Has the crypto community lost its faith in stablecoins

- USDC’s depegging was one of the biggest events of 2023, creating ripples in the broader ecosystem.

- Despite turbulences, USDT’s market share has grown on a YTD basis.

Over the years, stablecoins have proved to be a popular instrument in the Web3 space. By combining the benefits of cryptocurrencies while maintaining a stable value, they have emerged as the holy grail for new-age financial investors. This unique ability has cemented stablecoins as the primary way for traders on non-fiat crypto exchanges to enter and exit trades, thereby acting as a bridge between fiat and crypto ecosystems.

However, the utility of stablecoins lasts as long as they maintain their peg to the underlying asset, whether it is fiat currencies like the U.S. dollar (USD), or a crypto asset.

Unstable 2023

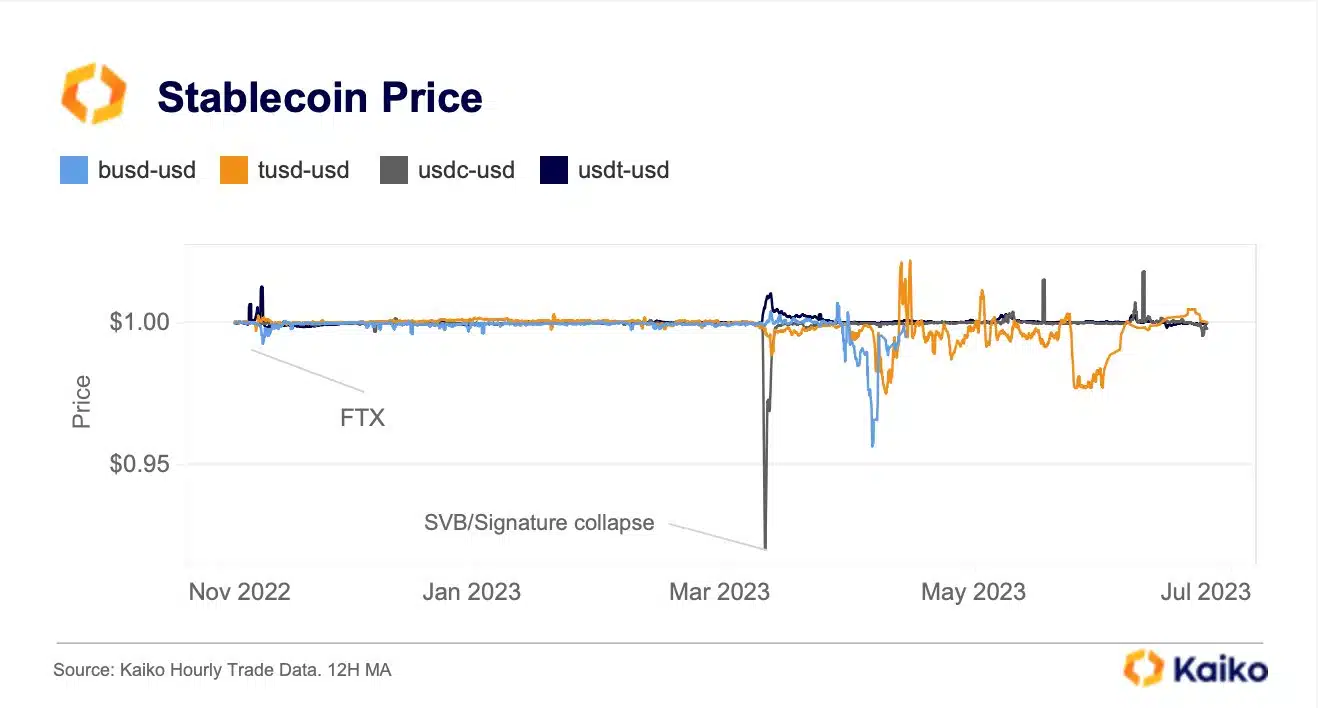

According to crypto market data provider Kaiko, stablecoin depegging events have increased considerably in 2023, with the contagion spreading through both collateralized and algorithmic stablecoins.

Source: Kaiko

Earlier in February, Binance-branded stablecoin Binance USD [BUSD] depegged from its dollar value. This was following orders by a New York based regulator to issuing company Paxos to halt minting of new tokens.

Then came the biggest depegging of 2023 thus far with USD Coin [USDC], the second-largest stablecoin by market cap, plunging to a discount of $0.9683 against the USD. The deviation was precipitated by issuer Circle’s disclosure that more than 8% of its reserves were trapped in the failed Silicon Valley Bank (SVB). The event caused mayhem in the market, causing a dent in investors’ portfolios.

In turn, crypto-collateralized algorithmic stablecoin DAI also lost its value because the majority of its collateral reserves were in USDC.

The latest such event which shook the market was the destabilization of the largest stablecoin Tether [USDT]. On 15 June, USDT suffered a slight depegging from USD triggered by imbalance on the Curve 3Pool, a liquidity pool regarded as a bellwether for investor sentiment regarding stablecoins.

While it was too early to evaluate the long-term impact on mainstream adoption, these frequent occurrences have started to cast aspersions on the stability and trustworthiness of stablecoins. Because it begs the question: What’s the point of stablecoins if they would struggle to retain their fundamentals of stability and low volatility?

USDT maintains the shine

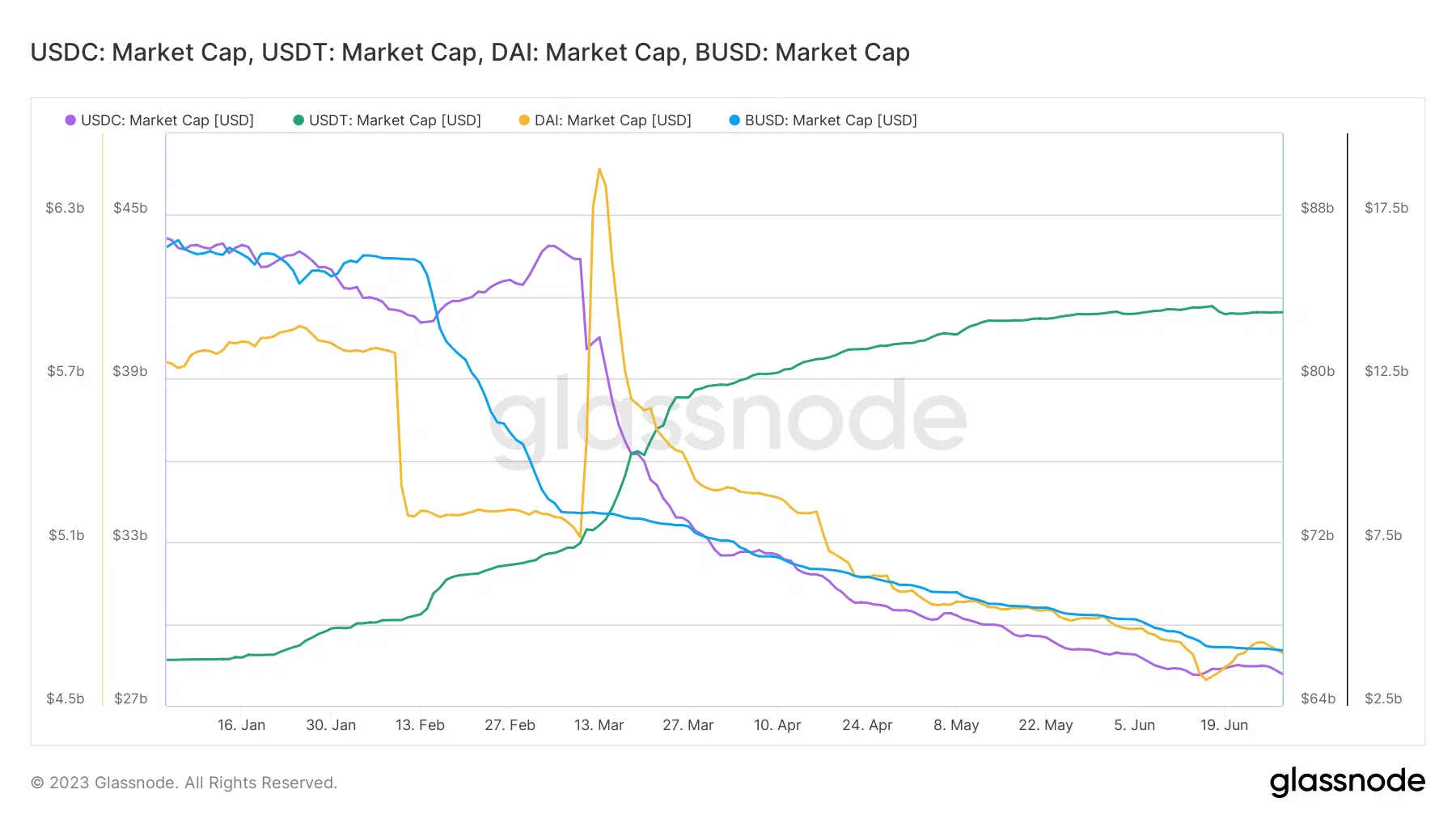

As discussed earlier, all top stablecoins underwent depegging over the past few months. However, despite some hiccups here and there, USDT managed to grow remarkably since the start of the year. Its market cap has jumped 25% on a year-to-date (YTD) basis and held a 64% market dominance, as per Glassnode.

USDT’s relevance could also be evaluated by its growing demand as a safe-haven asset in countries going through political and financial strife.

In stark contrast, other stablecoins like USDC, BUSD and DAI have succumbed to the factors at play, losing billions of their market cap since the beginning of 2023.