Hedera turns bearish: Can HBAR overcome its 90% drawdown?

- Hedera price in decline despite the looming institutional interests.

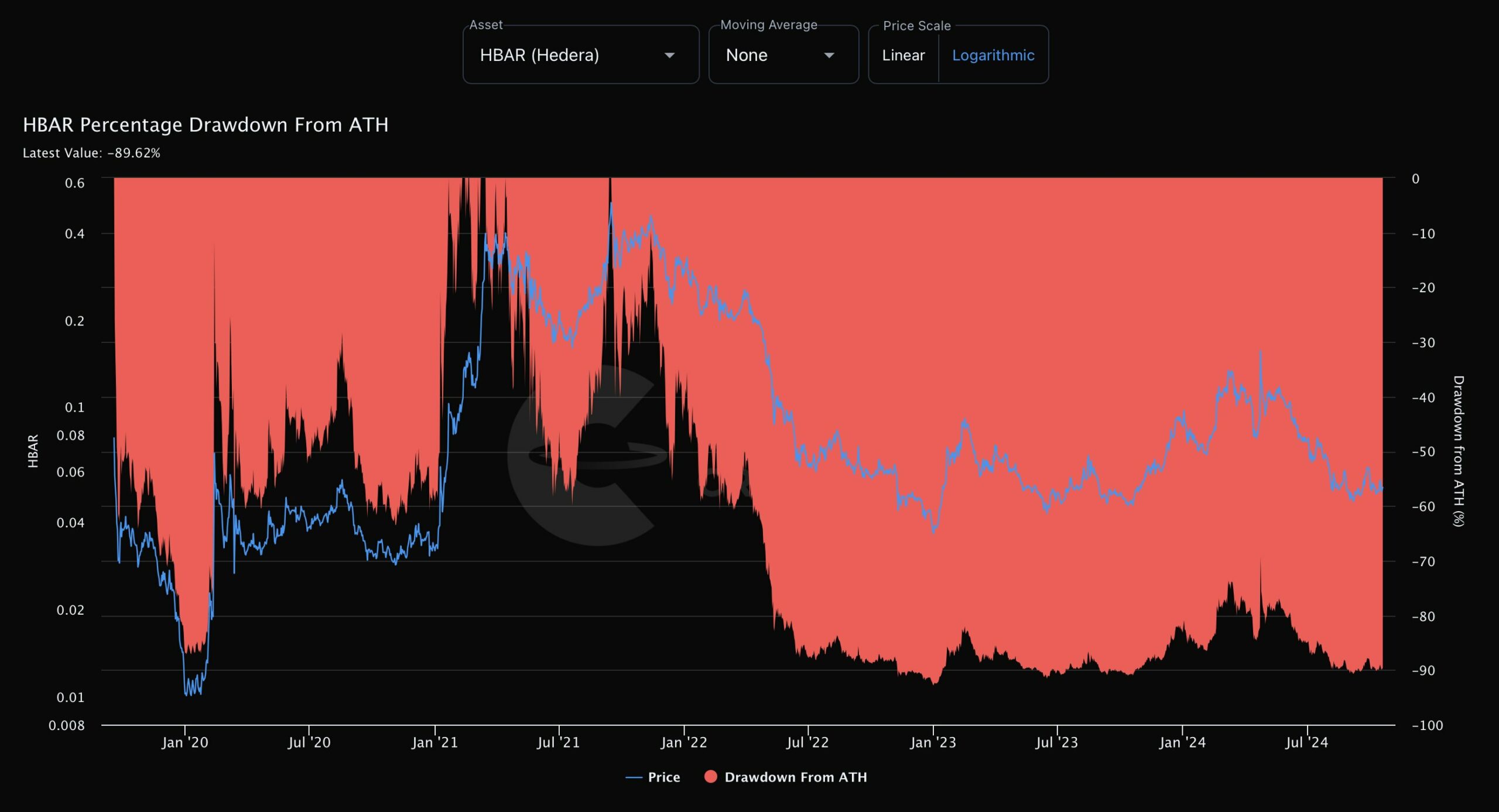

- HBAR, as of press time, was 90% below its all-time high.

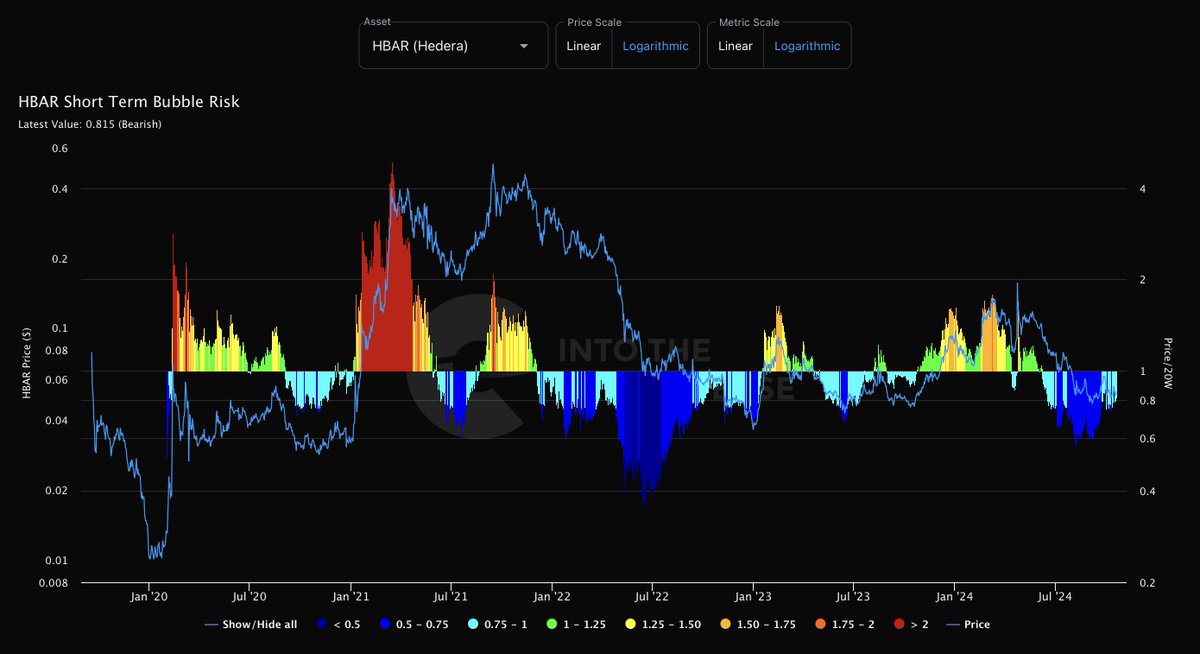

Hedera’s [HBAR] short-term bubble risk has turned bearish. This shift raises questions about the future of price of the HBAR token. Recently, Hedera has attracted more attention from crypto enthusiasts.

In the coming months and years, institutional investors are expected to pour significant funds into HBAR, potentially leading to a price surge.

Notably, Morocco recently announced a 2030 digital strategy powered by Hedera, aiming to utilize the network across the country. Additionally, the US HBAR Trust has gained institutional access with the launch of Canary Trust.

Despite this, HBAR currently faces short-term bubble risk and struggles with its token price, although adoption and real-life applications are growing.

HBAR price action and BTC valuation

The daily chart for HBAR reveals a bearish trend, confirmed by the short-term bubble risk indicator.

While the long-term outlook remains optimistic, a price of $0.036 serves as the invalidation point for bullish scenarios as the ascending trendline was invalidated first.

Currently, the bullish outlook is not clear, as the upward movement resembles a diagonal pattern. HBAR needs to reverse its current price trajectory which steadily declining.

A significant break above $0.064 is essential to indicate a potential comeback for the bulls. Observing patterns over multiple timeframes shows that a double bottom has formed, suggesting that the current bearish trend may not last long.

Moreover, HBAR is experiencing weakness against Bitcoin, indicating that the bearish trend may persist before any bullish recovery. Its BTC valuation is at the lowest levels since 2020, adding to concerns about HBAR’s immediate future.

Percentage drawdown

Additionally, Hedera’s price was 90% below its all-time high at press time, reinforcing the bearish outlook for HBAR. Historically, when the percentage drawdown from an all-time high reaches 90%, it often precedes subsequent gains.

Thus, despite the current decline in price, Hedera remains a project to watch closely. The platform’s real use cases may eventually support and enhance its token price.

Is your portfolio green? Check out the HBAR Profit Calculator

While Hedera faces short-term challenges, its long-term potential remains promising. Institutional interest and real-world applications of HBAR could drive future growth.

Traders should monitor key price levels and market trends as HBAR navigates this critical period. By keeping an eye on market developments and institutional movements, investors can better understand the future of Hedera and its potential to move higher.