Analysis

HBAR makes a move below $0.0520 — Should traders short it?

HBAR’s possible range-bound extension could present another shorting opportunity. Where will HBAR go next?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- HBAR was unable to exceed the resistance zone at $0.0520.

- The Open Interest has declined apart from a spike on 15 September.

Hedera [HBAR] recovery was blocked at $0.0520, setting the altcoin into a narrow short-range formation. So far, short-sellers have been targeting the $0.0520 resistance zone for re-entries. At the time of writing, Bitcoin [BTC] was below $27k, and a subsequent crack of $26.4k support could tip sellers to extend gains.

Is your portfolio green? Check out the HBAR Profit Calculator

Can sellers benefit from $0.0520 again?

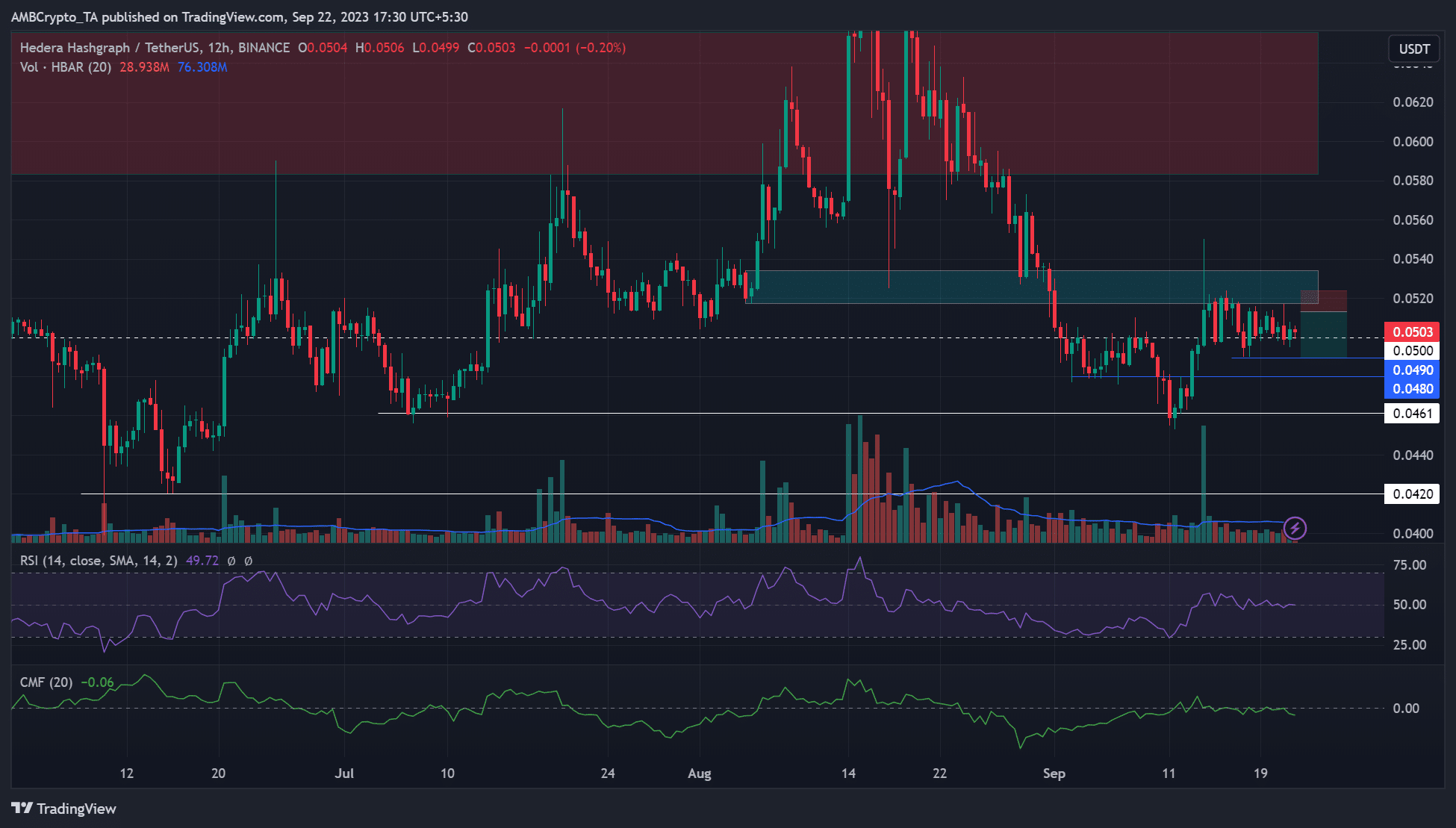

Despite reversing September losses, HBAR had not clawed back part of the August losses at press time. The recent recovery was blocked at the $0.052 – $0.53 resistance zone (cyan).

The resistance zone was a daily bullish order block but was invalidated after the extended drop in August. Since 15 September, HBAR’s price action has faced several price rejections at the roadblock.

With a possible extension of BTC reversal to the range-low, HBAR could witness another price rejection at roadblock. If so, the roadblock could be a short re-entry position with take-profit targets at $0.050 or $0.0490.

A move beyond $0.0525 will invalidate the short set-up. In such a case, a convincing candlestick session close above the $0.052 – $0.53 resistance zone could set HBAR for $0.0560 or $0.060 levels.

Meanwhile, the Relative Strength Index (RSI) fluctuated around the 50-median mark in the past few days. This indicated that buying and selling pressure was almost equal.

Similarly, the Chaikin Money Flow (CMF) fluctuated around its equilibrium level but retreated to the negative at press time. Thus, indicating a shift from stagnant capital inflows to outflows.

Open Interest rates declined

The Futures market also recorded fluctuations. For example, the Open Interest (OI) rates declined in the first half of September but spiked on 15 September, extending the decline afterward. It shows that demand fell over the same period apart from a spike on 15 September.

How much are 1,10,100 HBARs worth today?

Apart from the negative Open Interest rates, the Futures market volume was down 38% at press time. It further cements a bearish inclination.