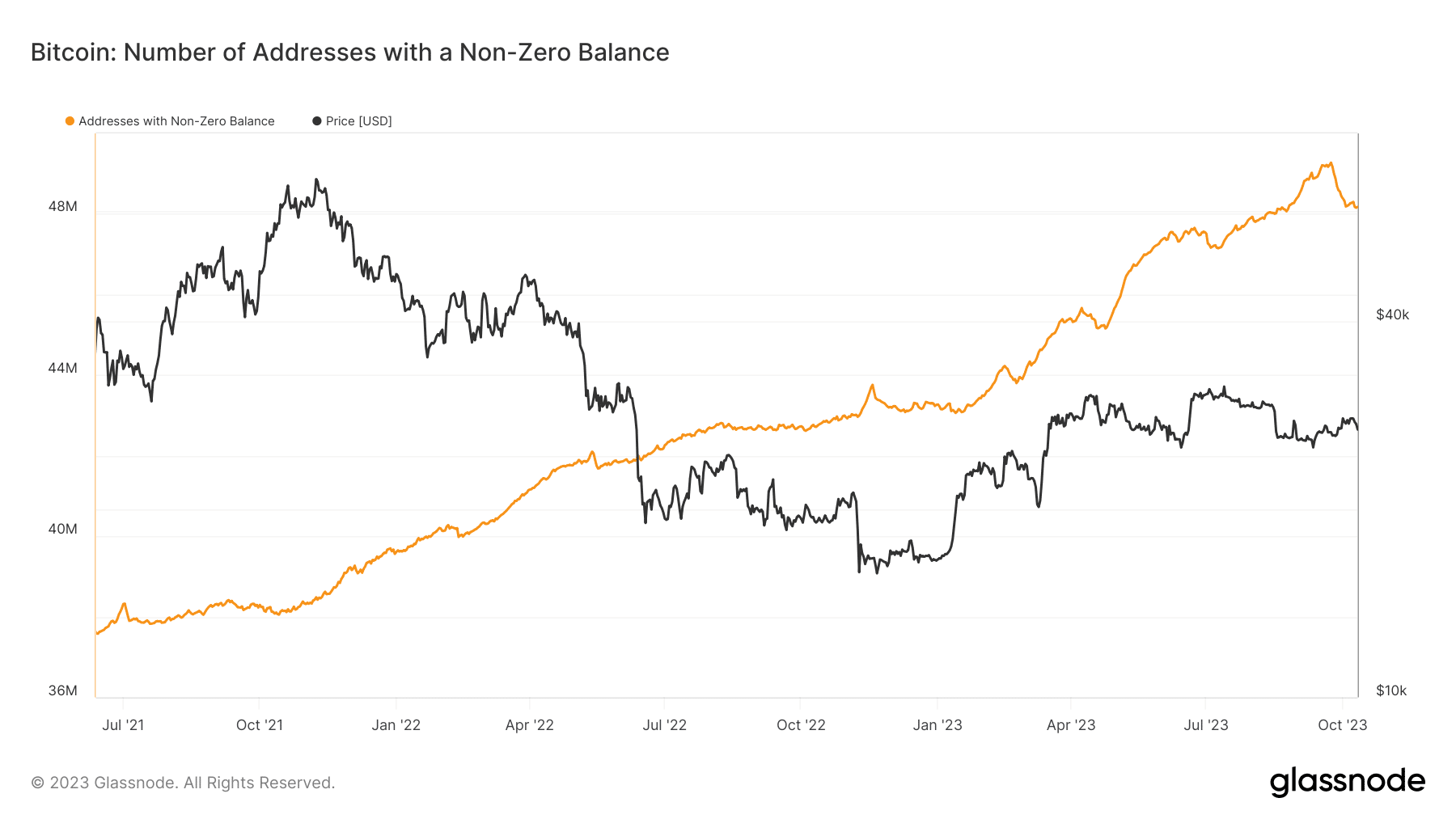

A higher risk-adjusted return boded well for the future adoption of the world’s largest cryptocurrency. After all, who doesn’t want to invest in risk-free assets?

This was also reflected in the growing ownership of Bitcoin. Despite the market downturn, wallets with non-zero balance proliferated, according to data from Glassnode.