Hedera [HBAR]: A likely patterned breakout could offer 7% gains if BTC…

![Hedera [HBAR]: A likely patterned breakout could offer 7% gains if BTC...](https://ambcrypto.com/wp-content/uploads/2023/01/diego-jimenez-A-NVHPka9Rk-unsplash-e1673171440600.jpg)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

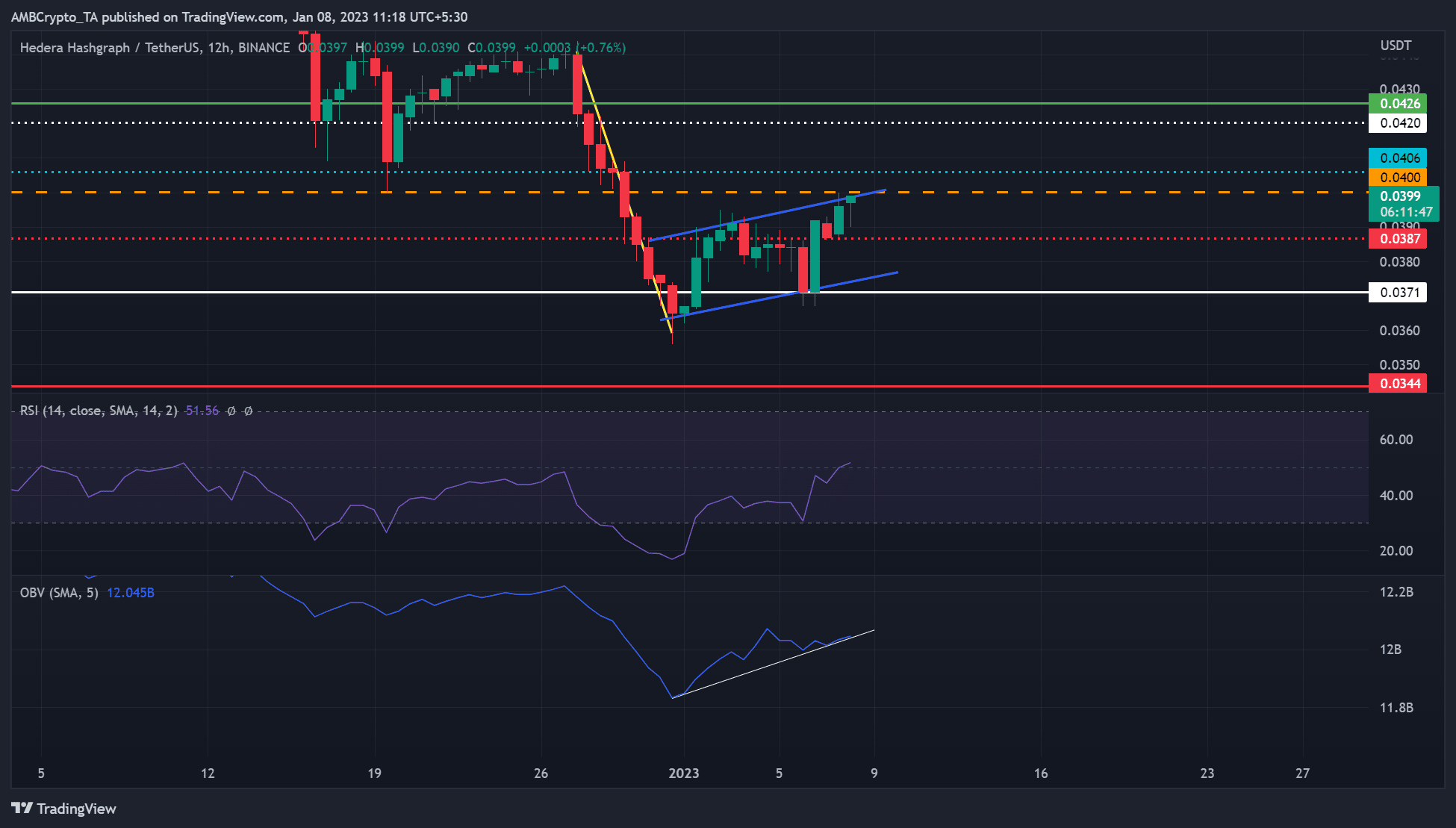

- HBAR was in a neutral market position.

- A patterned breakout to the upside could target $0.0426.

- A break below $0.0387 would give the bears more leverage.

Hedera [HBAR] posted an impressive rally over the past seven days. At press time, it was trading at $0.0399 and seemed eager to break above $0.0400.

The crossing could happen if BTC rises above $16,945. At press time, BTC faced rejection at the abovementioned level, which could make another HBAR move difficult.

However, the technical indicators on the 12-hour chart said otherwise.

Read Hedera [HBAR] Price Prediction 2023-24

Is a patterned breakout likely?

HBAR has risen from $0.0365 to $0.0400, up about 10% in the last seven days.

The Relative Strength Index (RSI) rose from oversold territory and was slightly above the midpoint of 50 units. The On-Balance Volume (OBV) also recorded higher lows since the beginning of the year. This shows that buying pressure increased with rising trading volume.

If trading volumes increase, the bulls could bring about a patterned breakout with a target of $0.0426. However, there are still some obstacles to overcome along the way.

Alternatively, HBAR could pull back if RSI is rejected around the midpoint. A few rejections around the midpoint in the past led to a price reversal, and a similar trend could cause HBAR to a correction. A declining BTC could accelerate the price reversal.

Such a downside move could force HBAR to retest or break support at $0.0387, invalidating the bullish bias described above. Moreover, HBAR has formed a bearish flag pattern that could target $0.0344 on an extreme downside breakout.

Are your holdings flashing green? Check the HBAR Profit Calculator

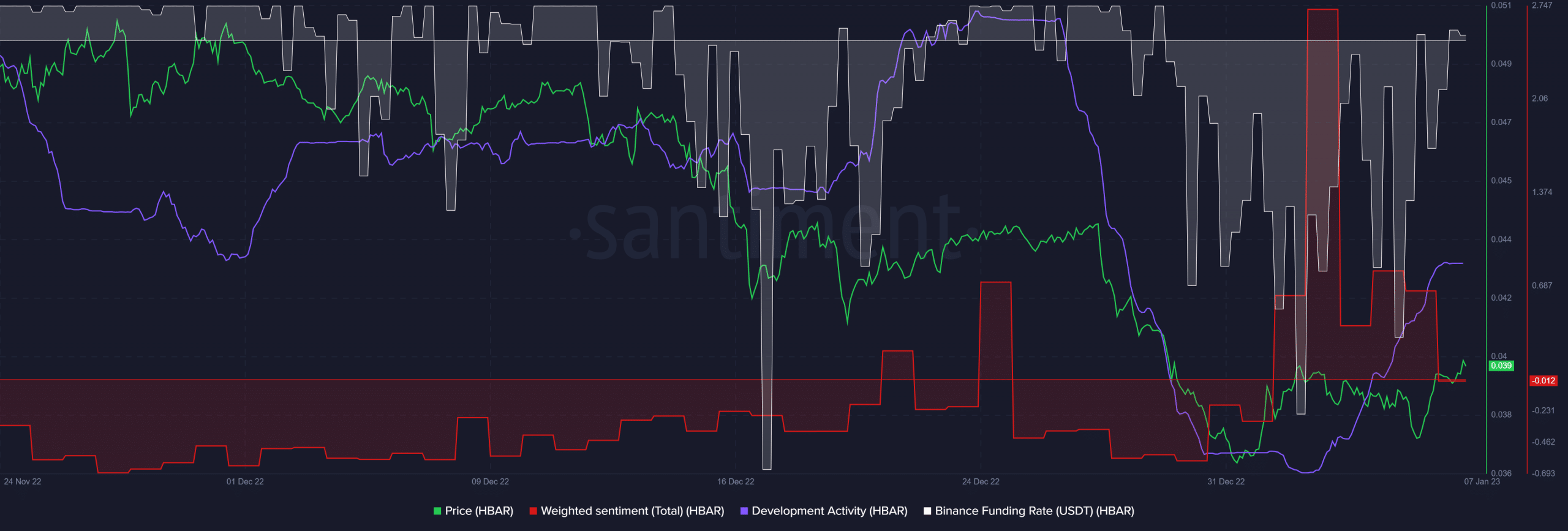

HBAR saw a massive development activity in the past week, but …

According to Santiment, HBAR’s price consistently followed development activity. Development activity increased steadily last week, boosting investor confidence in the network, as reflected in the improved weighted sentiment over the same period.

In addition, demand for HBAR in the derivatives market improved as the Binance Funding Rate for the HBAR/USDT pair improved over the same period.

However, sentiment and the Binance Funding Rate were neutral at press time, while development activity was stagnant. Investors should therefore rely on BTC for HBAR’s next price direction.