Hedera skips scheduled quarterly update, what’s next for HBAR?

- A look at what is happening on the development side of the Hedera network.

- HBAR bears slow down but low volume may hinder the bulls’ recovery attempts.

The crypto market just concluded an overall bearish week, during which HBAR experienced a significant downside. But the question is- How has the Hedera network faired in the last few days?

Is your portfolio green? Check out the Hedera Profit Calculator

The Hedera blockchain was scheduled for a quarterly testnet update on 27 April. This means the upgrade would have taken place sometime in the next few days.

However, the network recently announced that the update will not happen as planned. The decision is not expected to have much of an impact on the network.

1/ The quarterly Hedera testnet reset that was scheduled for Thursday April 27th, 2023 will be skipped. No action needs to be taken as a result of this decision. See below for more details.

— Hedera (@hedera) April 22, 2023

The decision will reportedly give developers more time to make changes to Hedera Smart Contract Service’s previous changes. Those changes were introduced in v0.35.2 of the Hedera service release.

The next update is scheduled for 9 May and it will be a mainnet update.

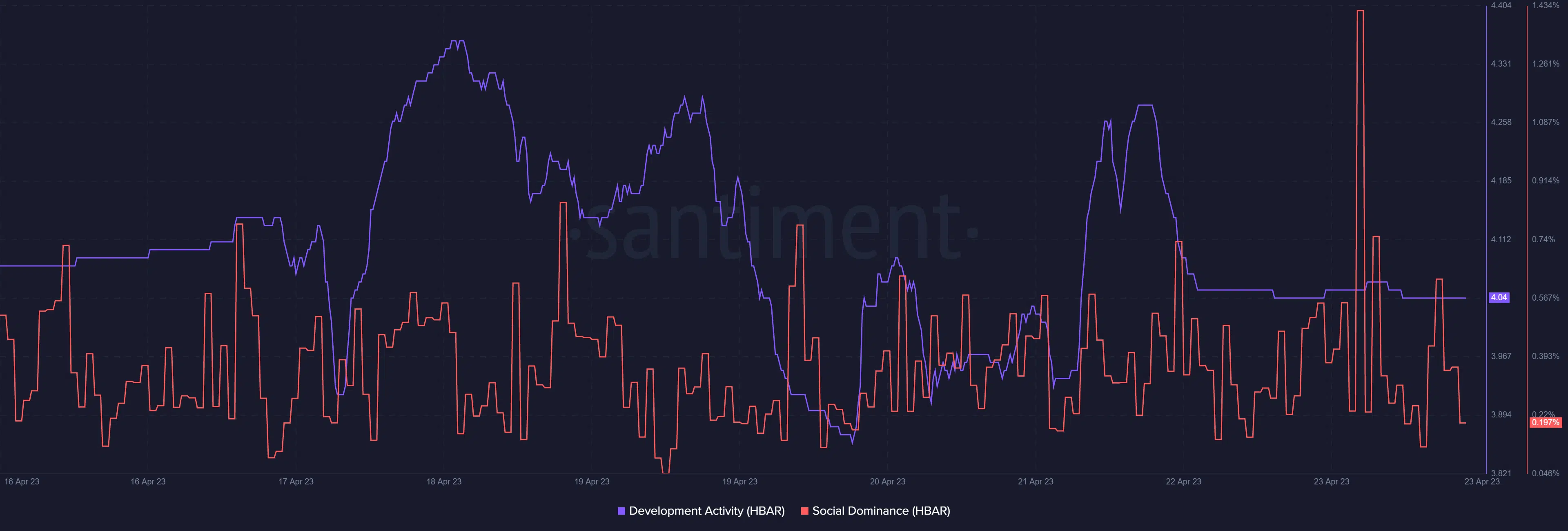

HBAR maintained a significant amount of development activity in the last few days. While all was calm on the development front, the network dominance just registered a noteworthy spike to its highest weekly level.

The spike might be related to a shift in HBAR’s demand dynamics especially in the derivatives segment. This is because the network dominance metric spike was accompanied by a spike in the Binance funding rate in the last 48 hours, at the time of writing.

This confirms a noteworthy HBAR demand uptick in the derivatives market.

Will HBAR bulls secure this opportunity?

The spike was also observed in HBAR’s price action which registered some consolidation at the $0.059 price level just above the 200-day MA.

The same price level demonstrated support in March. HBAR exchanged hands at $0.060, at the time of writing.

How many are 1,10,100 HBARs worth today?

HBAR’s MFI indicates that the bears are on a bit of a recess after the weekly selloff that took place last week. Some upside in the same metric in the last two days might be a sign that accumulation is taking place.

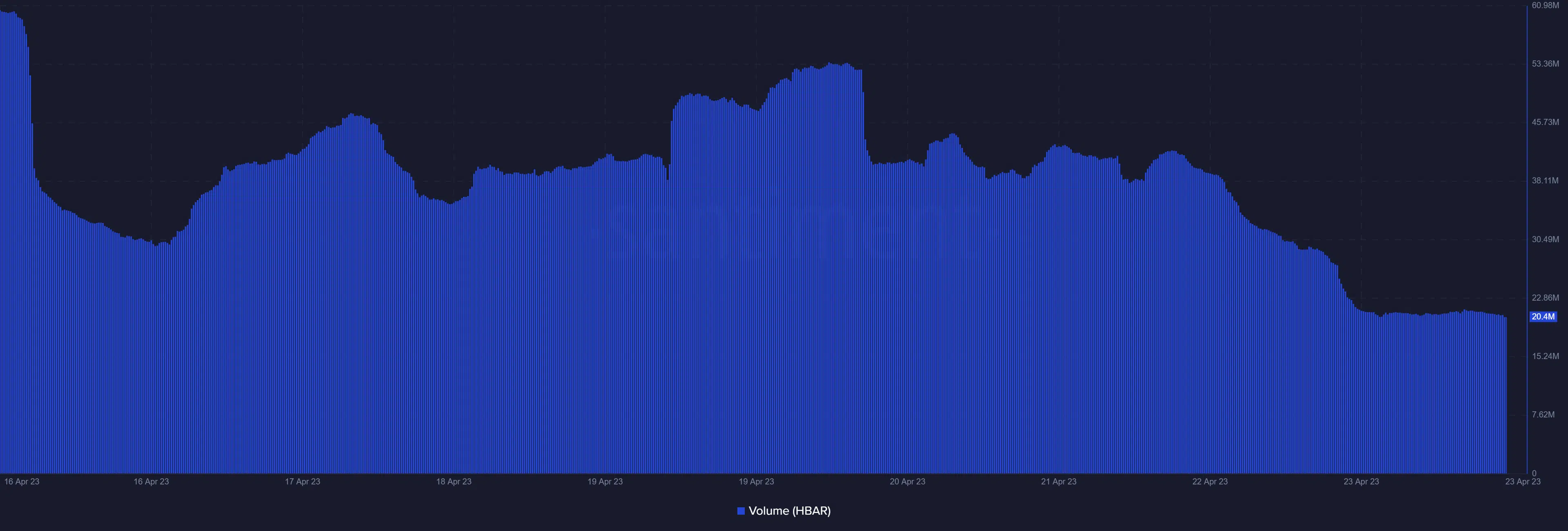

However, daily volumes remain low which reflects the lack of enough bullish momentum for a sizable rally.

Low bullish volume may indicate that investors are not yet confident about HBAR’s prospects in the next day.

In other words, the bears might have another chance at dominance if the market conditions allow.

However, there is still a chance that the market may enter a recovery phase, in which HBAR bulls might get a chance to bounce back.