HBAR’s price stands at the mercy of these recent developments. Assessing…

- HBAR demonstrates bullish resilience after maintaining an overall trajectory since June.

- Additionally, HBAR may witness a delayed impact of FedNow’s decision.

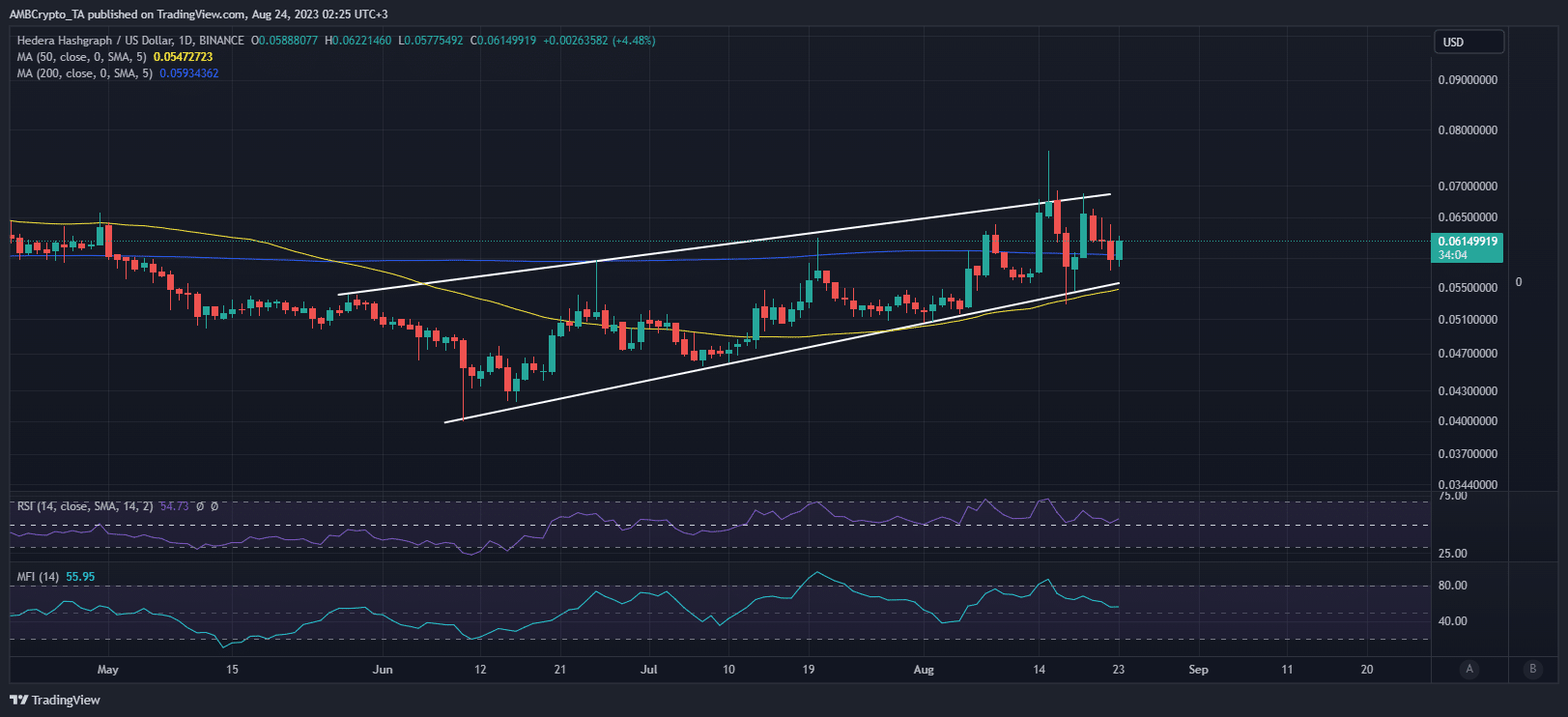

Hedera’s native cryptocurrency HBAR has so far managed to maintain an overall bullish sentiment despite recent market headwinds. The cryptocurrency has been trading within a range-bound ascending pattern underpinned by support and resistance.

Is your portfolio green? Check out the Hedera Profit Calculator

At press time, HBAR was about to wind up the third consecutive month of the aforementioned ascending pattern. Its ability to sustain this trend was called into question after the recent developments. The altcoin recently attempted a bullish breakout in mid-August before returning to the same range.

The short-lived breakout and the subsequent return to the range can be interpreted as a sign of weak bullish momentum. HBAR’s price was also shot down from its recent peak after encountering a resistance level last tested in April. HBAR exchanged hands at $0.061 at the time of writing.

Source: TradingView

HBAR’s Money Flow Index (MFI) has been declining since mid-August which was around the same time that the price peaked. If these outflows persist, then HBAR could be headed for a support retest near the $0.055 price level.

The cryptocurrency’s weighted sentiment has been cooling down after its mid-month spikes in line with the recent pullback.

Additionally, Hedera’s development activity metric has also slowed down considerably in the last few days. These findings could further weaken the market consensus, making it easier for a capitulation event to knock HBAR off its range.

Will FedNow offer price validation for HBAR?

Recent events especially involving FedNow-related announcements might have contributed to a confidence boost among HBAR traders. However, the falling sentiment metrics reflected a weak market reaction which was more in tune with concerns of an extended selloff.

The FedNow announcement is an important milestone for the company. It also happens to be the kind of event that could allow a flood of liquidity to flow through the Hedera blockchain. So, why aren’t prices in a parabolic rally?

Read about Hedera’s price prediction for 2023/2024

RBillions worth of liquidity will not flow into Hedera immediately. Hedera’s co-founder Mance Harmon stated that it will take some time before the FedNow achieves mass adoption.

? @hedera Co-Founder @ManceHarmon discusses what value their partner @droppcc provides to #FedNow. #HBAR

Full: https://t.co/REKrtaPD53 pic.twitter.com/Ldf0yyDetV

— Nebuchadnezzar ☀️⚡️ (@lIllIlllIIIll) August 23, 2023

Despite his statement, Harmond anticipates robust utility when merchants jump on board. The subsequent adoption could trickle into demand for the HBAR cryptocurrency.

In other words, the recent development could underpin HBAR’s long-term potential. The long-term trend already showed signs of a pivot as seen in the 200-day moving average. Nevertheless, the cryptocurrency’s price action remains at the mercy of short-term headwinds.