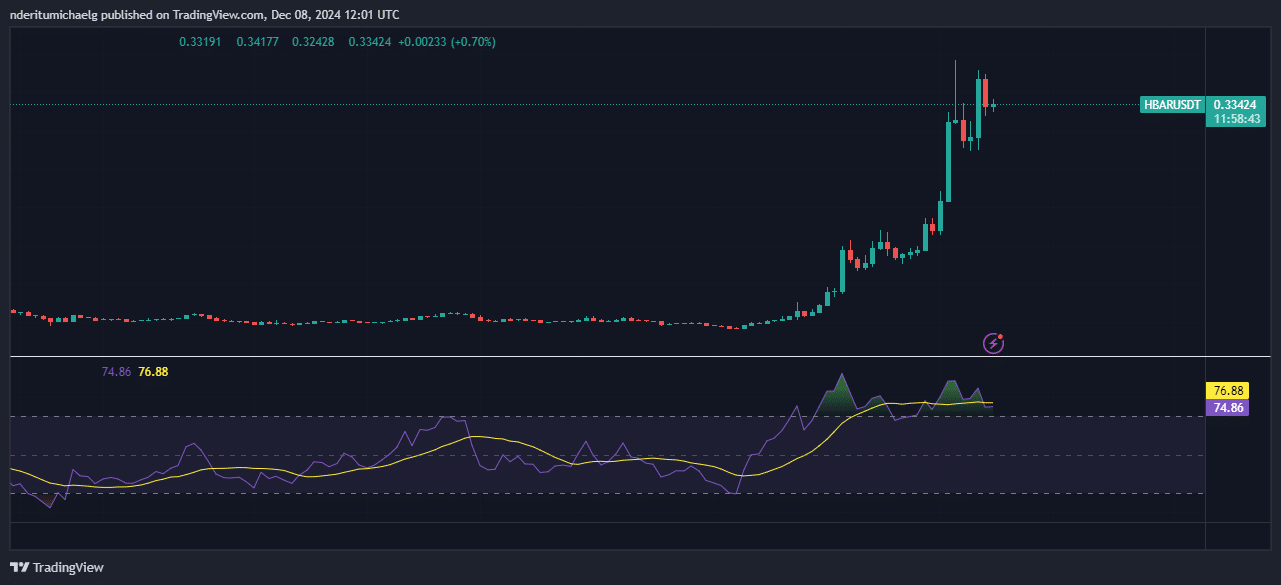

HBAR kicks off December with a 136% gain, hits new ATH – What now?

- HBAR concludes first week of December with an impressive run including a new ATH.

- Demand cools off potentially paving the way for profit-taking.

Hedera’s native cryptocurrency HBAR has been building on the bullish momentum that it achieved in November. It just concluded one of its most bullish weeks, earning a spot in the list of top gainers in the last seven days.

HBAR traded as low as $0.164 and achieved a weekly high of $0.392. This means the price went up by 136% from its weekly bottom to weekly top. The recent rally extended its gains to 831% from its current 2024 low in November.

This underscores an impressive recovery in less than 6 weeks. It closed the week at $0.33.

The cryptocurrency’s weekly rally also pushed the price to a new all-time high. HBAR was oversold at the time of writing, and some sell pressure had already manifested. A sign that traders who bought at recent lows have been taking profits.

Is HBAR experiencing a sell pressure build-up?

The bullish momentum was initially supported by a surge in spot demand. The latter peaked at $48.22 million on 2nd December, and has since cooled down.

The same spot market metric revealed that $8.62 million worth of outflows occurred in the last 24 hours, revealing a build-up of sell pressure.

Open interest has also been building up during the week. It peaked at $459.87 million on Saturday, marking a new all-time high.

Funding rates were still positive at the time of observation. A sign that demand was still outweighing any potential sell pressure building up in the derivatives segment. A surge in negative funding rates would signal strong incoming sell pressure.

Hedera on-chain stats indicate that the momentum is slowing

HBAR could be due for more downside as the bullish momentum slows down. This was evident by the decline in on-chai volumes from its peak on 3rd December.

Volume peaked at $67.59 million on that day, which was also the highest recorded on-chain volume that the Hedera network has ever achieved.

Hedera’s volume has since declined to a third of its peak. TVL also peaked on 3rd December at $211.86 million. It has since dropped to $196.65 million, although this recent peak was courtesy of HBAR price gains.

Is your portfolio green? Check out the HBAR Profit Calculator

In HBAR terms, the TVL has been declining since mid-November from 1.06 billion HBAR as of 16th November to 594.67 HBAR as of 8th December.

The sharp TVL decline could point to lower confidence or profit-taking as prices went up. It may not necessarily inspire confidence among investors but HBAR could still continue rallying if demand makes a comeback.